Bitcoin (BTC), continues its slow ascent towards its all-time high price levels. However, fundamental indicators are signaling a sell, suggesting that things might not be as perfect as they appear. Could this mean that BTC investors might have to wait longer to see the token reach a new all-time high?

Bitcoin Shows Sell Signal

According to data from 21milyon.com, BTC has seen an increase of over 5% in the last 24 hours, trading around $66,000. Additionally, popular crypto analyst Ali Martinez has pointed out a sell signal. In his analysis, the TD Sequential indicator on the 4-hour chart showed a sell signal for BTC. Since February 15th, each time this indicator suggested selling, BTC’s price dropped by 1.5% to 4.7%.

Moreover, BTC’s fear and greed index recorded a value of 90, indicating high market greed. When the metric reaches this level, it could imply a high probability of a price correction. Experts have examined data from CryptoQuant to see if investors have already started selling BTC, as the mentioned measurements show a downward trend. According to their analysis, BTC’s net deposits on exchanges are high compared to the 7-day average.

Technical Indicators for Bitcoin

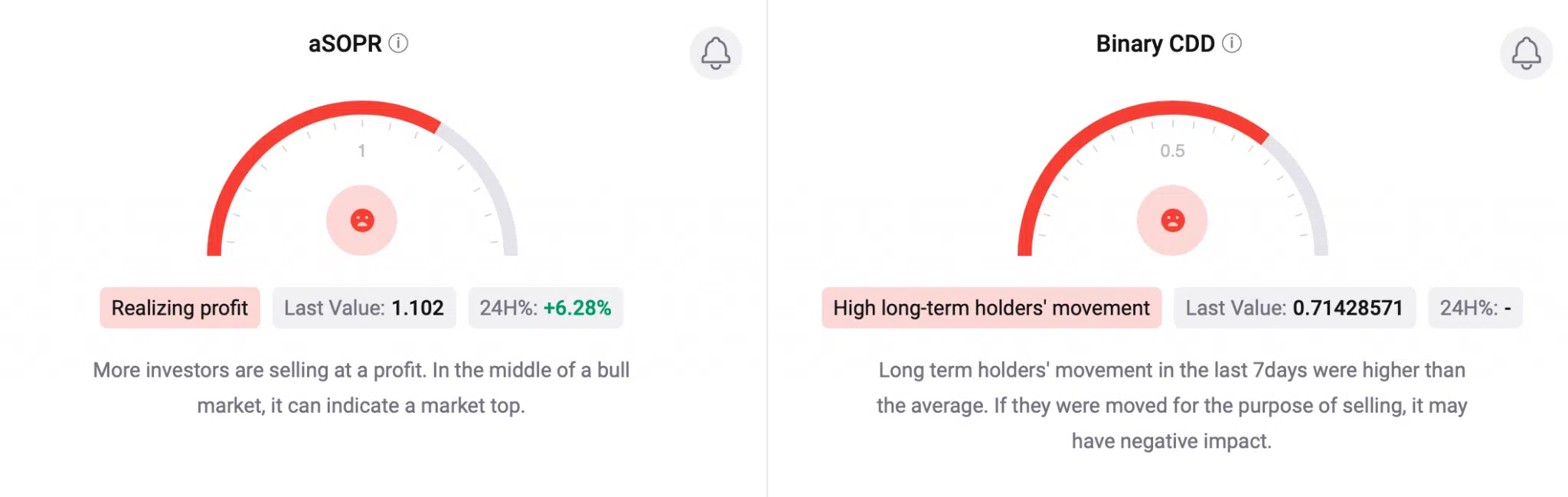

Higher deposits can be interpreted as higher selling pressure. The binary CDD of cryptocurrencies was trending downward, which means that the movements of long-term holders in the last seven days have been above average. This could create a negative impact if they moved for selling purposes. Additionally, the aSORP has also turned downward. This could indicate that more investors are selling for profit.

In the midst of a bull market, this could indicate that the market has reached its peak. Furthermore, Bitcoin‘s Relative Strength Index (RSI) being in the overbought territory could create selling pressure on the cryptocurrency. The Chaikin Money Flow (CMF) also recorded a decline, which could indicate a high probability of a price correction. However, the MACD continued to show a bullish advantage in the market, suggesting buyers are still in favor.