Miners and investors are preparing for the upcoming Bitcoin halving event and the introduction of Runes in the Bitcoin ecosystem, while Bitcoin transaction fees surpassed Ethereum for three consecutive days. According to Crypto Fees data, Bitcoin miners earned $7.47 million in transaction fees on April 17; this was about $160,000 more than the $7.31 million paid to Ethereum stakers.

Bitcoin Ecosystem and Halving Process

Bitcoin miners also earned $9.98 million and $5.91 million on April 15 and 16, respectively, leaving Ethereum stakers behind by $3.5 million and $1.1 million on those days. However, Ethereum continues to lead narrowly with a 7-day average fee of $8.55 million compared to Bitcoin’s $7.57 million.

Bitcoin transaction fees are determined based on the size or data volume of the transaction and the demand for block space at the time of the transaction. The recent increase in transaction fees in the Bitcoin ecosystem comes at a crucial time for Bitcoin miners as the halving event scheduled for April 20 will result in mining subsidies being reduced from 6.25 Bitcoins to 3.125 Bitcoins.

Currently, about 900 Bitcoins are mined daily, which equates to approximately $57.2 million at current prices. The $7.47 million in transaction fees on April 17 accounted for 11.5% of the total block rewards in the Bitcoin mining sector.

However, after the halving event, the share of block rewards from transaction fees will significantly increase, and about 450 Bitcoins will be mined daily. Therefore, miners will rely more on higher fees and the continuous increase in Bitcoin prices to compensate for the revenue drop expected at least in the short term due to the halving.

What’s Happening in the Bitcoin Ecosystem?

In January 2023, the introduction of the Ordinal inscription area similar to NFTs in the Bitcoin ecosystem helped miners earn more from transaction fees, and the launch of a new Bitcoin token standard, Runes, will enable a new revenue stream when the block halving occurs.

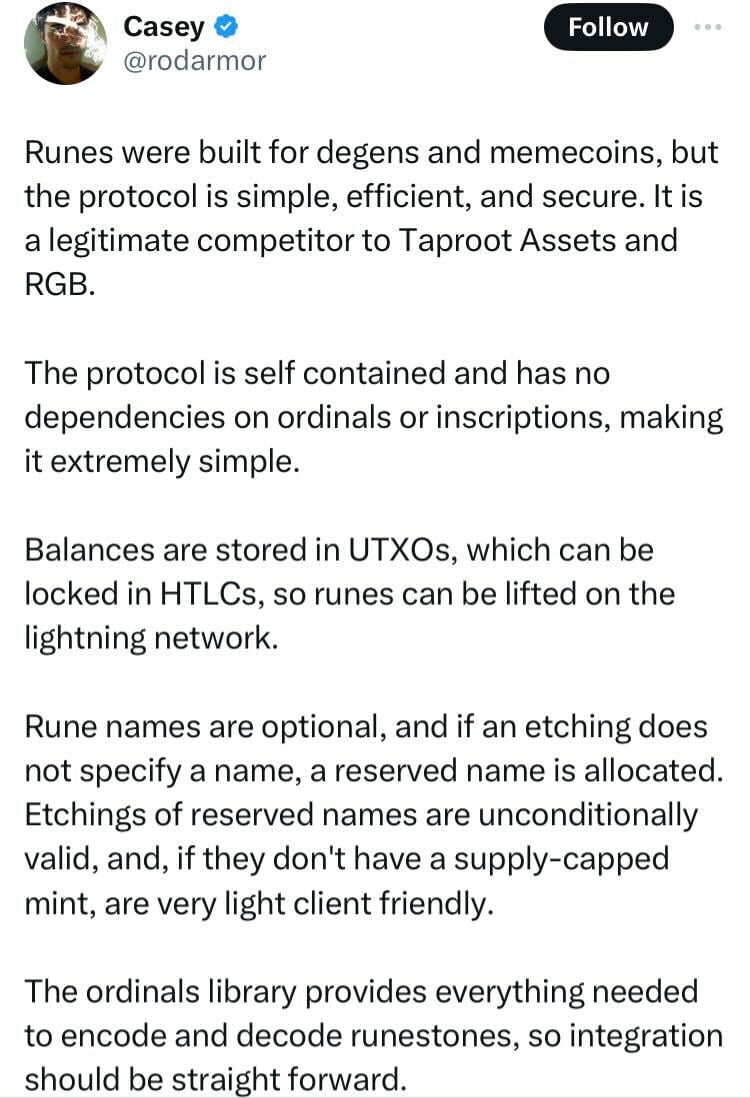

Runes, aiming to facilitate NFT and token creation in the Bitcoin ecosystem for memecoin enthusiasts and other community-focused crowds, will compete with Ordinals. Casey Rodarmor, who introduced the Ordinals space to users, states that Runes is entirely UTXO-based and therefore should not send as much spam to Bitcoin as Ordinals.

The recent increase in Bitcoin fees, partly due to investors shifting their focus to Runes, may have resulted from recent declines in BRC-20 token prices. According to CoinMarketCap data, the two largest BRC-20 tokens, Ordinals (ORDI) and Sats (SATS), experienced declines of 38% and 43% last week, respectively.

Türkçe

Türkçe Español

Español