Bitcoin and Ethereum experienced a 3.5% drop on May 24 due to the anticipated institutional milestone failing to invigorate the markets. Data from TradingView showed Bitcoin’s price movement around $67,000 and Ethereum’s price at $3,670. Both reacted quietly to the news of US regulators approving the launch of spot Ethereum exchange-traded funds.

What’s Happening in the Crypto Market?

Although ETF funds are a significant achievement for the crypto industry and a sharp policy U-turn for the Securities and Exchange Commission (SEC), they are not yet ready for trading. Additional preparations, which analysts suggest could take several weeks, have delayed the possible launch date. Discussing the latest events, Bloomberg Intelligence’s special ETF analysts James Seyffart and Eric Balchunas considered the idea of proceeding in mid-June.

Thus, BTC/USD and ETH/USD pairs avoided a rapid upward movement and even retreated from local highs at the daily close. What caught the attention of market participants that day were the dynamics between the two largest cryptocurrencies.

Popular investor Daan Crypto Trades saw significant potential for Bitcoin’s share of the overall crypto market value to be challenged when Ethereum ETF funds are launched. In a part of his post on X, he made the following remarks:

“With the recent Ethereum rally, we saw Bitcoin Dominance return. This has been in an uptrend for about 1.5 years, and if anything can reverse this trend, it will be Ethereum’s leadership with the approval of ETF applications.”

The risk to the uptrend was also noted by other traders as potentially marking the beginning of a full alt season. Bitcoin dominance reached 57% in mid-April, just before the halving of block subsidies; these were the highest levels in over two years.

Noteworthy Details

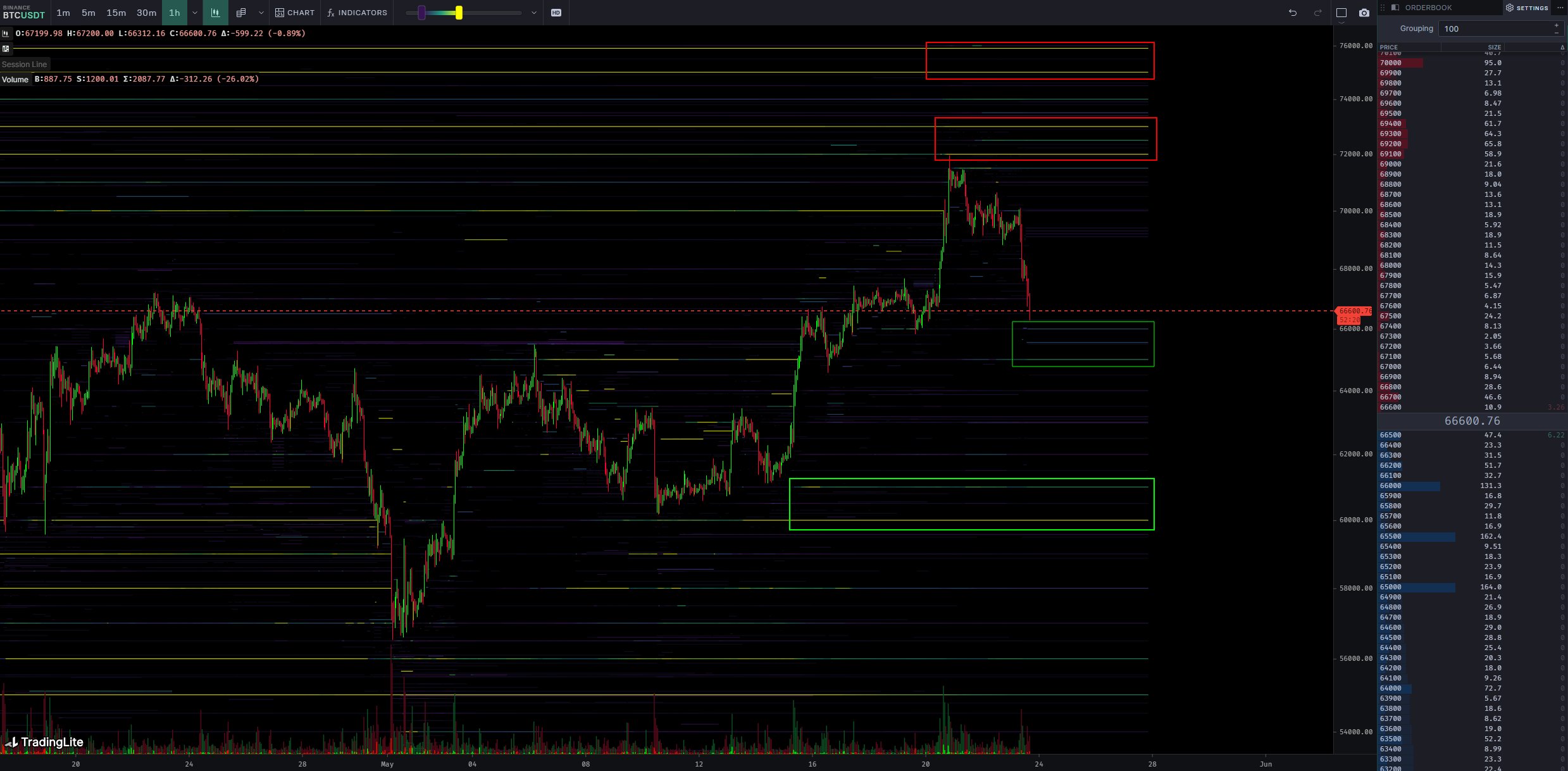

Popular trader Skew, examining how low Bitcoin price movement could go before buyers step in, noted an area of interest around $66,000. In the analysis published on May 23, he explained that this hosted nearby bid liquidity on the largest global exchange Binance:

“The initial spot demand seen around $66,000 – $65,000 shows the importance of the reaction in terms of absorbing sellers. Spot supply remains around the current high of $72,000 – $76,000.”

Skew highlighted that the week’s price increase was driven by spot exchanges, emphasizing both Binance and the largest US trading platform Coinbase.

Türkçe

Türkçe Español

Español