Bitcoin is once again above the $70,000 mark, yet strong GBTC outflows in the spot Bitcoin ETF channel continue. Data from BlackRock and Fidelity has not yet arrived, but a net outflow of $350 million could stoke concerns from the first day of the week. So, what are the current predictions for Bitcoin and Ethereum?

Bitcoin (BTC)

ETFs have seen net outflows for five consecutive days, turning the past week into a nightmare. Considering the pressure from the Fed on cryptocurrencies, this was not surprising. Simultaneously, the process of converting Genesis’s massive GBTC reserves into cash continues.

On the bright side, Goldman Sachs’ latest report indicates that customer interest in Bitcoin has increased with the approval of ETFs. The net inflow of over $11 billion in less than three months confirms this. If Bitcoin avoids massive drops and comprehensive bans or FUD, it should continue to draw demand through the ETF channel.

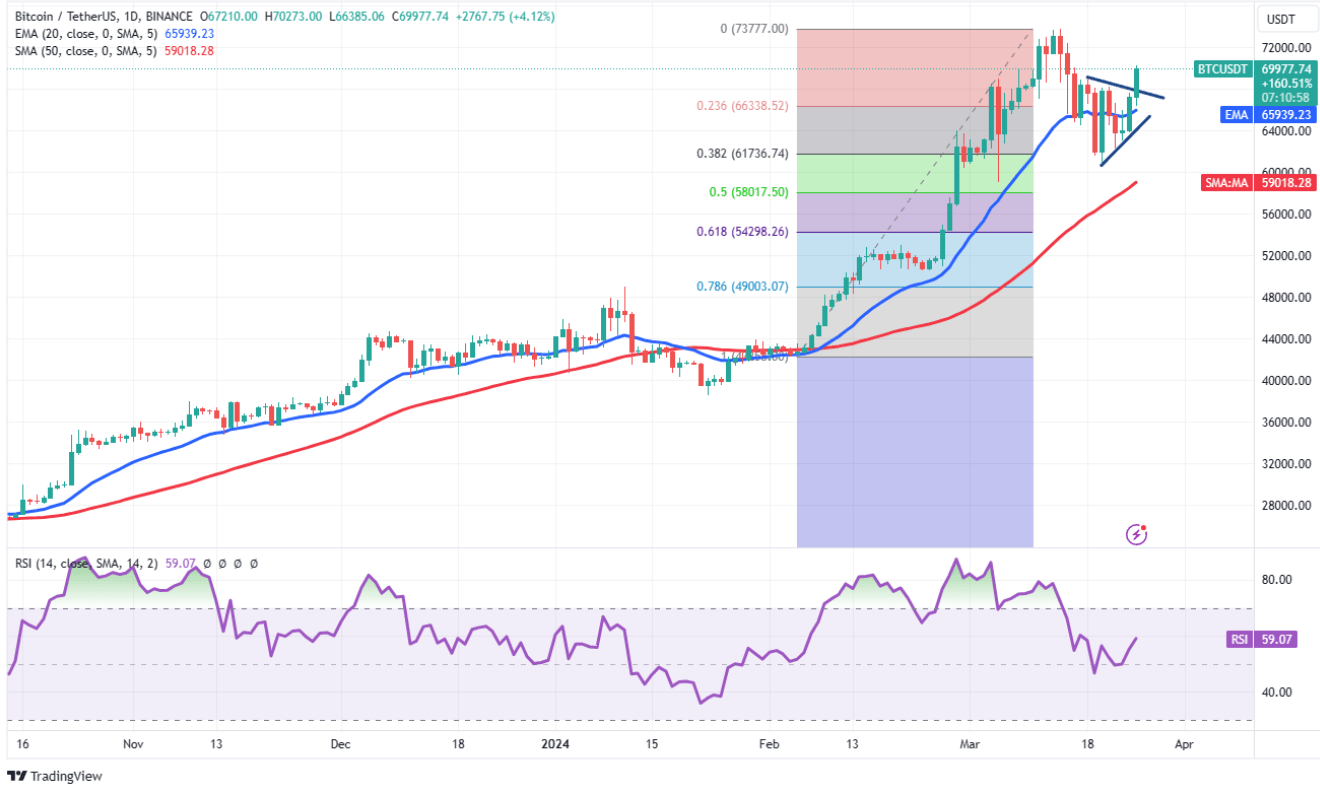

Turning to the price, BTC continues to close above $69,000. This reflects the bulls’ appetite to test the $73,777 level. If the rise continues as “one step back, two steps forward,” the target is $80,000.

