Bitcoin‘s (BTC) fourth block reward halving is approaching, leading to unprecedented interest levels and a spike in Google searches related to the block reward. Data from Google Trends shows that the interest in ‘Bitcoin halving’ has reached the highest point ever recorded, more than doubling the levels observed during the previous halving in 2020. Currently, the search interest for ‘Bitcoin halving’ is at 45 points, with Google predicting it will reach the “peak popularity” score of 100 by the end of this month.

Price Increase Supports Growing Interest

The Bitcoin block reward halving is scheduled to occur around 07:00 AM UTC on April 20. With the halving, the block reward given to miners per block in BTC will drop by 50%, reducing the current reward from 6.25 BTC to 3.125 BTC.

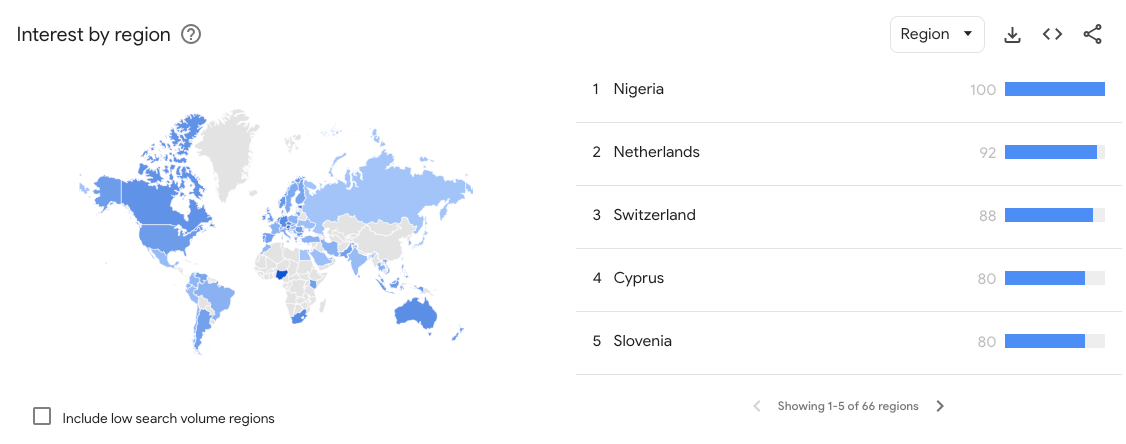

Data from Google Trends reveals that the growing interest in the block reward halving is quite pronounced in various regions including Nigeria, the Netherlands, Switzerland, and Cyprus. The increased interest in Bitcoin’s block reward halving coincides with Bitcoin’s notable performance in recent months.

According to data provided by CoinMarketCap, BTC started the year at $42,200 and surged 74% to an all-time high of $73,600 on March 14. However, following this peak, the price of the largest cryptocurrency entered a consolidation phase and is currently trading at $61,078, down 17% from its all-time high.

High Expectations for Post-Halving Period

Despite the current price trend of Bitcoin, many market commentators continue to be optimistic about its future path, referencing historical price movements following previous halvings. Commentators, based on past trends and fundamental principles governing Bitcoin’s scarcity and demand dynamics, evaluate that significant rallies could occur in the months following the halving.

The growing interest in Bitcoin’s block reward halving, its significance as a store of value and investment asset, is part of the broader market sentiment. Market participants eagerly await the halving, while discussions about Bitcoin’s price and potential impacts on the cryptocurrency market continue to shape investor sentiment and guide the market.

Türkçe

Türkçe Español

Español