Bitcoin price continues in the red due to panicking investors despite all the good news. However, it remains above $60,000, and remembering last year, $60,000 was a dream then. Now, investors dream of BTC reaching six-figure targets.

Will Cryptocurrencies Rise?

Four charts indicate that the bullish phase of Bitcoin’s bull cycle is not over yet. While US stock markets wiped out $1.1 trillion, MTGOX creditors are receiving billions of dollars in BTC, and a Reuters poll shows Harris ahead of Trump. Investors continue to be influenced by the panic that started with Germany. They are not wrong to be afraid.

However, short-term declines do not mean that the BTC price will continuously fall. There are at least four reasons for this. Let’s look at the charts.

MVRV

Looking at this, the indicator (orange) is above the 365-day moving average (blue). This tells us that the upward trend in BTC price should continue. Additionally, if it falls below the 365-day average, the real big sales might start then. Glassnode analyst James said;

“At the beginning of July, the MVRV ratio pulled back to its 365-day moving average and found support near this average. Such corrections occur near price bottoms, and the upward trend remains intact in 2024.”

Spot Bitcoin ETF

Since trading began on January 11, ETFs have seen significant interest. Crypto and finance expert SoSo Value notes that the cumulative total net inflow since January 11 is $17.50 billion. Moreover, volumes remain strong, and our spot ETH ETFs have also started trading on exchanges.

Halving

Since the last block reward halving, nothing abnormal has happened. In fact, we have seen good performance. Historical data shows that the actual peak is seen within 12 months after the halving. However, we have not even tested the ATH yet.

In previous cycles, it went like this:

- First halving 1000% in 12 months

- Second halving 200%

- Third halving 600%

Now, after the fourth block reward halving, BTC is still trading sideways. And there is still a long way to go until 12 months are up. This means we could see higher peaks in the next 9 months.

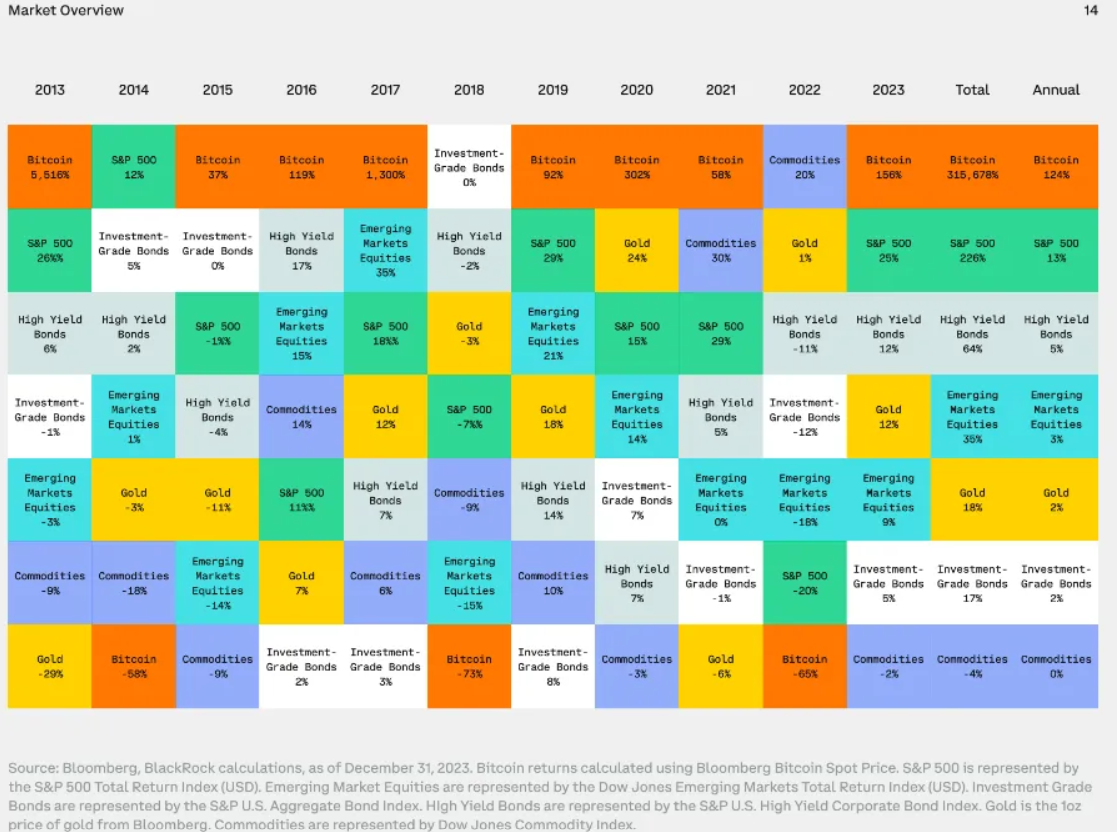

Past Price Performance

Based on past trends like monthly performance, Bitcoin’s poor performance in 2024 seems unlikely. Moreover, BTC tends to see its main rises in the last quarter, with an average increase of 93%.

Türkçe

Türkçe Español

Español