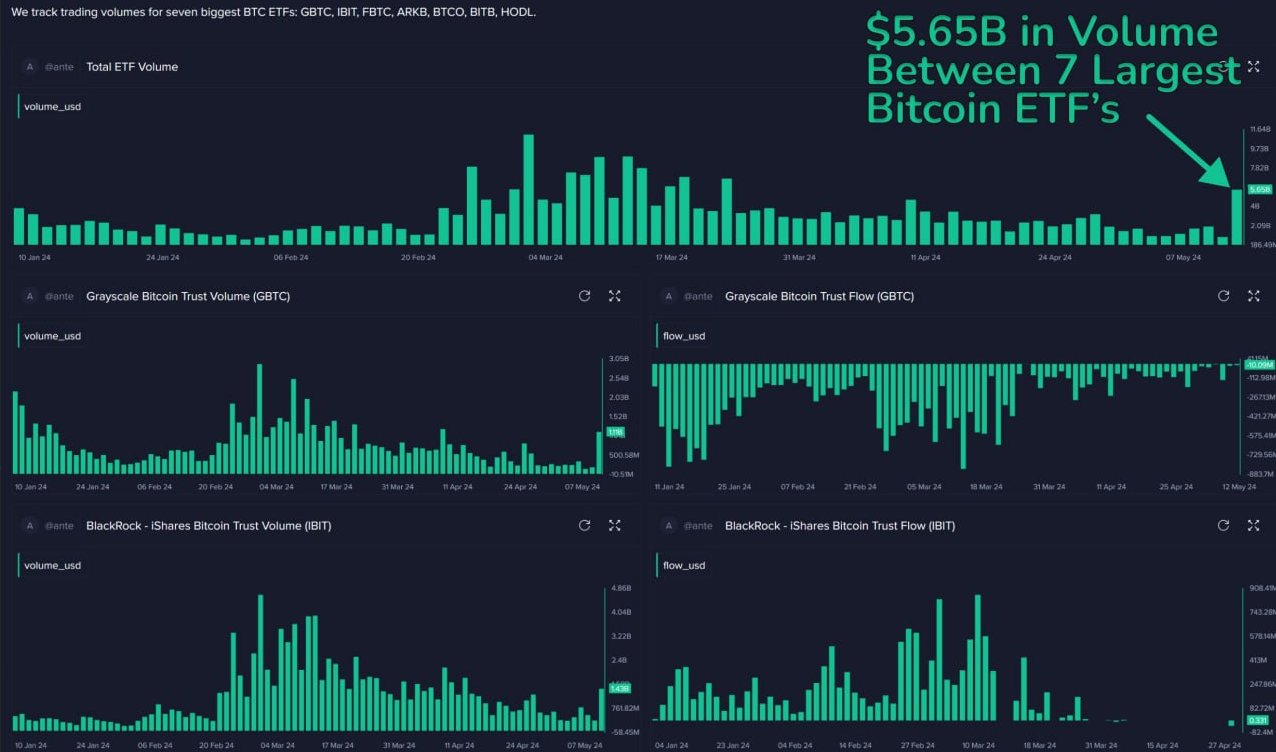

Bitcoin price surged to around $67,000, pushing Bitcoin ETF volumes to a 7-week high. These ETFs, returning to levels unseen since late March, are trading with a daily volume of approximately $6 billion.

Key Factors Behind the Surge

Bitcoin’s inclusion in new institutional investment products is a significant factor in this rise. Around 1,000 firms in the United States purchased Bitcoin exchange-traded funds (ETFs). According to research firm Santiment, daily spot Bitcoin volumes exceeded $5 billion.

Crypto Traders Are Rushing to This App – Here’s Why You Should Too

Crypto Traders Are Rushing to This App – Here’s Why You Should Too

In one day, the total volume of seven Bitcoin ETFs reached $5.65 billion. This is the highest volume recorded since BTC/USD reached its all-time high of $73,800. Santiment reported that this week saw $5.65 billion in volume among the seven largest spot ETFs in the US. Santiment interpreted this increase as a sign that “the days of whales accumulating only on-chain are over.”

Positive Impact on Bitcoin and the Market

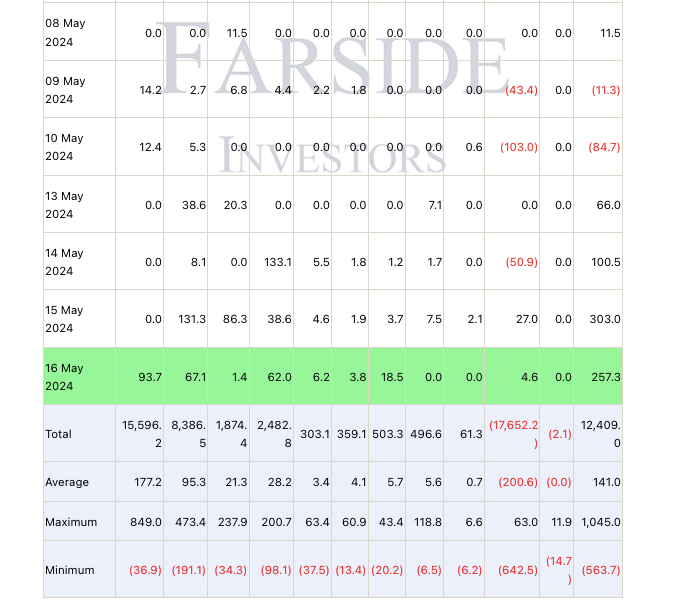

Hedge fund manager Thomas Kralow also highlighted the rise, stating it is a positive indicator for the market. The increase in spot ETFs continued throughout May, with positive inflows every day.

However, institutions like Grayscale Bitcoin Trust, previously known for significant outflows, have seen modest interest recently. According to data from UK investment firm Farside, Grayscale Bitcoin Trust (GBTC) saw modest interest of $27 million and $4.6 million on May 16 and 17, respectively.

Institutions Have Now Adopted

Form 13F filings show that 937 US firms turned to Bitcoin ETFs in the first quarter. This number is significantly higher than the number of firms interested in gold ETFs in their first quarter post-launch.

The BTC price surpassed the $65,000 support and rebounded from purchases at this level. Trading firm QCP Capital attributes this move to genuine institutional and sovereign adoption. They also note that Bitcoin has exited the halving period and sharply rebounded when it fell below $60,000.

Türkçe

Türkçe Español

Español