Bitcoin price has seen a significant difference between November 2022 and now. It has been a challenging period, but it seems to be ending. The psychological pressure and depression of bear markets are giving way to the fear of missing out (FOMO) in the bull season. Sleepless nights were inevitable during both periods’ toughest days. Now, we may be approaching the days when investors’ sleep will be filled with joy.

Has the Bitcoin Bull Begun?

The price of the king of cryptocurrency experienced an increase of nearly 30% last month, which was a remarkable gain worthy of October’s historical performance. The only question on investors’ minds is whether this is just a temporary rise. We might be at the beginning of a new bull season or in the midst of the last rise before a downfall.

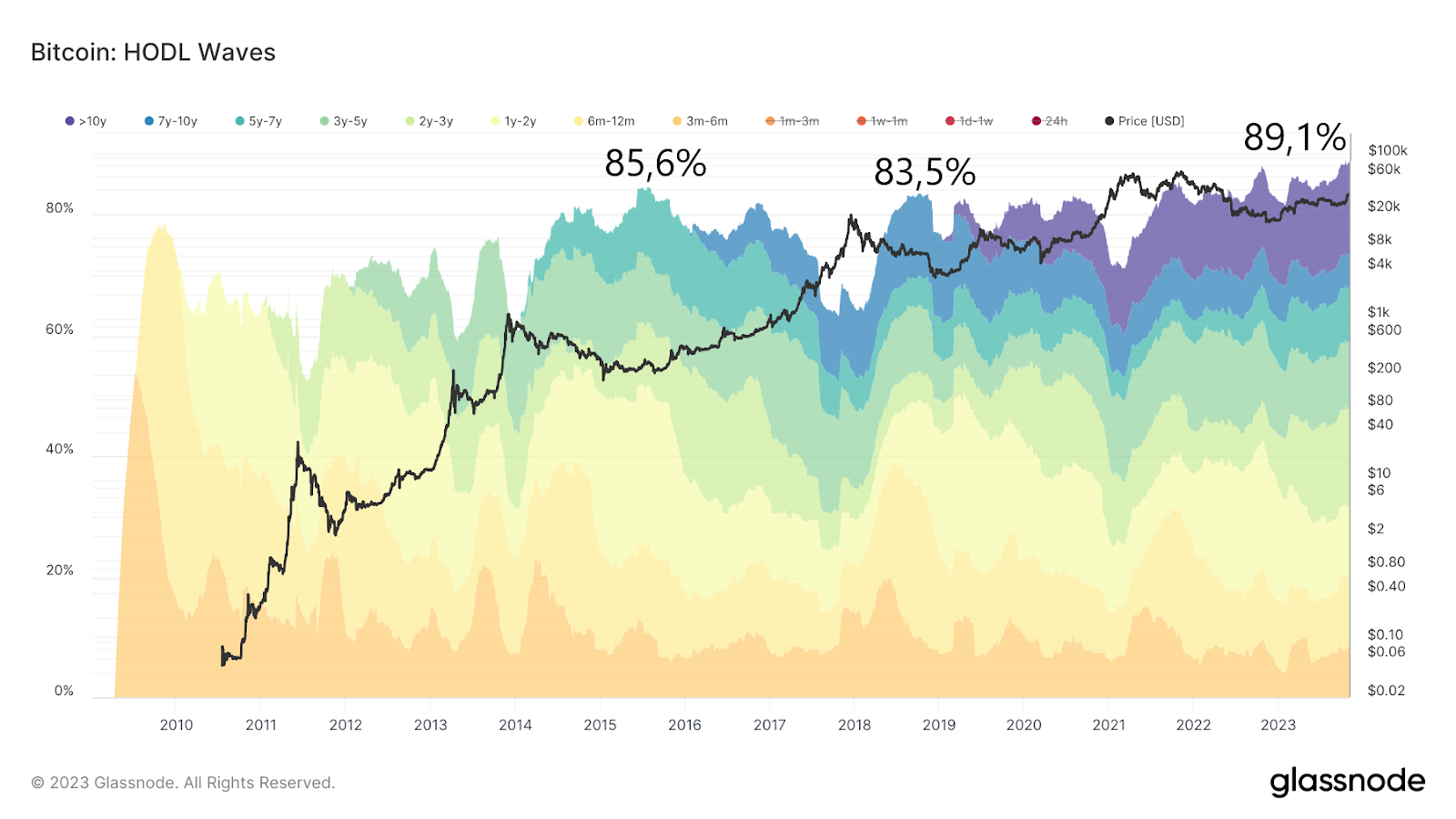

However, some data suggests that the first option is more reasonable, indicating the start of a bull season. We can understand the current period by looking at the HODL Waves chart. For the past 90 days, almost 90% of BTC supply has remained inactive. Additionally, many late investors from the previous cycle have transitioned into long-term investors. All of this indicates that the bull market has begun and that a significant portion of investors are avoiding selling.

Cryptocurrency Bull Market Begins

The HODL Waves chart is based on how long BTC remains inactive in wallet addresses. For example, if you sent 1 BTC to wallet X and it stayed there for 1 year, and then you sent 5 BTC to wallet Y, which remained there for more than 3 months, the hodl type is determined based on specific time intervals.

Currently, 89.1% of the BTC supply is inactive. In comparison, this percentage was 83.5% just before the December 2018 cycle bottom. Interestingly, this is happening despite the clear recovery in the cryptocurrency market. Normally, this percentage should have dropped much lower due to profit-taking.

Therefore, investors are maintaining their belief in the spot Bitcoin ETF that will be approved no later than 2024. The ATH (all-time high) of more than 3 months in the HODL Waves chart caught the attention of renowned on-chain analyst DylanLeClair_, who said:

“To really push this thing to new highs, it will require Wall Street to get rid of hodlers’ coins.”