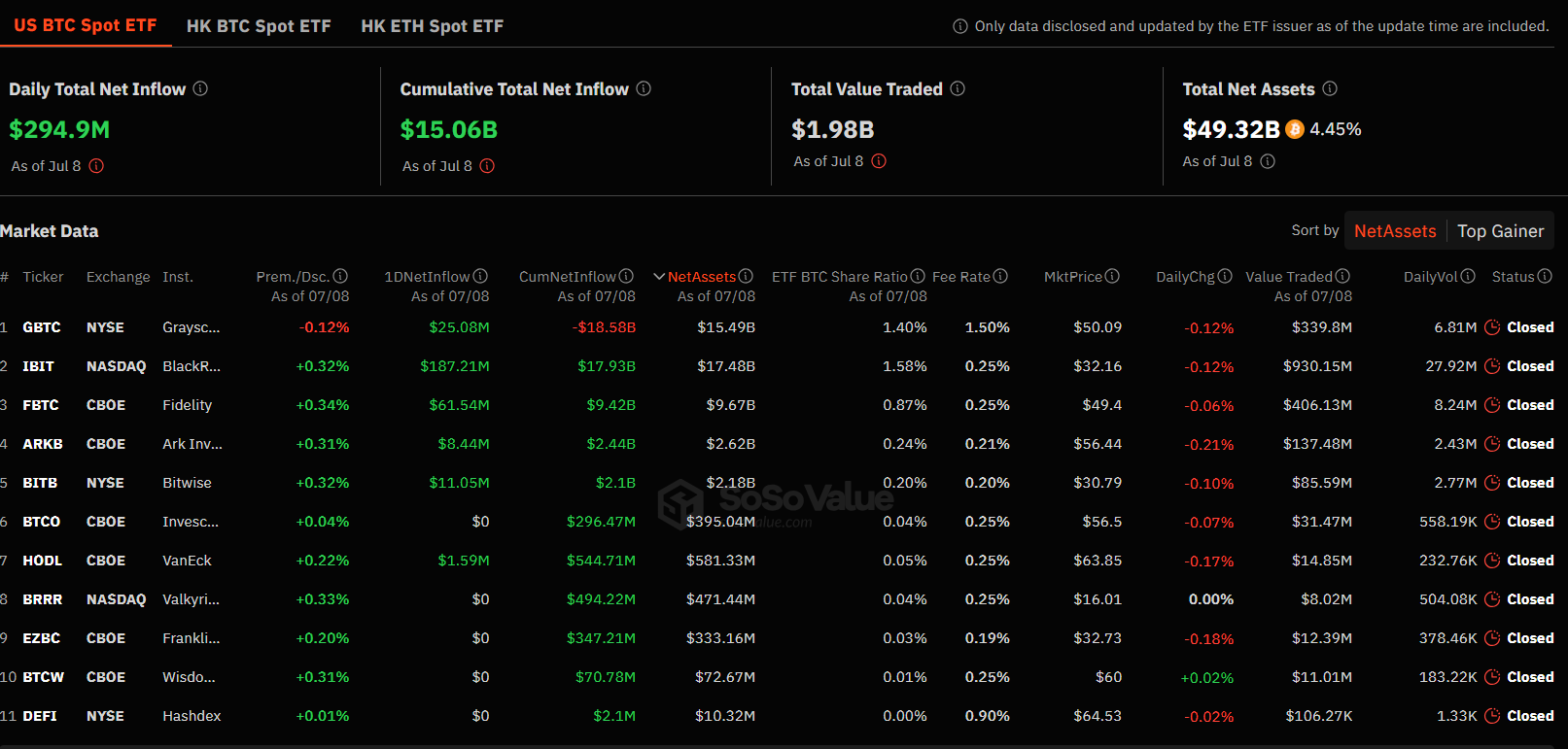

On July 8, spot Bitcoin ETFs experienced the highest inflow in a month, attracting $295 million in a stagnant crypto market. Led by major players like BlackRock and Fidelity, this inflow reflected investor confidence despite market uncertainties. With Bitcoin  price surpassing $57,500 today, the positive sentiment in spot Bitcoin ETFs is expected to continue.

price surpassing $57,500 today, the positive sentiment in spot Bitcoin ETFs is expected to continue.

BlackRock and Fidelity Lead the Way

In this significant inflow towards Bitcoin ETFs, BlackRock‘s fund led with a record daily inflow of $187.2 million. Fidelity followed with gains of $61.5 million. Additionally, the Grayscale Bitcoin Trust (GBTC) saw an inflow of $25.1 million, marking a rare positive price movement day. This increase represents the largest daily inflow collected by ETFs since June 5.

Bitwise recorded an inflow of $11 million, Ark Invest $8.44 million, and finally VanEck $1.59 million. These significant inflows occurred during a period when the market was grappling with concerns over large Bitcoin sales by the German government and repayments to Mt. Gox creditors. The German government caused market fluctuations by transferring 26,200 BTC to exchanges and market makers. According to Arkham Intelligence, the government still holds 27,460 BTC worth $1.57 billion. These movements led to uncertainty among investors.

Another source of concern is the release of $8.5 billion worth of Bitcoin into the market as the collapsed Japanese crypto exchange Mt. Gox begins repayments to creditors following the 2014 hack incident. The entry of such a large amount of Bitcoin into the market could further depress prices. However, some analysts argue that these concerns might be exaggerated and that the market could absorb this additional Bitcoin supply without issues.

Bitcoin Price Volatility Continues

In the last two trading weeks, the cryptocurrency Bitcoin experienced a significant drop, falling to $53,600 on July 5. This figure marks the first time Bitcoin has fallen below $54,000 since February.

Factors such as government sales, creditor repayments, general market dynamics, and investor sentiment contributed to this decline. At the time of writing, Bitcoin was trading at $57,457.

Türkçe

Türkçe Español

Español