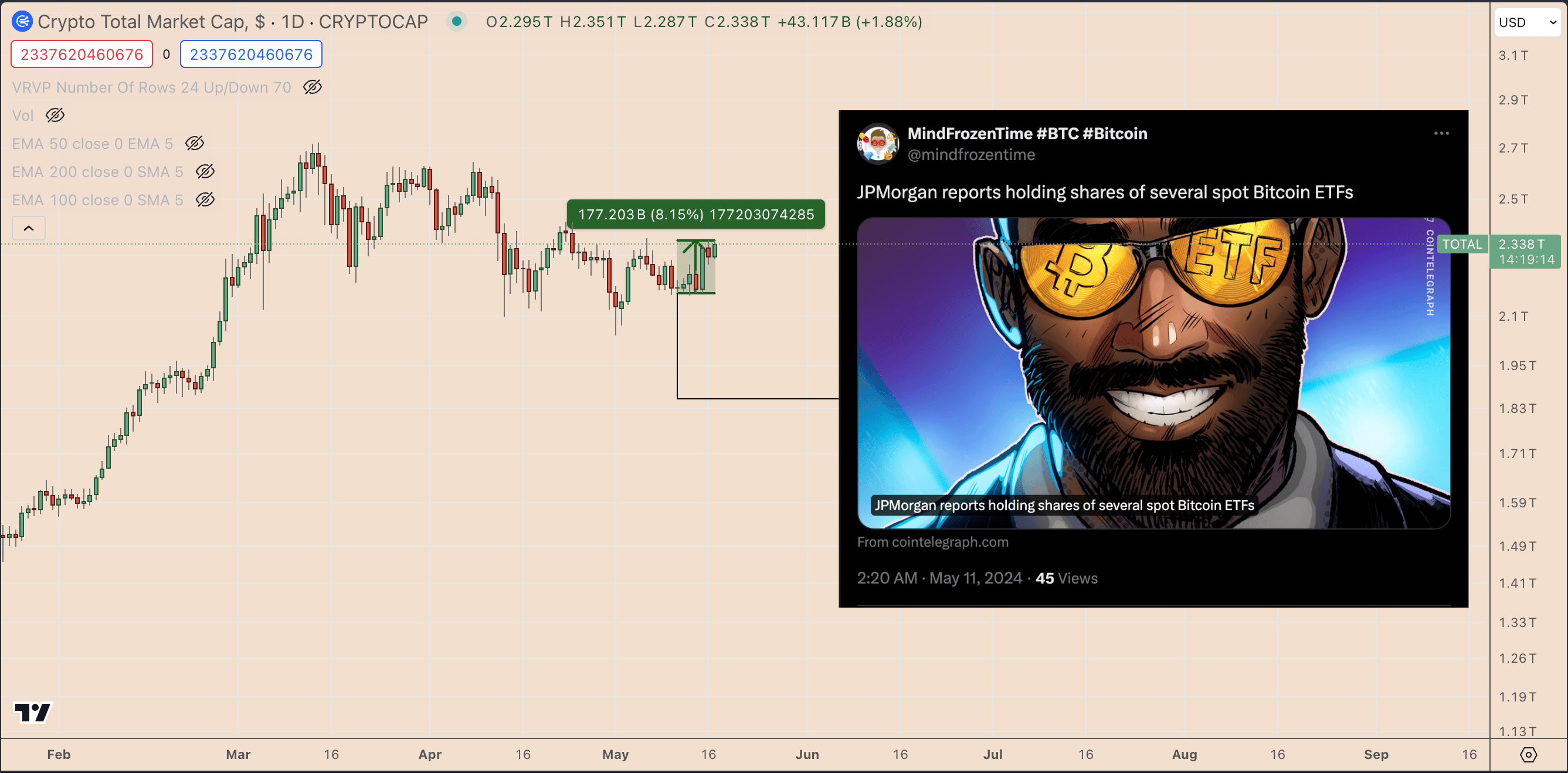

The cryptocurrency market is on the rise today, with the total market value increasing by approximately 2.50% in the last 24 hours, reaching $2.35 trillion on May 17. This includes gains from top cryptocurrencies Bitcoin and Ethereum, which rose by about 2% and 4%, respectively. One of the main factors driving the crypto market up today is the ongoing inflows into spot Bitcoin exchange-traded funds (ETFs) in the United States.

Why Is Bitcoin Rising?

