In the complex world of financial instruments, Bitcoin ETFs have caught the attention of experts like Vijay Boyapati. Boyapati sees Bitcoin ETFs as an advantage for attracting significant capital inflows into an inflation-resistant store of value, while also highlighting a significant disadvantage: the increase in custody risk. Let’s examine Boyapati’s views and the necessity of addressing this custody risk.

Vijay Boyapati’s Perspective: Bitcoin ETFs as an Advantage for Capital Inflow

Vijay Boyapati, a prominent figure in the finance world, positions Bitcoin ETFs professionally due to their unique ability to attract large capital inflows. In an environment where global savings seek refuge in inflation-resistant value stores, he believes Bitcoin ETFs will emerge as an attractive option.

The natural design of ETFs, allowing for seamless and diversified access to various assets, makes them an attractive path for investors looking to protect their capital against inflation.

The Custody Risk Conundrum: Lessons from Gold’s Fragility

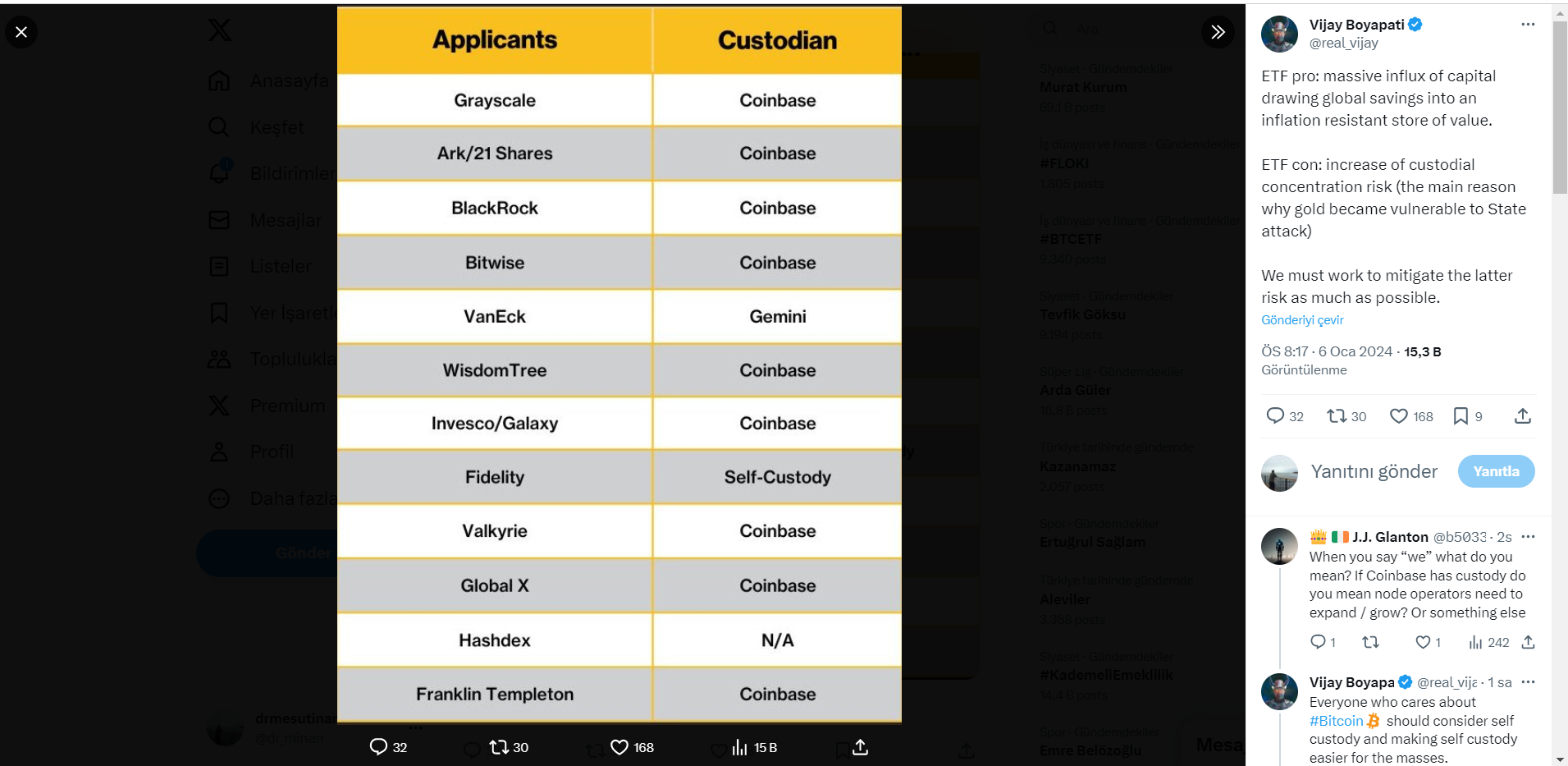

However, Boyapati draws attention to a critical downside associated with the rise of Bitcoin ETFs: the increase in custody risk. This risk reflects a historical fragility observed in gold, where high custody concentration led to sensitivity against state attacks.

As the financial environment evolves, reducing the risk of custody-focused concentration becomes a strategic necessity. Lessons drawn from gold’s fragility underline the need for proactive measures to ensure the resilience of inflation-resistant value stores. Addressing this risk requires a multifaceted approach, ranging from diversification strategies to robust regulatory frameworks.

Implementing diversification strategies within the Bitcoin ETF ecosystem can help distribute custody responsibilities and reduce the risk of concentration associated with a single institution holding a significant portion of the assets. This approach aligns with Boyapati’s emphasis on reducing the risk of custody concentration, which could potentially threaten the stability and security of value stores.

Striking a Balance: Embracing Bitcoin ETF Benefits While Reducing Risks

Vijay Boyapati’s perspective sheds light on the dilemma of Bitcoin ETFs. Directing capital to inflation-resistant value stores points to an advantage for Bitcoin ETFs. On the other hand, the risk of custody concentration in certain institutions implies a downside for Bitcoin ETFs.

The challenge lies in establishing a balance that benefits from the advantages of Bitcoin ETFs while actively working to reduce the associated risks.

Türkçe

Türkçe Español

Español