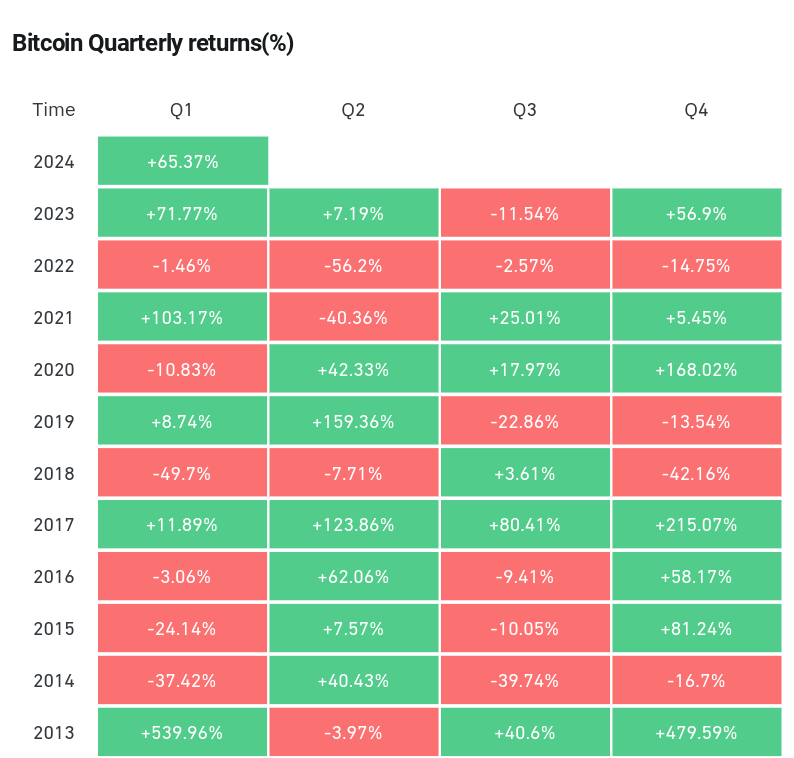

Significant developments in the cryptocurrency market continue to make headlines. Accordingly, Bitcoin is facing the risk of exhaustion as it approaches the end of the first quarter of 2024 with a 65% price increase. Trading firm QCP Capital warned its Telegram channel subscribers in an update on March 29 that the exponential rise could pose a problem in the next quarter.

What to Expect on the Bitcoin Front?

Bitcoin market observers are focused on the weekend as several important candles, including weekly, monthly, and quarterly, are closing simultaneously. After a transformative start to the year, Bitcoin’s price action continues to hover around all-time highs, yet it still struggles to establish new support. According to QCP Capital, the outlook for the second quarter remains very bullish. The firm believes the following factors will contribute to the momentum:

“There are enough factors to form a very bullish view for the second quarter;

-

1. Ongoing demand for a spot Bitcoin ETF and shrinking supply as GBTC exhausts.

-

2. The Bitcoin halving event.

-

3. ETNs on the London Stock Exchange.

-

4. Potential approval of an Ethereum spot ETF.”

Noteworthy Details in the Report

Despite these developments, the extent of progress recorded since the beginning of the year, including the launch of spot Bitcoin exchange-traded funds in the United States in January, indicates that bulls might have difficulty maintaining this momentum. QCP shared the following statement regarding the issue:

“At the same time, the price rally was exponential in the first quarter and there are signs of exhaustion.”

The largest altcoin, Ethereum, is also noted for its decreasing sentiment and persistent high funding rates on exchanges. The update included the following statement:

“We are cautious about the futures market as we continue our rise and are also prepared to gain some value in significant downturns.”

The latest live data from TradingView and data monitoring platform CoinGlass confirms that the BTC/USD pair has seen a 65.4% increase since the beginning of the year.

This is competing with the first quarter of 2023, with only a 6% difference between the two quarters. Meanwhile, the BTC/USD pair, which closed well above $61,000, is set to print its seventh consecutive green monthly candle, a feat seen only once before in 2012.

Türkçe

Türkçe Español

Español