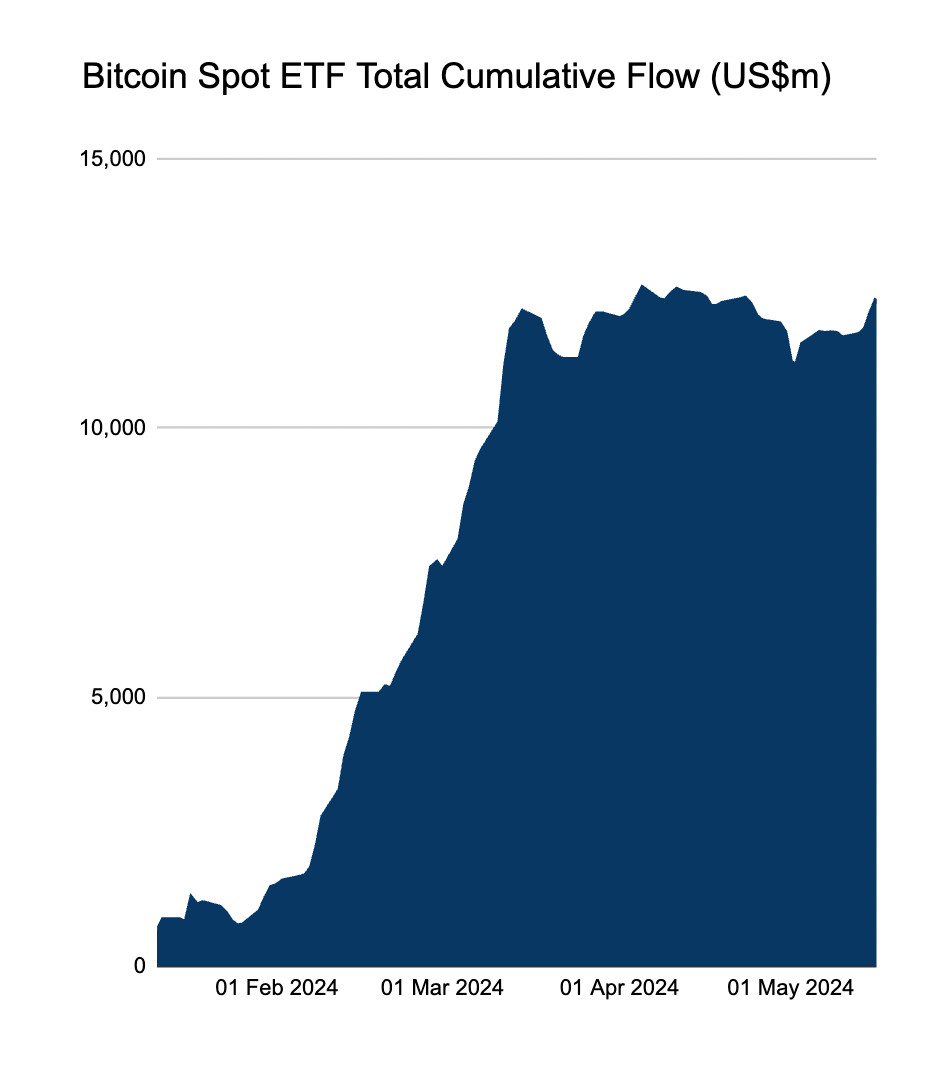

The continued gains in the crypto market parallel the resumption of inflows into US-based spot Bitcoin ETF funds. As of May 16, these funds managed approximately $12.40 billion worth of Bitcoin, up from $11.18 billion at the beginning of the month. Interestingly, the inflows are emerging as over 600 firms reported holding Bitcoin ETF funds in their portfolios.

JPMorgan, the world’s largest banking institution, announced that significant assets are held in various Bitcoin ETF funds in the market. The bank’s diversified investment portfolio includes Bitcoin ETF funds from BlackRock, Fidelity, and Bitwise, each with investments exceeding $1 million.

Similarly, another major banking giant, Wells Fargo, recently disclosed its exposure to Bitcoin ETF funds in a filing with the US Securities and Exchange Commission (SEC). Wells Fargo reported holding 2,245 shares of the Grayscale Bitcoin ETF fund (GBTC).

These announcements highlight the increasing acceptance and adoption of Bitcoin and other cryptocurrencies in the traditional finance sector, helping boost the crypto market’s valuation today.