Conversely, if the price turns down from its current level, the recent rise will become a bull trap, and altcoin investors will be shocked if the price drops to $59,000. The key support is at $59,098.

Ethereum Price Prediction

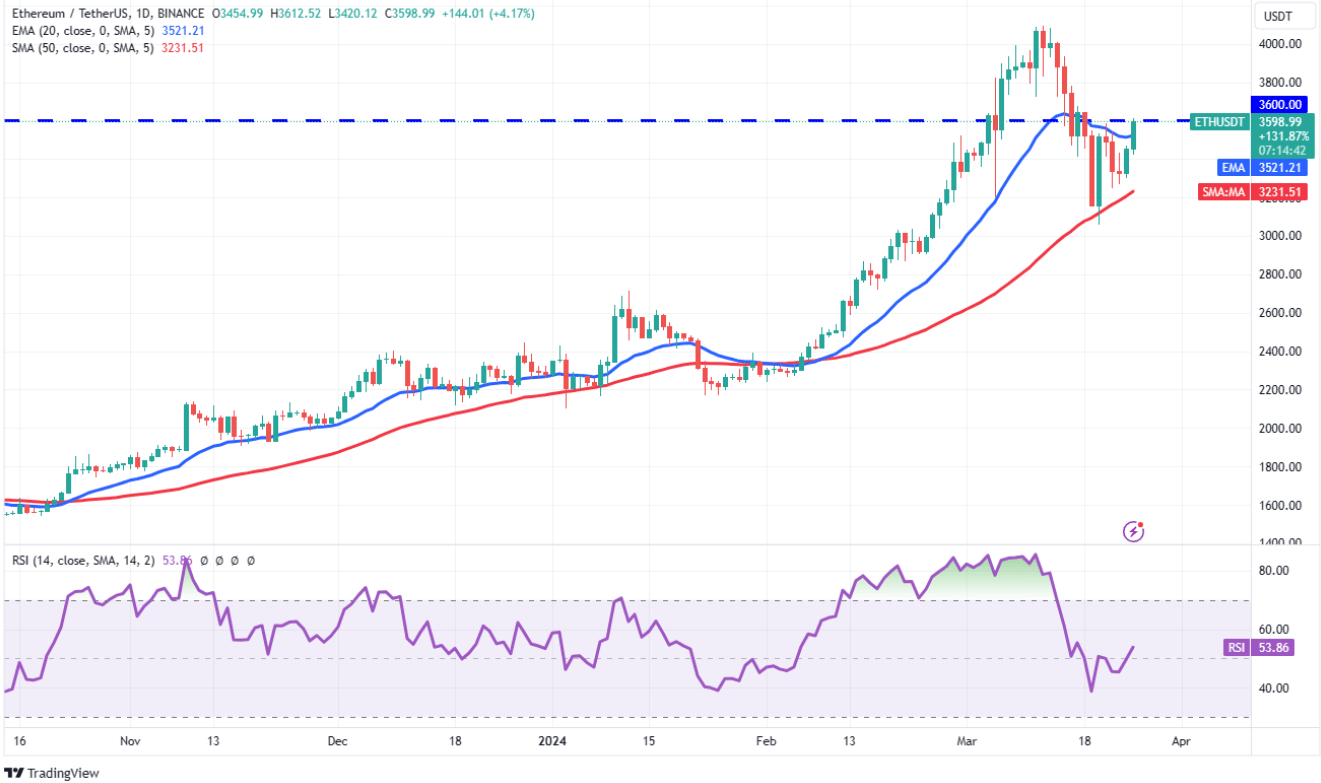

The negativity pumped by ETFs is clearly felt in the price. The SEC implies that it won’t be as straightforward as the BTC ETF. A positive for Ethereum’s price is the reclaiming of the 20-day EMA. As long as the price stays above $3,521, there could be more upside for ETH.

If the rise continues, the ETH price could set sail towards targets of $3,679 and $4,094. However, closures below $3,679 will dampen optimism, and falling below the 50-day SMA could invalidate the short-term bullish scenario. In this case, we could see a deeper correction towards $2,868.

Experts expecting a test of the $950 billion support for altcoins could see their bearish scenario become a reality with ETH losses.

Türkçe

Türkçe Español

Español