The price of Bitcoin has once again surpassed $26,000 but has yet to break through the $26,800 region. However, there are some exciting indicators. We have seen many times before how markets that have been dull for a long time suddenly turn into highly volatile days. Today could be another one of those days. Shallow volatility has never been sustainable for cryptocurrencies.

Bitcoin and Cryptocurrencies

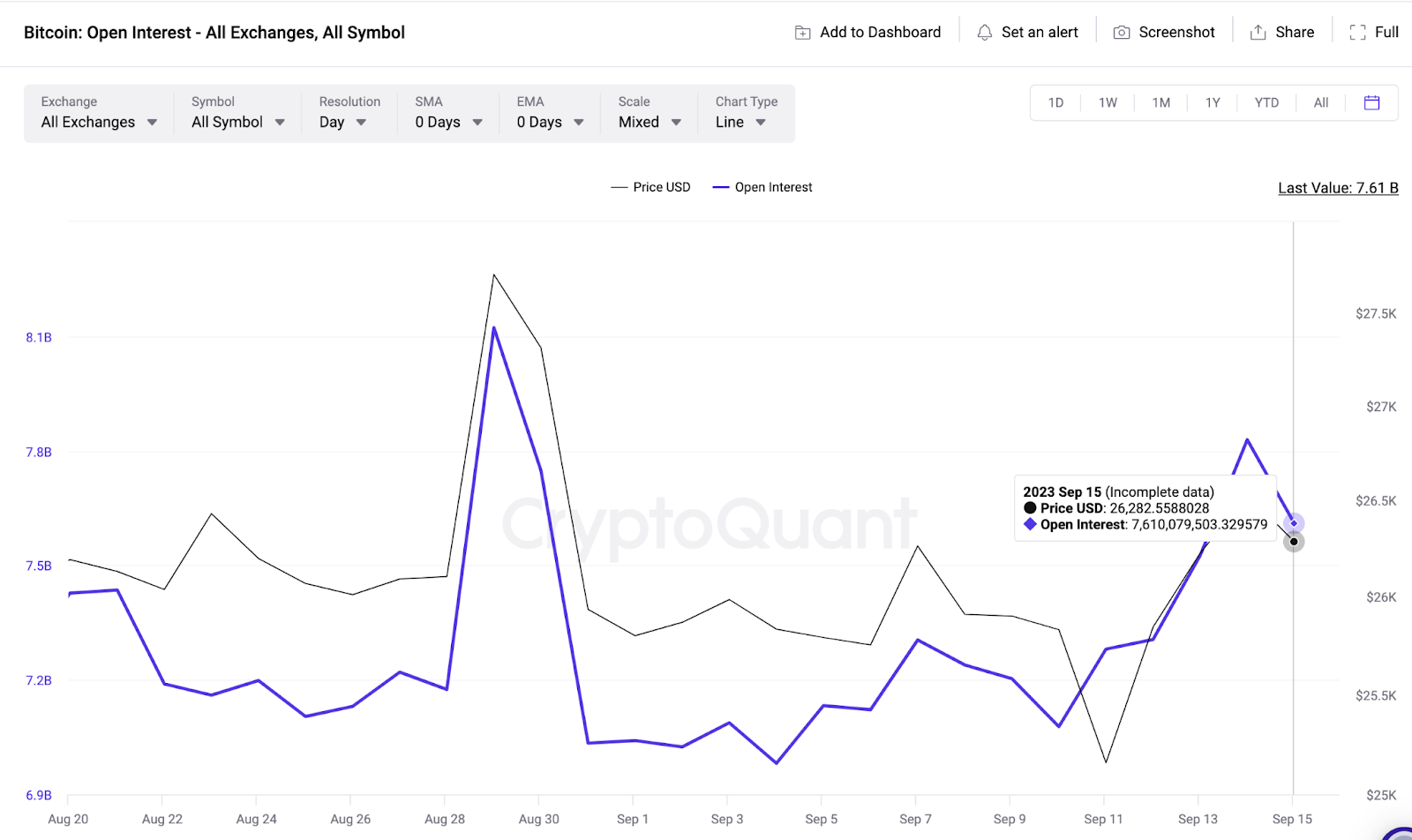

Investors usually withdraw their capital from markets when the price of an asset falls. However, there has been a different trend in Bitcoin derivative markets for the past two weeks. Between September 1st and September 15th, the Open Interest price of BTC increased by $640 million. Moreover, this trend is occurring amidst concerns about the upcoming Fed’s inflation and the sale of FTX assets. It should not come as a surprise that abnormalities are considered normal in the crypto world.

