With the rise of the king cryptocurrency, altcoins have also started to gain momentum. Double-digit gains are attracting attention. The Grayscale decision suggests that this positive sentiment could continue for a while, benefiting investors in the medium term. One popular altcoin could surpass the $250 level during this period.

Bitcoin Cash (BCH)

Institutions are now fully entering the world of cryptocurrencies. EDX Markets, a trillion-dollar asset management company partnered with Fidelity, recently launched trading services for four cryptocurrencies, including BCH Coin. This development has led to a resurgence in BCH Coin investors. The recent court ruling also fueled this positive sentiment.

Bitcoin Cash (BCH) price has surpassed $200 as it attempts to recover the losses caused by the altcoin market crash in mid-August. The court ruling that deemed the Securities and Exchange Commission’s (SEC) rejection of the Grayscale Bitcoin ETF application as “arbitrary and capricious” laid the groundwork for this rise.

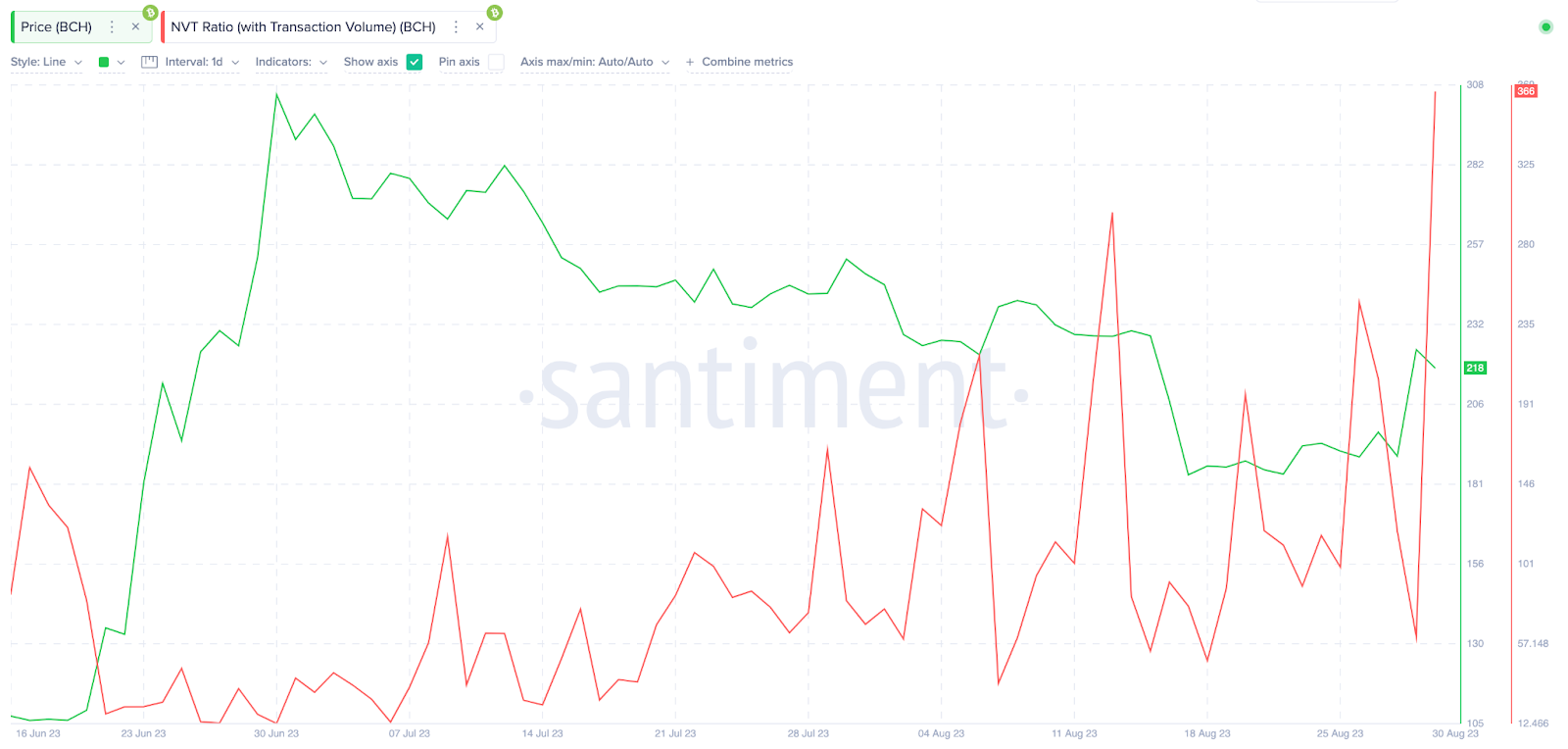

The NVT ratio indicates that this upward trend could continue. As shown below, the Bitcoin Cash NVT ratio has been on the rise since the price of BCH fell from its peak of $329 on June 30, 2023, due to the altcoin market crash.

After the sudden crash on August 17, the NVT ratio rose and reached another local peak of 366 on August 30. In simple terms, the NVT ratio weighs the current market capitalization against the fundamental transaction activity. An increase in the NVT ratio indicates that the Bitcoin Cash network is still experiencing a healthy level of economic activity, even as prices decline.

BCH Coin Price Prediction

Despite the positive news and on-chain signals that fuel optimism, alarms indicating ongoing risks are also flashing. Miners who sold BCH Coin worth $525 million between June 20 and August 30 indicate that selling pressure could intensify at local peaks. During the recent downtrend, miners’ sales largely supported the bears. Furthermore, the continued depletion of reserves could lead to the exhaustion of bulls before reaching the $250 initial resistance.

In the short term, testing the $235 and $250 resistance levels is likely. The range between $200 and $190 could serve as support in the event of a possible selling wave.