The price of BTC is currently at $33,850 and the cumulative value of cryptocurrencies is over $1.24 trillion. The volume is approaching the $100 billion threshold again. All indicators suggest that rallies could continue for cryptocurrencies. So what are the expectations of experts on this matter?

Bitcoin (BTC) Analysis

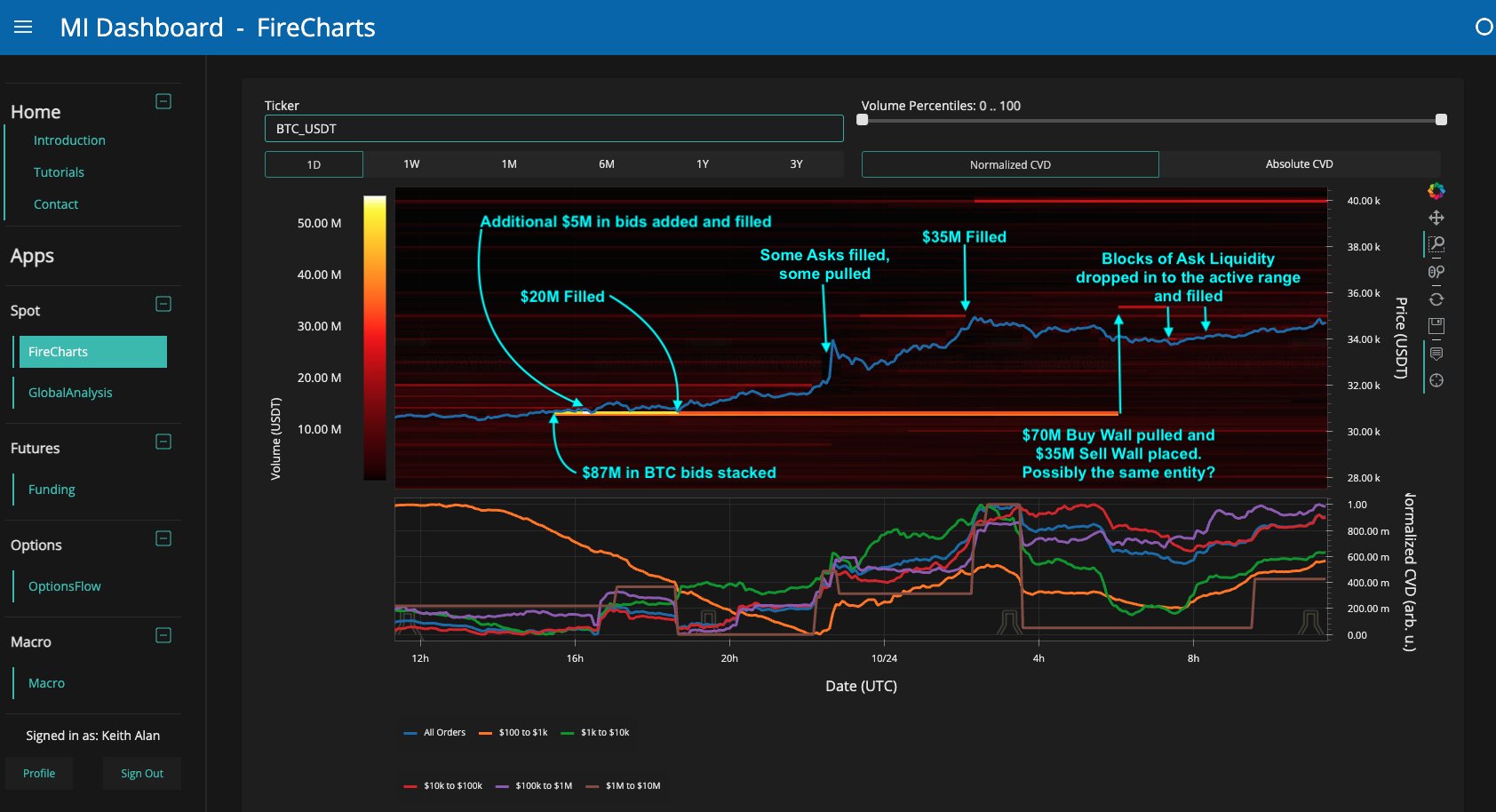

Bitcoin ETF expectation pushed the price above $35,200 and reached a 17-month high. The price increased by nearly $5,000 in a day, surprisingly. Material Indicators stated in their social media post that the market’s resistance, which has been in place for the past year and a half, was easily overcome.

“To be honest, we were expecting more resistance at $30,500, $31,500, and even $33,000. These levels were destroyed, and when a $87 million buying wall emerged at $30,600, it laid the foundation for an R/S reversal without any hesitation from the market. After surpassing $32,000, some of the overall liquidity was withdrawn, and the weak liquidity enabled BTC to quickly rise to $35,000.”

Cryptocurrency Analysts’ Predictions

So what do other experts think about the recent rally and what will happen next? CryptoBullet warned investors by saying, “Funding is largely positive.”

“This means that most traders are longing for it. The majority is never right. Market makers will have to wipe out these late longs.”

The abnormality in funding rates was significant, and Daan Crypto Trades also addressed this issue. According to him, this reversal was a positive indicator and reflected the structure of a bull market. Therefore, the rise of cryptocurrencies, led by BTC, should continue.

“During a bull market, it should be noted that we often have weeks of positive funding rates as it is seen as the “price to pay for participation.””

Popular macro analyst James Stanley argued in his latest assessment that the Personal Consumption Expenditures (PCE) data to be announced on October 26th will be the most important determining factor for DXY in the short term. Since DXY and BTC constantly share inverse correlation, data-driven rise can pull down BTC price. It is predicted that the PCE data, which is followed by the Fed as an inflation indicator, will decrease on an annual basis compared to the previous data but increase by 0.3% on a monthly basis.

If DXY loses the level of 104.7 on October 26th with the positive data, this could mean the continuation of the rally for the cryptocurrency markets. The extent to which the price is affected by developments in the macro front will also indicate whether this rise is the beginning of a bull market. If the price continues to rise in any case, it will suggest that the abnormal demand is now moving to end the bear market.