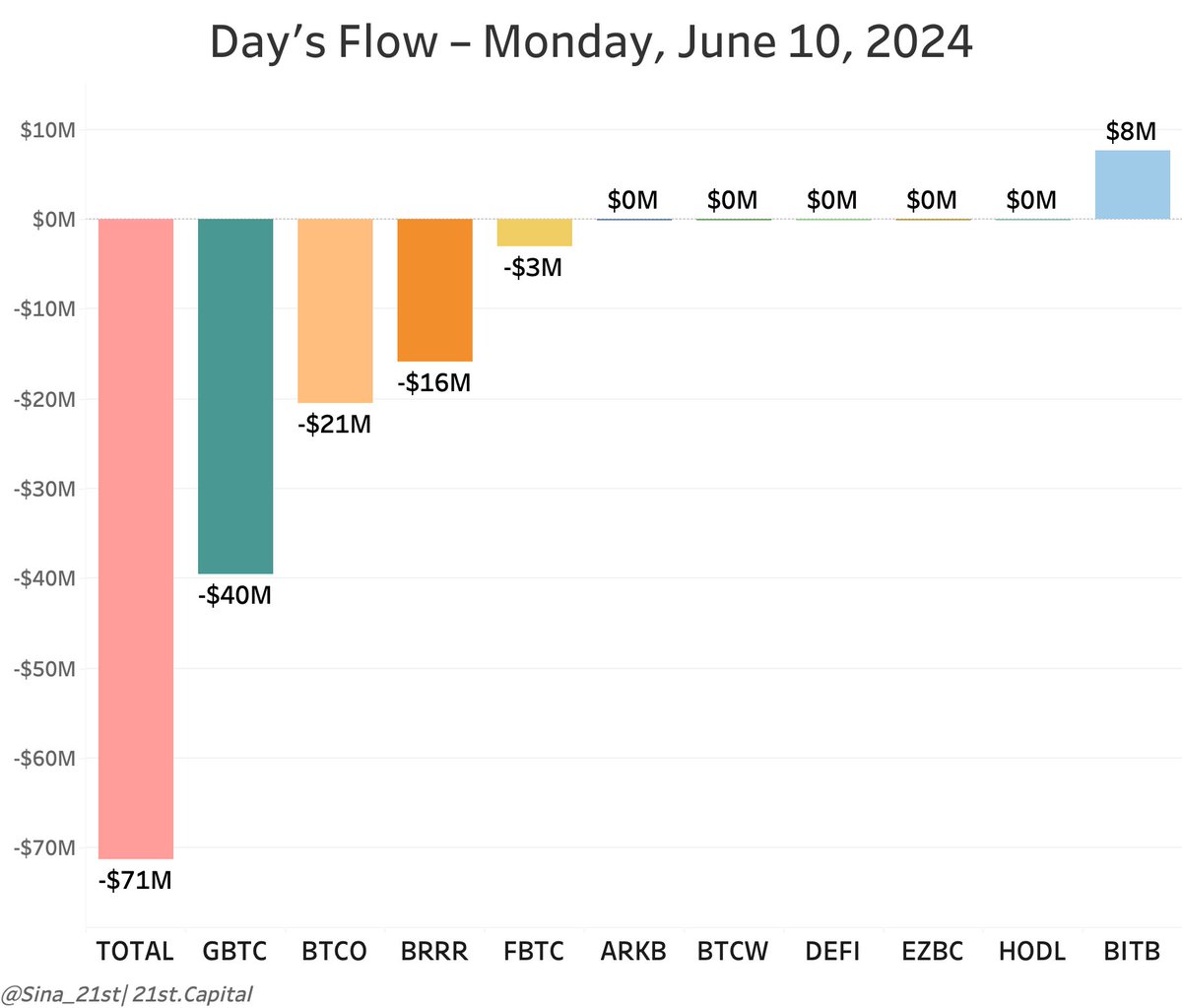

In the US, 11 spot bitcoin investment funds saw a daily net outflow of $64.93 million on June 10, ending the longest inflow streak of 19 days. Grayscale’s GBTC led with a total outflow of $40 million this week. According to SosoValue data, Invesco and Galaxy Digital’s BTCO saw a net outflow of $20 million, with other funds also experiencing investor redemptions on Monday.

What’s Happening on the ETF Front?

Valkyrie’s Bitcoin ETF fund reported a net outflow of $16 million. Fidelity’s FBTC fund saw a net outflow of $3 million, marking its first negative flow since May 2. BlackRock’s IBIT fund, the largest spot Bitcoin ETF by net assets, recorded a net inflow of $6 million, while Bitwise’s BITB fund saw an inflow of $8 million.

The record-breaking 19-day inflow streak, which ended on May 7, accumulated over $4 billion in net inflows. Since their inception in January, the 11 spot Bitcoin ETF funds have recorded a total net inflow of $15.62 billion.

According to crypto trading firm QCP Capital, Bitcoin’s price fell on May 7 after US non-farm payroll and unemployment data presented conflicting views on the US economy, leading investors to shy away from riskier assets due to uncertainty.

Developments in the Process

Markets are awaiting the release of the US Consumer Price Index (CPI), a key measure of inflation, as well as the Federal Open Market Committee meeting expected at the end of this week. CME Group predicts a 99.4% chance that the Fed will maintain the current interest rates between 5.25% and 5.50%, while a Reuters poll of economists suggests the Fed could cut rates twice starting in September this year.

Meanwhile, US ETF issuers are still awaiting feedback from the Securities and Exchange Commission regarding the S-1 registration statements they submitted late last month. Issuers need SEC-approved S-1 forms to officially launch spot Ethereum funds.

Türkçe

Türkçe Español

Español