Cryptocurrencies are experiencing one of the best weekends recently, with altcoins reaching significant levels. As demand for ETFs has revived, it has increased market interest, and Bitcoin (BTC)  $91,081 has risen to the $68,700 mark at the time of writing. What is happening in the market? Here are the latest evaluations from cryptocurrency experts.

$91,081 has risen to the $68,700 mark at the time of writing. What is happening in the market? Here are the latest evaluations from cryptocurrency experts.

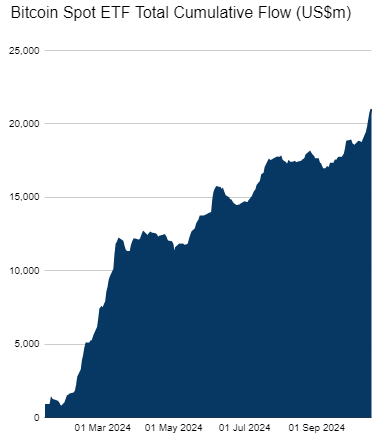

Bitcoin ETF Data

In today’s analysis, Daan Crypto Trades highlighted the rising demand for ETFs. Over the past week, there have been impressive inflows, and such consistent cash inflows have not been seen for quite some time. On Monday, there was a net inflow of over half a billion dollars into BTC ETFs. While the subsequent days did not surpass this record, they remained close.

- Monday +$555.9M

- Tuesday +$371M

- Wednesday: +$458.5M

- Thursday +$470.5M

- Friday +$273.7M

The total inflow over just five days reached $2.129 billion. This figure constitutes about 10% of the total ETF inflows to date. The increasing risk appetite among institutional investors is likely fueled by strong performance in the last quarter.

Bitcoin Predictions

Crypto Faibik mentioned in the latest market analysis that BTC’s journey to $88,000 has now begun. With the breakout of a bullish flag on the three-day chart, we should see more closes above the key level. Indeed, BTC’s price was above this level at the time of writing.

We are witnessing the sixth test of resistance after months of tedious ups and downs. The more intense the resistance is tested, the higher the likelihood of a breakout. Marco Johanning shared the following current chart, indicating that November could be a stronger rally period.

“Next week will be calm in terms of economic news, and the upcoming US elections in November are becoming increasingly focal. I anticipate a rise in November.”

By the end of the article, BTC had reached as high as $68,765. Given the macroeconomic calm expected in the following week, we might see a quick attempt at $70,000 soon. However, weak volume casts doubt on this possibility.