Bitcoin suffered a significant value loss following a dip on the night of December 11. This period, particularly the liquidation of long positions in the futures market, led to significant losses. As of the writing of this article, Bitcoin is trading at $41,786. What can be expected for Bitcoin? We examine with expert analyst comments and important data.

Why Is Bitcoin Falling?

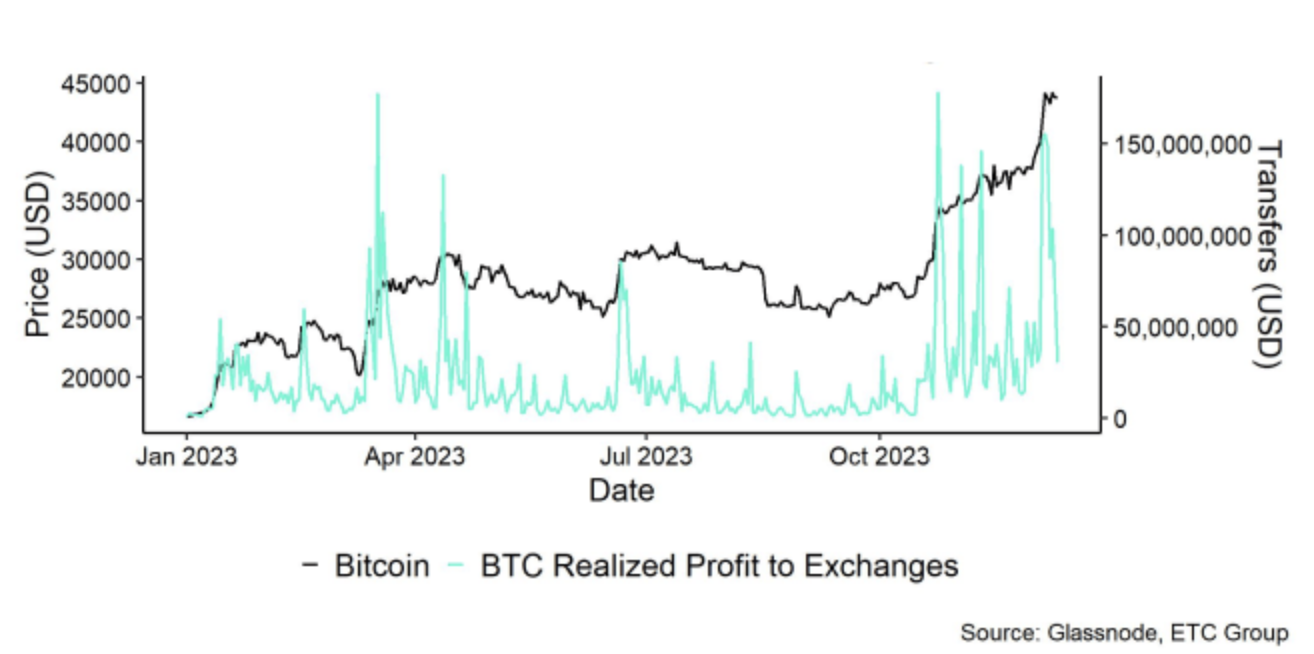

According to an analysis conducted by the ETC Group, the price correction experienced in Bitcoin is linked to the increase in circulating Bitcoin that is currently in a profitable position. ETC Group Research Director André Dragosch stated in his statement:

“As Bitcoin investors make more and more profit, crypto assets have recently retreated.”

Following this statement, Dragosch drew attention to on-chain data showing an increase in the amount of Bitcoin in profit sent to exchanges. According to Dragosch, investors in the market are in a strong profit environment, which could mean some investors may tend to realize profits from their positions.

In the ETC Group analysis, it was announced that 88.3% of Bitcoin addresses and 77.6% of Ethereum addresses are in profit. ETC emphasized in a report on the subject that these rates are close to the highest values since the beginning of the year.

Profit Realizations Continue

The report also highlighted that profit-making activity primarily took place among short-term Bitcoin holders, that is, those who hold for less than 155 days. The report on the subject stated:

“Short-term holders’ transfers of Bitcoin to exchanges for profit reached their highest level since July of this year. This definitely delayed the current rally a bit due to increasing selling pressure.”

According to the ETC Group analysis, last week was the first week since the beginning of October that saw net outflows from crypto asset products traded on the exchange. Dragosch announced a net fund outflow of $18.2 million for the week ending on December 8 in total. According to the analysis, most of these outflows, $13.1 million, were seen in Bitcoin exchange-traded products (ETP). However, Ethereum ETPs saw a net fund inflow of $5.8 million.