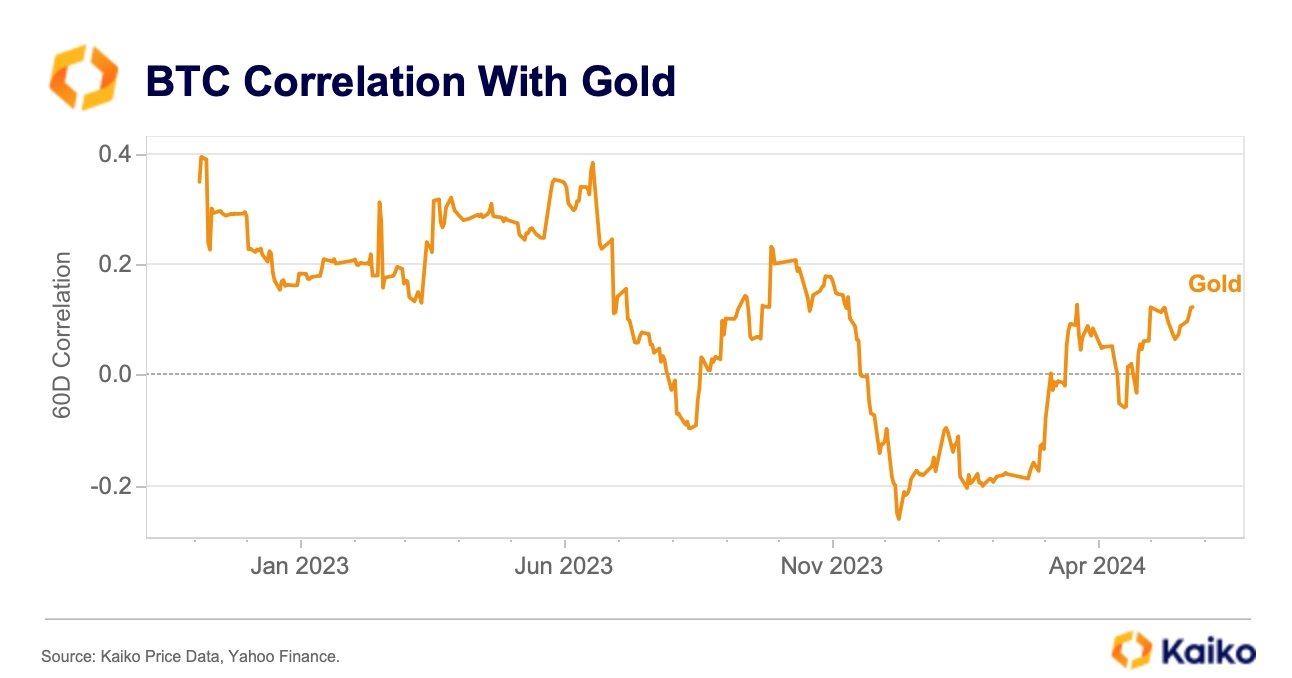

Recent data showed that the relationship between Bitcoin and Gold is deepening, with the 60-day correlation trending upwards. This indicates that the prices of these two assets are increasingly moving together. This developing dynamic was highlighted in a recent post by Kaiko on X, which detailed the effects of this trend.

What Does the Concept of Correlation Mean?

Correlation is a statistical measure that shows how closely two variables move in relation to each other. A positive correlation means that the prices of two assets move in the same direction. As the correlation value approaches 1, this relationship strengthens.

Conversely, a negative correlation indicates that prices move in opposite directions, with -1 representing the strongest negative correlation. A correlation value of zero indicates no relationship between the assets, meaning their price movements are independent of each other.

Recent Trends in Bitcoin and Gold Correlation

According to Kaiko’s analysis, the correlation between Bitcoin and Gold has been trending upwards in recent months. This trend was depicted in a graph showing the 60-day correlation metric over the past few years. Towards the end of 2023, the correlation fell into the negative territory, indicating that Bitcoin and Gold were moving in opposite directions. However, more recent data highlighted that this correlation has turned positive again, but remains relatively low with a current value below 0.2.

In 2022, the Bitcoin-Gold correlation peaked at around 0.5, which is significantly higher than the current level. Despite the recent increase, the current correlation value is still far from this historical peak. This suggests that while Bitcoin and Gold are moving more in sync compared to the end of 2023, their relationship is not as strong as it has been in the past.

What Could This Mean for Investors?

The degree of correlation between assets is a crucial factor for investors considering portfolio diversification. Highly correlated assets do not offer the benefits of diversification, as their price movements tend to mirror each other.

The relatively low current correlation between Bitcoin and Gold suggests that they can still serve as effective diversification tools within an investment portfolio. Investors holding one of these assets might find it beneficial to add the other to their holdings to potentially reduce risk and increase returns.

Market Context and Future Outlook

The increasing correlation between BTC and Gold may be influenced by broader market trends and investor behaviors. Both assets are often seen as hedges against economic uncertainty, and their rising correlation could reflect a convergence in how investors perceive their roles in a diversified portfolio.

However, the relatively low current correlation leaves room for further alignment or divergence depending on future market conditions and economic developments.

Türkçe

Türkçe Español

Español