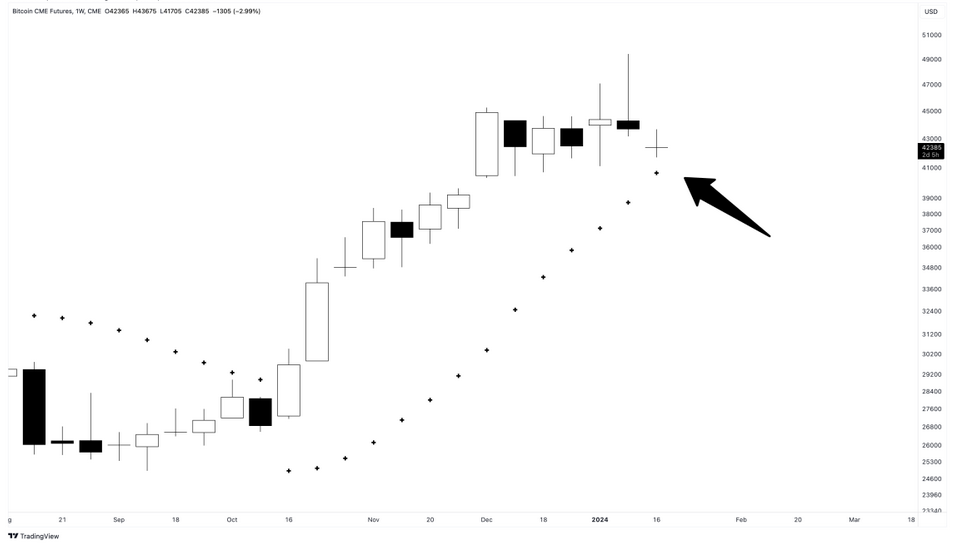

Recently, Bitcoin has witnessed a significant retreat, experiencing a 15% drop from its 2024 high of $49,000. This unexpected downturn has sparked debates and analyses within the crypto community following the approval of 11 spot Bitcoin Exchange Traded Funds (ETFs). Investors are now examining the charts for indicators of Bitcoin’s next move.

Has Bitcoin’s Uptrend Ended?

The sudden correction necessitates a closer examination through the lens of technical analysis. Notably, the decline included a bearish candle on the daily chart, signaling a potential reversal in Bitcoin’s upward trajectory. Adding to the complexity, there was a significant wick depicting a major sell-off following the peak in prices.

CME BTC Futures’ emergence with a notable downward gap further complicates matters. Such gaps often act as potential resistance levels and reinforce the prevailing bearish trend.

A Glimmer of Optimism for Bitcoin

Amidst the prevailing negative signals, a glimmer of optimism emerges from an important technical indicator, the Parabolic SAR. Despite market turmoil, the untouched weekly BTCUSD Parabolic SAR indicator points to the resilience of the long-term bullish trend.

This indicator, known for its effectiveness in identifying potential reversals, provides a contrasting perspective amidst instant bearish signals and sentiment.

Understanding the Parabolic SAR

In this context, it’s important to understand the significance of the Parabolic SAR by grasping its functionality. As an effective technical analysis tool, the Parabolic SAR primarily determines the direction of an asset’s momentum and offers insights on entry and exit points.

The ‘SAR’ in Parabolic SAR stands for ‘Stop and Reverse’. It is represented on charts as a series of dots above or below price bars, with a dot below indicating bullish momentum and a dot above signaling a bearish trend.

A distinctive feature of the Parabolic SAR is its role as a trailing stop-loss. As the price of the asset fluctuates, the Parabolic SAR is dynamically adjusted and approaches the price line. This dynamic adjustment allows investors to effectively manage their positions, securing profits while minimizing potential losses.

In the current context of Bitcoin’s market dynamics, the position of the Parabolic SAR, still below the weekly chart’s price bars, indicates that the long-term bullish trend continues uninterrupted.

Türkçe

Türkçe Español

Español