Open interest reflects the value of current active contracts in derivative markets. The increase in open interest is considered positive because it indicates an increase in positions. According to CryptoQuant’s Exchange Reserves data, Bitcoin investors have withdrawn 13,000 BTC from crypto exchanges this month. This outflow occurred shortly after the release of the CPI data on September 13th.

If open interest continues to increase and outflows from exchanges persist, it is believed that investors who believe in the rise of Bitcoin will start to return. The price could then recover.

BTC Price Prediction

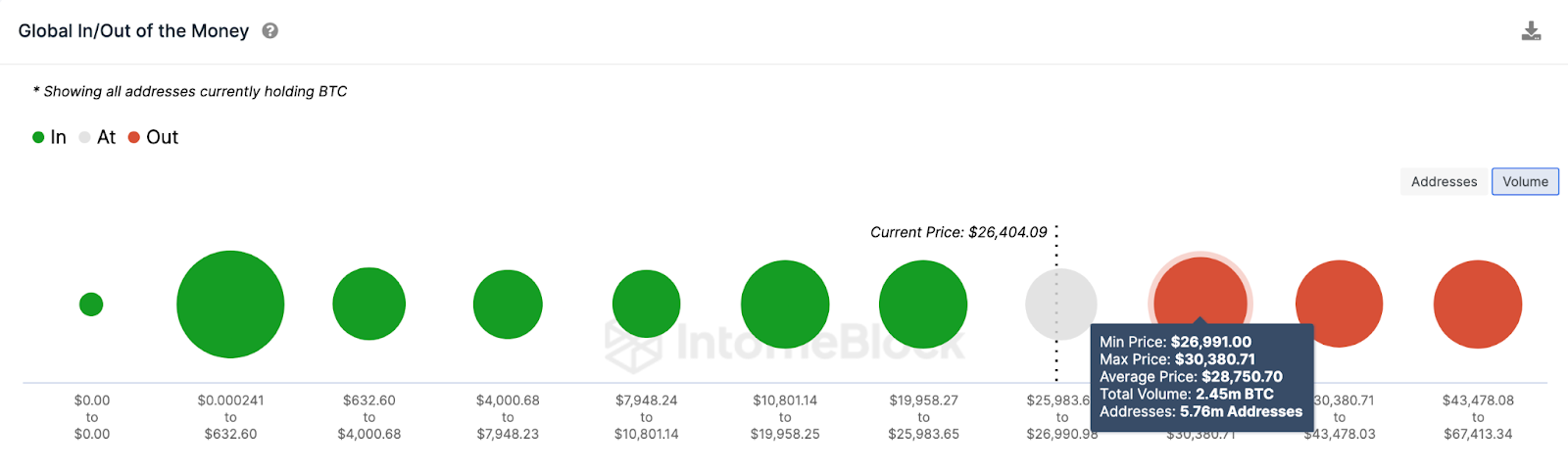

From an on-chain perspective, the Bitcoin price appears ready to make further gains if the momentum in the broader cryptocurrency markets turns bullish. However, the sell wall at the $28,750 range could pose a significant obstacle. The GIOM chart, which shows the entry price distribution of current Bitcoin investors, supports this narrative.

On average, 5.76 million addresses hold 2.45 million BTC at $28,750. This indicates that the price could face strong resistance in this range.

Nevertheless, the fact that the price has been consolidating above $26,400 for some time now suggests that we may not see deeper lows despite the recent negative news. This could indicate that news is already priced in and events are being disregarded. Additionally, if the Fed unexpectedly announces a ceiling interest rate on Wednesday evening, things could rapidly turn in favor of the bulls. If the Fed plans to start interest rate cuts in the second half of next year, it should not delay any further.