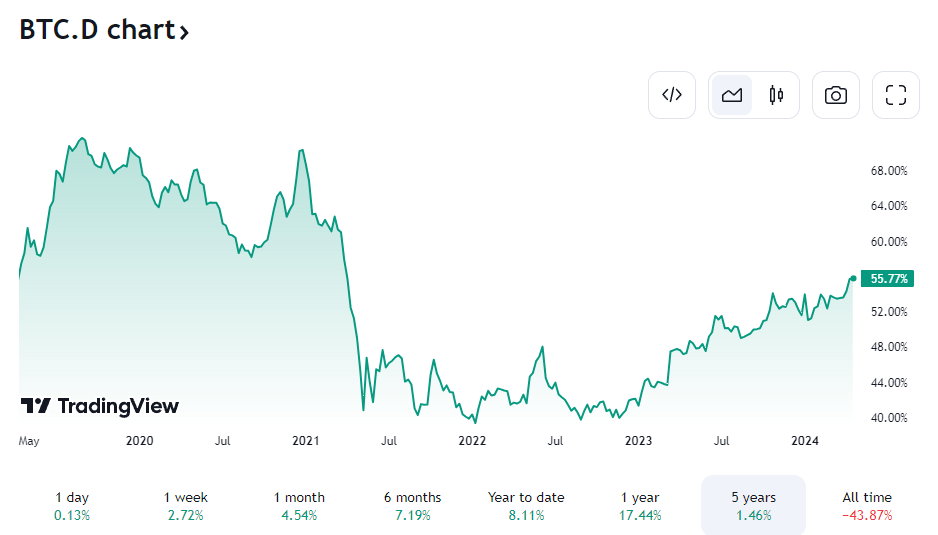

Bitcoin dominance reached a three-year peak over the weekend, with only six altcoins out of the top 50 crypto assets by market value outperforming Bitcoin so far this year. Dogecoin stands out as the best-performing altcoin in the top 50, with a gain of just over 77% from the beginning of the year to April 15, rising from $0.09 to $0.15 according to TradingView data.

Bitcoin and Altcoin Market Performance

Other crypto assets that performed well during this period include memecoin Shiba Inu, Bitcoin smart contract network Stacks, Binance‘s BNB, Ethereum Layer-2 network Mantle, and GPU sharing blockchain network Render (RNDR). Bitcoin rose from its January 1st price of $44,100 to $65,000 at the time of writing, representing a 54% increase since the beginning of the year.

Many analysts attribute the price increase to consistent institutional inflows into 10 spot Bitcoin exchange-traded funds in the US, which were approved in January of this year and generated over $12 billion in cumulative net inflows, according to Farside Investors data.

In particular, Bitcoin dominance reached a three-year high of 56.5% on April 13 and sharply rebounded from market-wide sell-offs caused by rising geopolitical tensions in the Middle East. Bitcoin dominance data represents the ratio of Bitcoin’s market value to the cumulative market value of all other cryptocurrencies.

Expert Commentary on Bitcoin

Bitcoin recovered in the following days, while many smaller altcoins failed to keep pace and experienced significant price declines. Alternative Layer-1 network Aptos and decentralized crypto exchange Uniswap recorded losses of 35% and 31% respectively in the last seven days, ranking among the projects with the biggest drops in market value among the top 50 tokens.

IG Market analyst Tony Sycamore noted in his investment memo dated April 14 that Bitcoin appeared to be on its fourth consecutive weekly decline and the expectation of no further Fed interest rate hikes was putting pressure on crypto investment sentiment. Despite the current negative trend towards risky assets, Sycamore predicted that Bitcoin could gradually climb to $80,000 in the coming months, depending on whether it can hold above its key support point, and shared the following statement:

“We expect the uptrend to continue towards $80,000, provided Bitcoin remains above the support zone between $60,000 and $58,000.”

Türkçe

Türkçe Español

Español