Notable Details

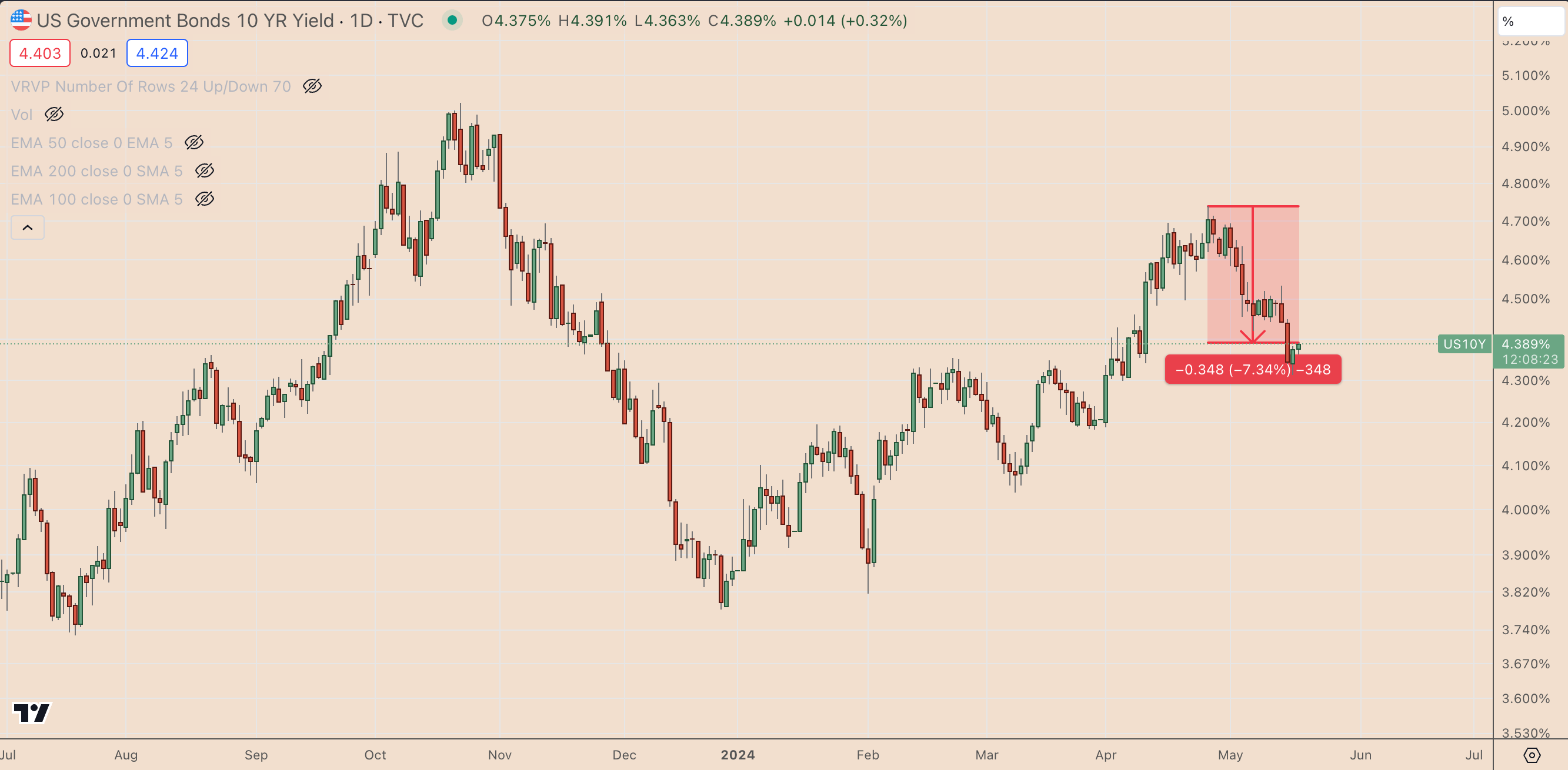

Interestingly, the Bitcoin ETF inflows coincide with a decline in US bond yields; this indicates a growing risk appetite among investors amid a rising crypto market and the likelihood of lower returns in the Treasury market.

This trend primarily developed after the US Federal Reserve’s two-day Federal Open Market Committee (FOMC) meeting concluded on May 1; during this meeting, central bank officials announced they would not raise interest rates in the near future until inflation calms down. On May 15, the US Consumer Price Index (CPI) showed a decline in inflation. As a result, bond investors now see the first rate cut happening in September instead of November, as initially expected.

Türkçe

Türkçe Español

Español