As the cryptocurrency market continues to fluctuate, Bitcoin  $104,127 has fallen below $92,000, with deeper lows anticipated. The failure to reclaim the $97,138 mark raised the risk of increasing downward momentum, leading to a sell-off and long liquidations that define today’s market situation.

$104,127 has fallen below $92,000, with deeper lows anticipated. The failure to reclaim the $97,138 mark raised the risk of increasing downward momentum, leading to a sell-off and long liquidations that define today’s market situation.

What Price Could Bitcoin Drop To?

The Titan of Crypto discussed the risk of decline during a week when markets were warned by overbought signals. Predictions suggested a potential drop to around $90,000, with a further target set at $94,200. Without protection at these levels, bitcoin could see a pullback towards the Kijun support near $83,500 if the current weakness persists and is supported by ETF exits.

“Bitcoin Short-Term Update

As expected, a pullback towards $94,200 occurred. Interestingly, when I shared this target, no analysts mentioned it.

What comes next? If the breakout is confirmed, the next key support could be around $83,500.”

Despite the ongoing declines, there is a prevailing belief in the continuation of upward momentum in the medium to long term. The reaction from more professional investors in the ETF market could see a dip near $83,500, with billion-dollar ETF inflows potentially causing panic with corresponding outflows.

Current Status of Cryptocurrencies

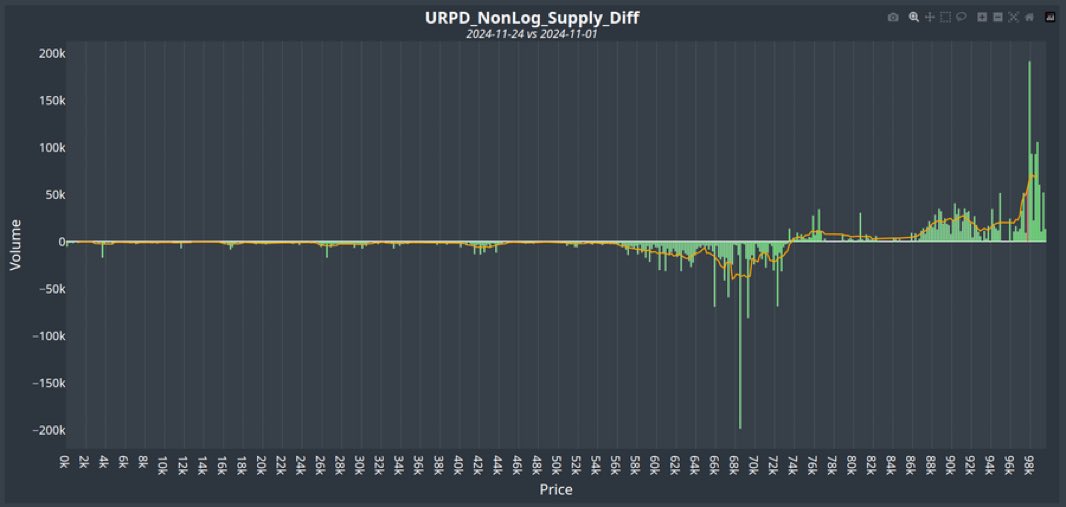

In his recent assessment, QuintenFrancois highlighted massive sales by long-term investors. While Michael Saylor individually acquired over $10 billion worth of BTC, long-term investors viewed prices nearing $100,000 as an opportunity for profit.

“In November, long-term investors sold 198,000 BTC. It is quite normal for long-term holders to start profiting at $100,000. Relax, #Bitcoin will absorb all this selling pressure.”

While declines in bear markets challenge investor psychology, the high volatility of bull markets induces similar effects. Experienced investors prefer to observe markets from a broader perspective rather than focusing on short-term fluctuations, preparing for trends that may evolve in the upcoming months. Currently, the news cycle indicates potential for increased gains by early 2025.

Türkçe

Türkçe Español

Español