Cryptocurrency exchange balances are changing rapidly. Compared to the peak level in 2020, Bitcoin balances have decreased by 25% to 2.39 million BTC. This figure is the lowest since April 2018. Currently, approximately $139.86 billion worth of Bitcoin is held on exchanges worldwide. The decline is interpreted as a sign that investors’ confidence in cryptocurrency exchanges is waning.

Which Factors Contributed to the Decline?

The collapse of the FTX exchange and ongoing market volatility played significant roles in the reduction of Bitcoin balances. Investors have become more cautious about the reliability of exchanges and started withdrawing their Bitcoin. In the first quarter of 2024, about $10 billion worth of Bitcoin was withdrawn from exchanges. These withdrawals are raising concerns about a potential future shortage in Bitcoin supply.

The rapid decline in Bitcoin balances on exchanges is also attributed to the introduction of spot Bitcoin ETFs. In January 2024, spot Bitcoin ETFs were launched in the US for the first time, accelerating Bitcoin withdrawals since then. The low levels of Bitcoin reserves may indicate a decrease in selling pressure, and if demand increases, it could support a bull market.

Investors May Have Lost Confidence in Exchanges

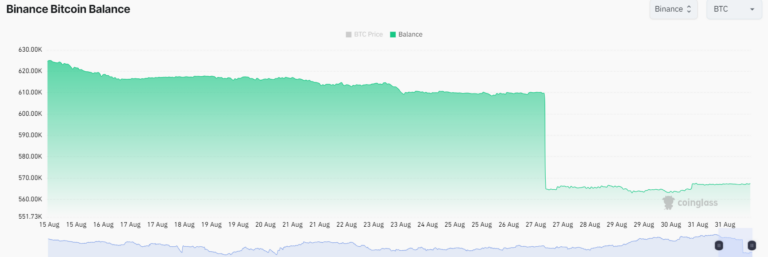

The collapse of FTX and other scandals in the crypto market further shook investors’ confidence in exchanges. The lack of confidence has led many investors to withdraw their Bitcoin from exchanges to private wallets. The withdrawal of millions of dollars worth of Bitcoin from major exchanges like Binance and Bittrex is seen as a tangible reflection of this loss of confidence. Notably, Bitcoin balances decreased by 800,000 from 3.2 million in March 2020 to September 2024.

The decline in Bitcoin supply signals a potential supply shortage in the market. This shortage could affect Bitcoin prices in the next 6 to 12 months. Additionally, market fluctuations and concerns about exchange security are driving investors towards alternatives like spot ETFs.

Bitcoin Dropped 14% in the Last 30 Days

Bitcoin’s 14% drop in the last 30 days has created a pessimistic atmosphere in market analyses. The fact that Bitcoin has not surpassed its previous peak level 123 days after the halving is drawing the attention of investors and analysts.

It remains to be seen whether Bitcoin will start a rally in the last quarter of 2024. This uncertainty will be a crucial factor in determining the future strategies of Bitcoin investors.

Türkçe

Türkçe Español

Español