Spot Bitcoin ETFs attracted extremely strong volumes, pushing Bitcoin prices to an all-time high. Although this is an exciting period, it was not expected to continue indefinitely. Recently, while there has been some recovery, net inflows remain flat. So, what is the latest situation for BlackRock?

BlackRock BTC ETF

According to applications made to the U.S. Securities and Exchange Commission, two funds managed by BlackRock have started holding BTC ETF. BlackRock purchased from its own issued BTC ETF, IBIT. Wall Street giant’s BlackRock Strategic Income Opportunities and BlackRock Strategic Global Bond funds made purchases of $3.6 million and $400,000, respectively.

BlackRock’s IBIT exchange-traded fund has received more inflows than all other funds since ETFs began trading in January. It is even expected to surpass BlackRock in terms of total reserve size this week. According to recent reports, hundreds of firms have enriched their investment portfolios with various Bitcoin ETFs, primarily IBIT. The demand was so intense that it outperformed the launch period of Gold.

The two funds that purchased the IBIT ETF are managed by the firm’s global fixed income CIO, Rick Rieder.

Spot Bitcoin ETF Latest Situation

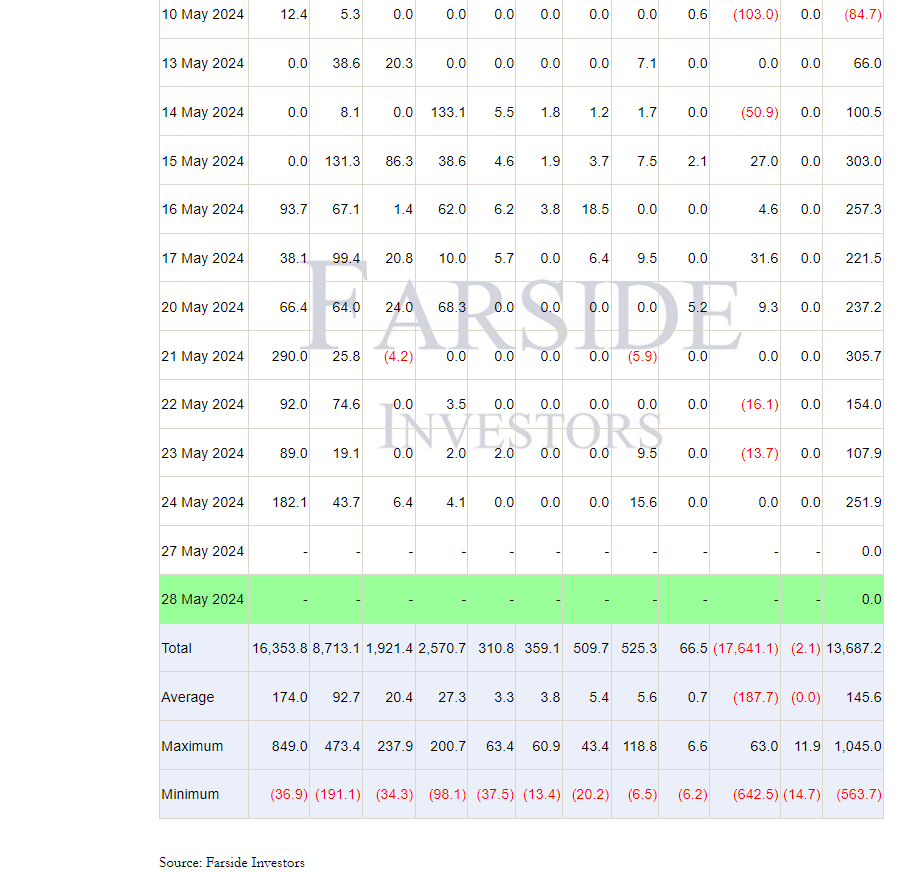

Spot Bitcoin ETFs have seen steady net inflows since May 13. Sales on the GBTC side have largely halted, and with the support of net inflows there, we have started to see total inflows remain positive. According to data from May 24, there was an inflow of $251 million. This figure was the strongest since the inflows on May 16.

Meanwhile, total inflows to all spot Bitcoin ETFs reached $13.6 billion. Although this number fell for a while, it continues to break new records every day. GBTC has seen $17 billion in outflows to date, while IBIT has experienced $16.3 billion in inflows. The Fidelity fund has seen net inflows of $8.7 billion.

Türkçe

Türkçe Español

Español