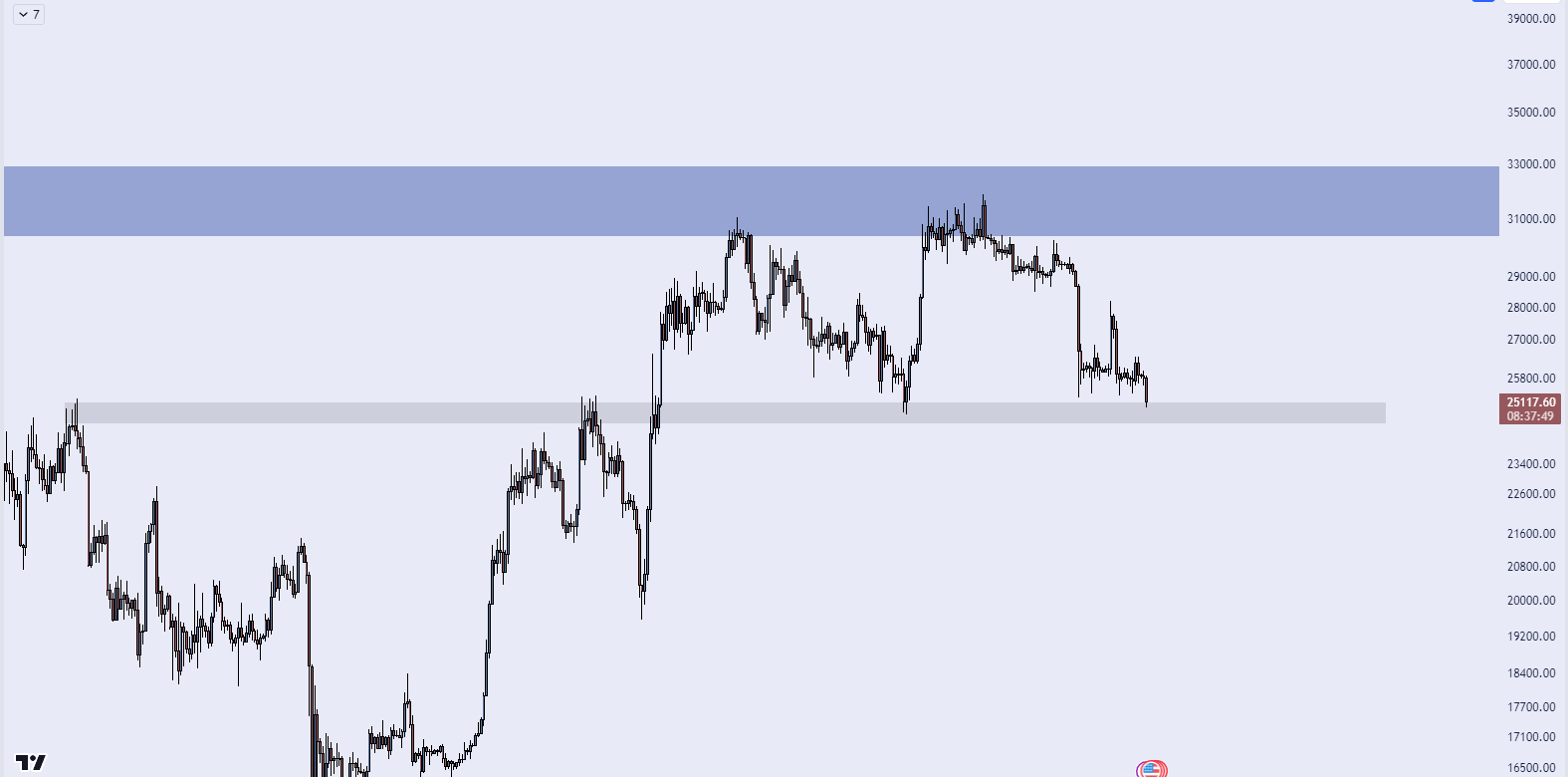

The price of Bitcoin has violated the $25,000 zone multiple times and concerns are growing as closing prices below $25,300 have started. Especially altcoin investors are starting to see lower prices in most cryptocurrencies than the November 2022 crash. With a volume of $30 billion, the unpleasant markets are not easily attracting anyone.

