Bloomberg’s chief commodity analyst, Mike McGlone, predicts a potential 60% price drop for Bitcoin (BTC), warning investors about a looming downturn. McGlone expects the recession risk to trigger the decline in BTC.

Bitcoin on Its Way to $10,000, According to McGlone

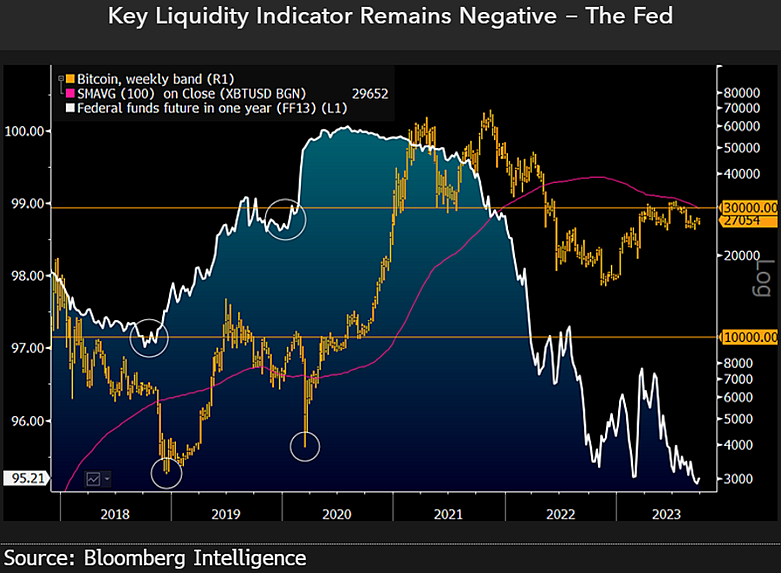

McGlone highlights that the fundamental indicator for BTC continues to rise due to negative liquidity and recession signals worldwide. The analyst believes that the United States will enter a recession by the end of 2023.

McGlone states that the most crucial resistance level for Bitcoin’s price is $30,000, and he expects the leading cryptocurrency to fall and head towards $10,000 amid increasing risks.

At the time of writing, Bitcoin is trading at $27,692, representing a 0.32% increase in the last 24 hours. McGlone’s prediction corresponds to a 60% decrease in Bitcoin’s price. Such a drop in Bitcoin is expected to have a significant impact on altcoins, resulting in substantial losses.

All Risk Assets Under “Risk”

McGlone also points out that the overall crypto market’s most significant risk lies in the potential decline of exchanges as a recession emerges. The chief commodity analyst at Bloomberg warns, “The third quarter will be a preparation period for recovery or recession in the crypto market. Our expectation is that it will be the latter for almost all risky assets. Despite signs of contraction in the US, Europe, and the deflationary effects of the real estate crisis in China, most central banks are still tightening.”

The relatively low performance of the Bloomberg Galaxy Crypto Index (BGCI) may reflect real changes for an asset class that rises when interest rates are zero. In 1987, US Treasury bonds reached their peak a week before the stock market crash, and crude oil hit its peak in July 2008. There are some parallels between the present and the past.

So far, price drops in Bitcoin have occurred before the Fed’s pivots, indicating that the cryptocurrency continues to serve as a leading indicator and shows what may be needed to increase liquidity.

Türkçe

Türkçe Español

Español