Bitcoin, TradFi market starts the week struggling as it returns to the $67,000 level. The largest cryptocurrency is approaching a rematch with the last resistance around the all-time highs of $69,000 and $73,800. Whether it will reach this point in the coming days is the main concern of market participants, and various factors may contribute to the continuation of the bullish trend.

What Is Happening on the Bitcoin Front?

These factors include hints of US economic policy as the Federal Reserve releases the minutes of its May meeting, while US unemployment data is also on hold. When it comes to Bitcoin price action, investors are increasingly confident that a local bottom has been reached and that a rise will occur after two months of consolidation. Data obtained by TradingView shows that Bitcoin has returned to an upward trend this week, reaching close to $67,000 in the Asian session after briefly dipping before the weekly close.

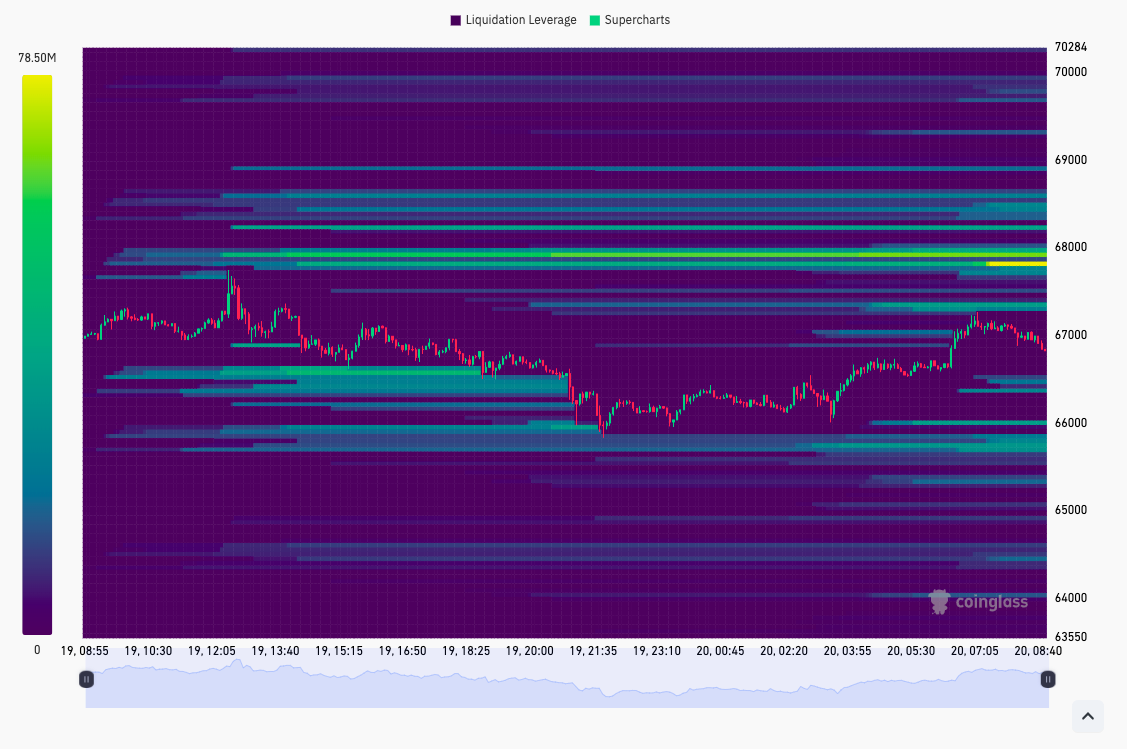

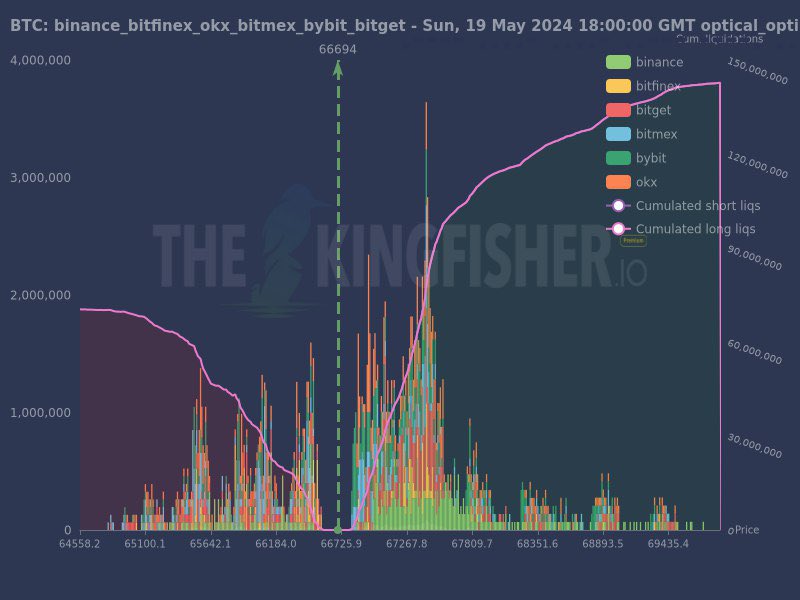

This short-term weakness accompanied geopolitical uncertainty in Iran, but the BTC/USD pair quickly shrugged it off as it maintained its 10% gains for May. The latest data from data analysis platform CoinGlass now shows that most of the immediate general resistance is just below $68,000. Crypto Traders Are Rushing to This App – Here’s Why You Should Too

Notable Statements About Bitcoin

Additional data shared by IT Tech, a contributor to the blockchain data analysis platform CryptoQuant, on X shows the liquidation levels surrounding the spot price. Market participants were in a positive mood commenting on the latest Bitcoin price action. Popular investor Crypto Damus noted that it was the first weekly rise since October 2023. Crypto Damus stated that last week’s candle erased previous losses and closed at $66,210.

MNTrading trading firm’s founder and CEO Michael van de Poppe reiterated his thoughts on a steady march towards new highs for Bitcoin and shared the following statements:

“Bitcoin will likely continue to move in this range. I don’t expect significant volatility. I prefer to wait for consolidation and slow down upward movements towards the all-time high.”

Van de Poppe also added that he expects altcoins to perform better during this period, as they have suffered more severe losses during Bitcoin’s consolidation phase, and shared the following statements:

“Slow upward progress, slow but steady steps towards a vertical move in Q3/Q4.”

Türkçe

Türkçe Español

Español