Bitcoin and Cryptocurrencies Are Falling

September 11 brought greater losses for cryptocurrencies. The price of BTC broke the parallel range between $25,500 and $26,500, but the breakout brought even greater losses. The disruption of the period of shallow volatility lasting more than 10 days was already expected. Investors were extra concerned that this would happen through a decline. If the daily closing takes place below $24,750, this could trigger losses of up to $20,000.

Crypto analyst Horse believes that the $25,000 level of Bitcoin price is the best area to trap sellers.

“The best area to trap sellers. It offers a short-term buying opportunity because it is undoubtedly the best place in terms of risk/reward ratio.”

The price movements in global markets and the historical lows in on-chain indicators may give buyers hope for a positive trend.

The Current Situation of DXY

The dollar is quietly strengthening. The DXY, which has fallen below 100, indicates a possibility of a negative price reversal by touching the highest levels of its long-term range at around 104.8 points. A declining dollar can support the price of Bitcoin.

Critical Days Ahead

The inflation data will be released on September 13. Due to the increase in fuel prices, an increase is expected in September inflation. If the August inflation, which will be announced tomorrow, comes in high, the bears’ hand can strengthen significantly as expectations for the next month will also be negative.

On the other hand, FTX is expected to give approval for the sale of billions of dollars of cryptocurrency reserves on the same day. $200 million worth of daily sales are planned. Considering that the cumulative volume in cryptocurrencies is at the $30 billion level, these net sales can trigger major losses.

What’s Next for Bitcoin?

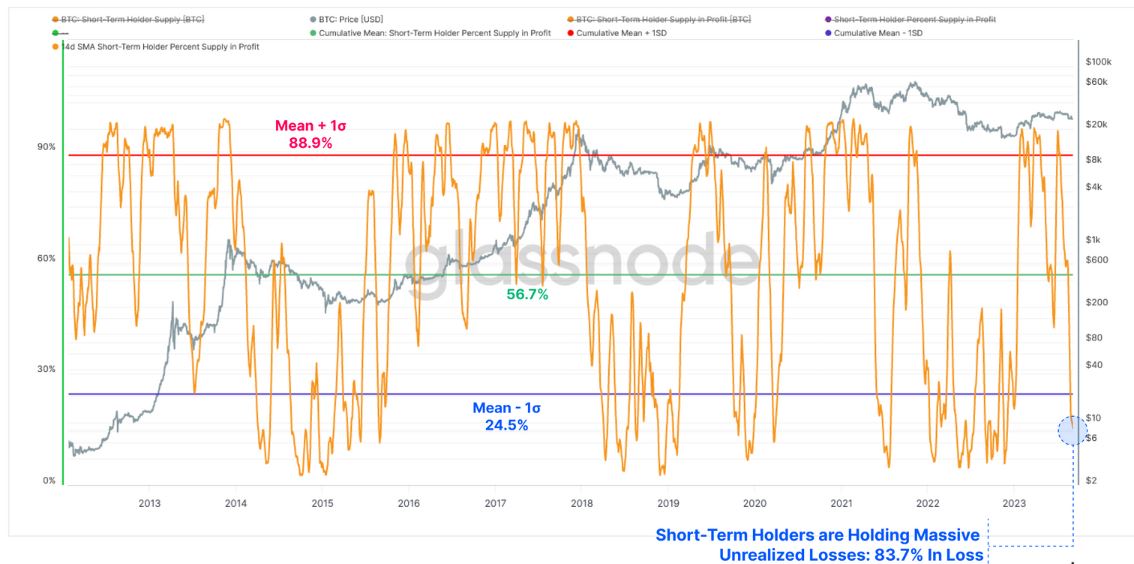

According to Glassnode’s latest report, the recent price drop in the past few weeks has led various metrics to hit historical lows. Current market conditions are characterized by low liquidity and low trading volumes. This makes it difficult for bulls to push the BTC price through multiple resistance levels, and long-term investors may start accumulating as the excitement of the rise diminishes.

“Realized Profit and Loss are at levels equivalent to the 2020 market and highlight that the excitement of the 2021 bull market has completely disappeared.”

However, DXY is promising and on-chain bottoms indicate that it is time for an unjustified rise to begin.