As Bitcoin and Ethereum reach new levels in 2023, crypto investors wonder what the new benchmarks will be. At this stage, it’s clear that every new prediction holds significant importance. Analysts Ali Martinez and Alex Thorn have shared their assessments for Bitcoin and Ethereum, thinking that the rise will continue.

New 2023 Record for Bitcoin and Ethereum

Bitcoin and Ethereum started the week with an increase, bringing new records for 2023. BTC rose to $40,884. At the time of writing, Bitcoin is trading at $40,736, up 1.87%.

Ethereum also renewed its 2023 record, rising to $2,228. After a slight pullback, Ethereum is trading at $2,216 at the time of writing.

Alex Thorn’s Bitcoin Prediction

According to Alex Thorn, Bitcoin is currently witnessing increased activity from investors who are buying at the $40,000 level and anticipating a rise. Therefore, BTC is undergoing an accumulation phase. This accumulation indicates a strategic positioning by market participants who are potentially expecting a shift in momentum.

As sellers exhaust at the $40,000 level, Bitcoin’s price could see an upward movement with the next resistance levels being $42,000 and $46,000, according to the analyst‘s predictions. The analyst’s forecast suggests that the current market dynamics support an upward trend and that investors are looking at key resistance levels as potential targets for Bitcoin’s next price movement.

In this scenario, the analyst focuses on the interaction between buyers and sellers, indicating a potential shift in market sentiment. If the current accumulation trend continues and sellers weaken, it could pave the way for Bitcoin to surpass resistance levels and open higher price targets.

Analyst Ali Martinez’s Ethereum Prediction

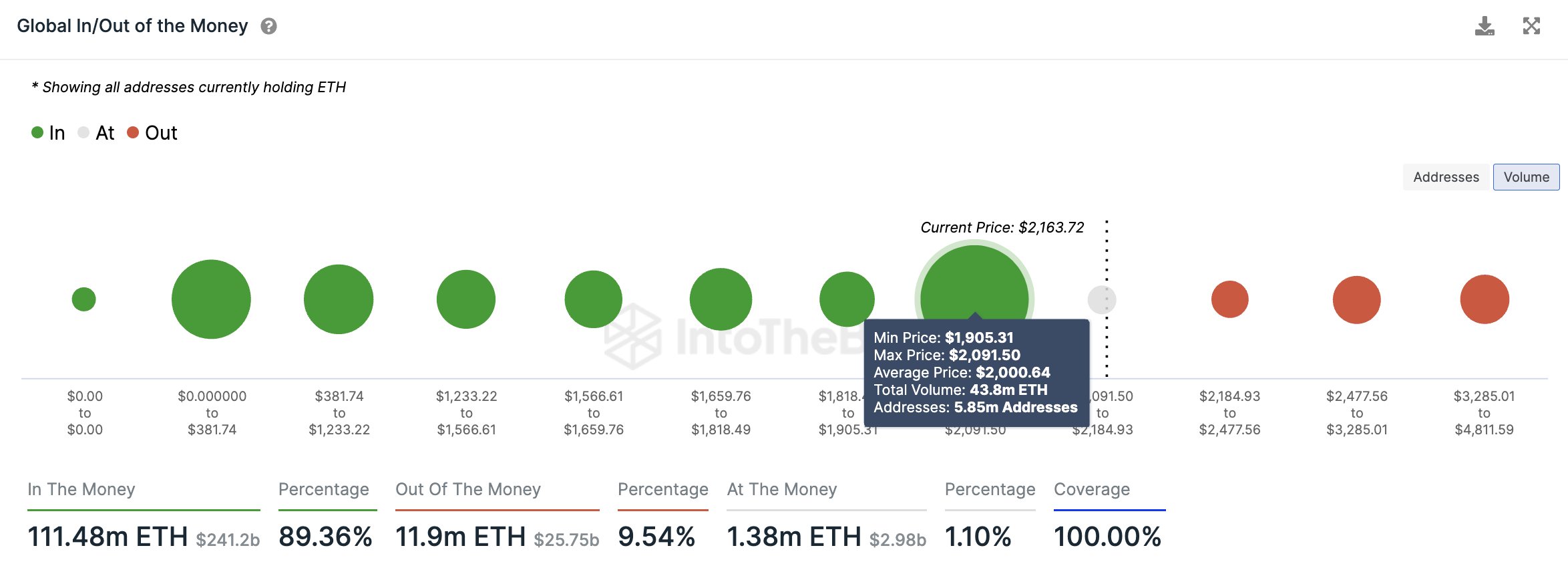

The current price of Ethereum, above $2,000, offers a potentially favorable buying opportunity, supported by data indicating a significant amount of tokens has been purchased in this range. According to analyst Ali Martinez, information from intotheblock highlights that 5,850,000 wallets collectively hold 43,800,000 ETH purchased between $1,900 and $2,100.

According to Ali Martinez, this accumulation demonstrates a significant level of investor interest and commitment at these price levels, potentially forming a strong support level for Ethereum in the coming period. In light of this information, historical data points to a strong foundation and potential resilience at the $2,000 threshold, suggesting it may not be too late for investors to consider entering the Ethereum market.