Bitcoin (BTC) is approaching the $58,000 mark again, causing pain for altcoins. Many cryptocurrencies are continuing the day with losses exceeding 5%. Moreover, as the SEC opens new fronts in its war against crypto despite the upcoming elections, investor confidence is once again shaken. So, what does Mike say?

Bloomberg Analyst BTC Prediction

Since March, the Bitcoin price has been unable to find strength for a new all-time high and is now at $58,000. The extremely boring movement has continued for months, providing many opportunities for short sellers. They have been rewarded with BTC’s decline. So, how does Mike view the current situation, and what are his predictions?

McGlone says that BTC/USD is currently around 11 times the value of the S&P 500, which is close to a record level. In the first three months of 2020, BTC reached 15 times the S&P’s value. This was a record. Mike says:

“The Bitcoin/S&P 500 peak, which is currently around 11 times, was 15 times in the first quarter of 2020, and this year’s peak was 14 times. The largest cash flow in history and the past launch of US ETFs may indicate a swing towards 7 times for Bitcoin/SPX.”

In summary, historical data suggests we might be on the verge of a significant decline for BTC.

BTC Price Prediction

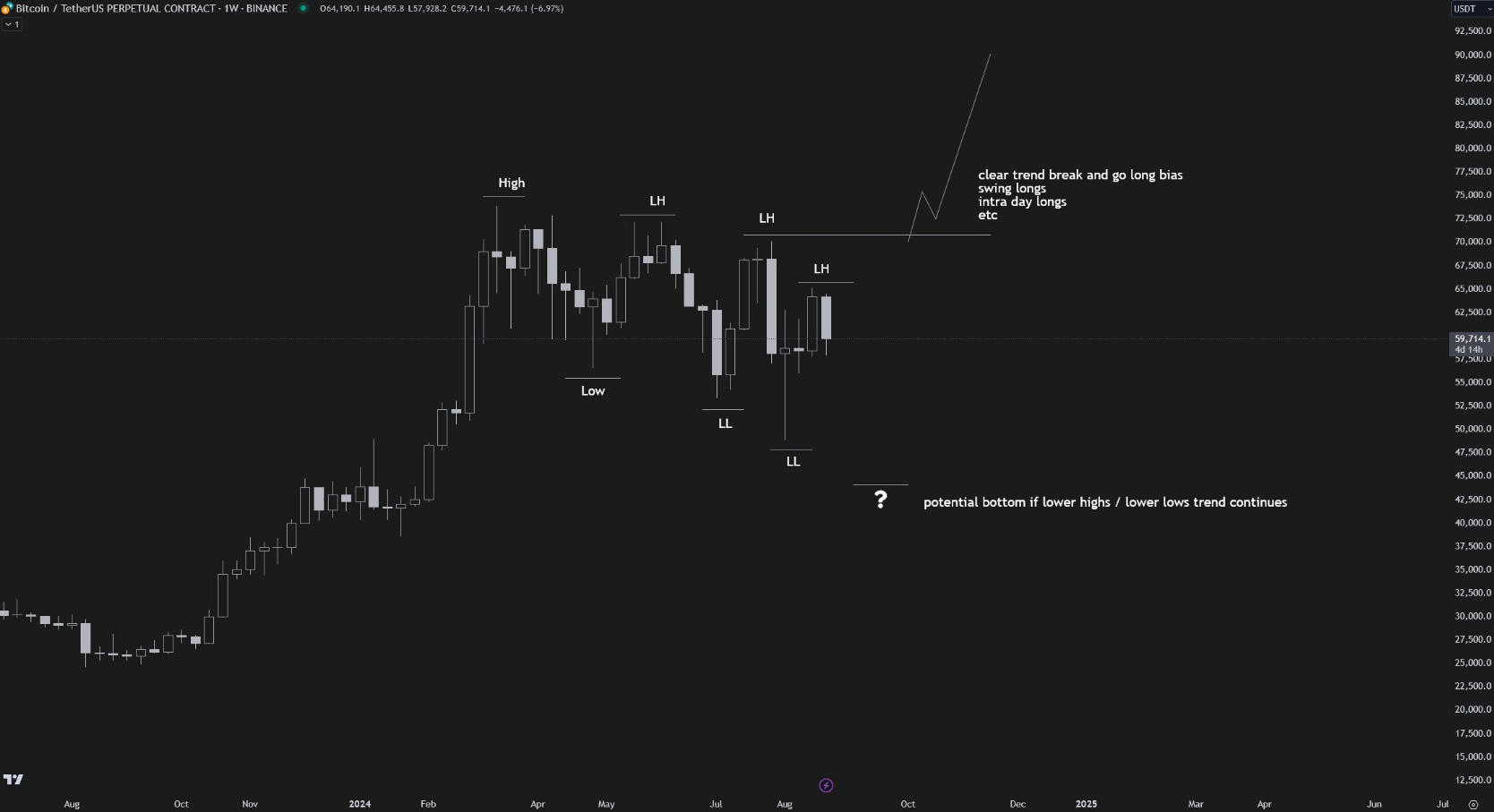

Popular crypto analyst Crypto Chase says there has been no breakout in the trend following the peak in March and months of consolidation. On the other hand, BTC has retested $58,000 for the second time in the last 24 hours.

“The bright side of all this consolidation is that a trend breakout should be a clear signal for all-time highs. The not-so-bright side is that a lower dip might be next (but I see this as a buying opportunity / there should be a dip before ATHs).”

How deep a dip we will see is unknown, but in August, BTC fell to $49,000. If there is a larger dip, it will be extremely painful for altcoins.