An industry analyst says that if corporate entries continue, Bitcoin could face a sell-side liquidity crisis by September. Ki Young Ju, founder and CEO of data analysis platform CryptoQuant, predicted a Bitcoin supply crisis within six months in a post on March 12th.

What’s Happening on the ETF Front?

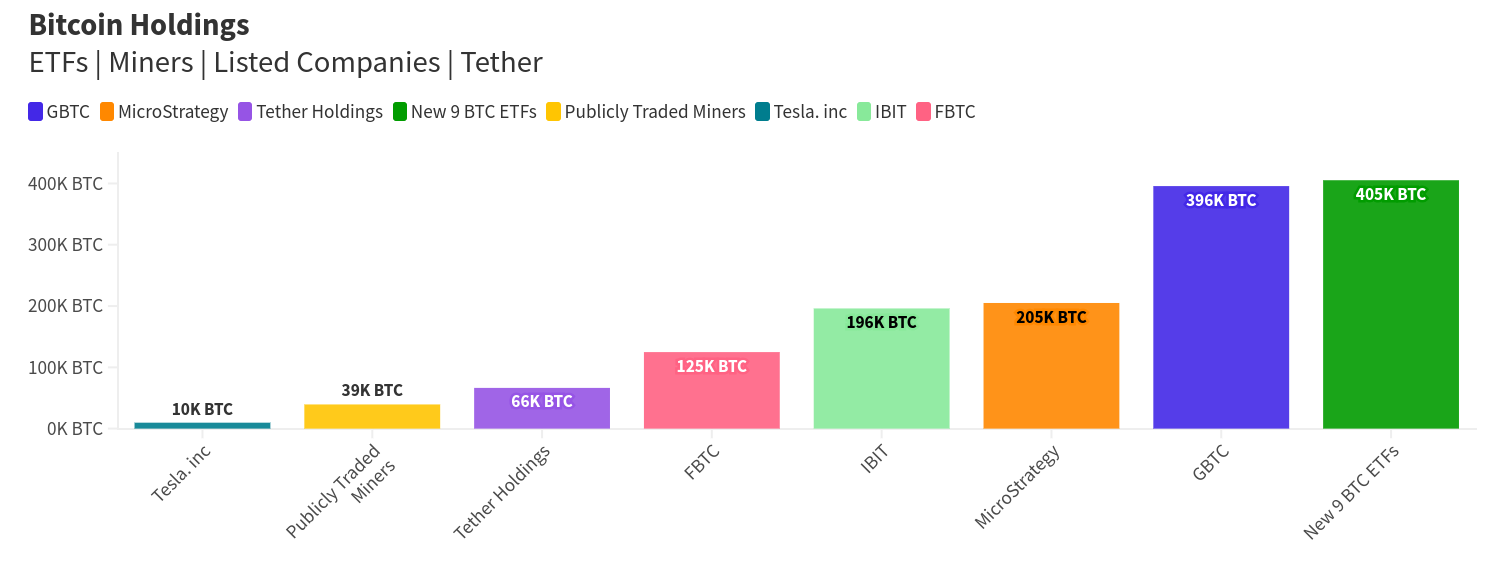

While US-based spot Bitcoin exchange-traded funds (ETFs) are gaining momentum, industry participants say that Bitcoin’s role as a corporate investment is just beginning. These funds, which currently hold assets worth approximately $30 billion, have been the most successful ETF launch in history. However, if this trend continues, a new phase could emerge where there may not be enough Bitcoin to meet the demand. Ki Young Ju commented on the issue:

“Bears can’t win this game until the spot Bitcoin ETF entry stops.”

Ki noted that ETF funds alone set aside more than 30,000 Bitcoins last week, and with the 3 million Bitcoins held in exchange and miner wallets, the likelihood of a supply-induced price shock is becoming clear:

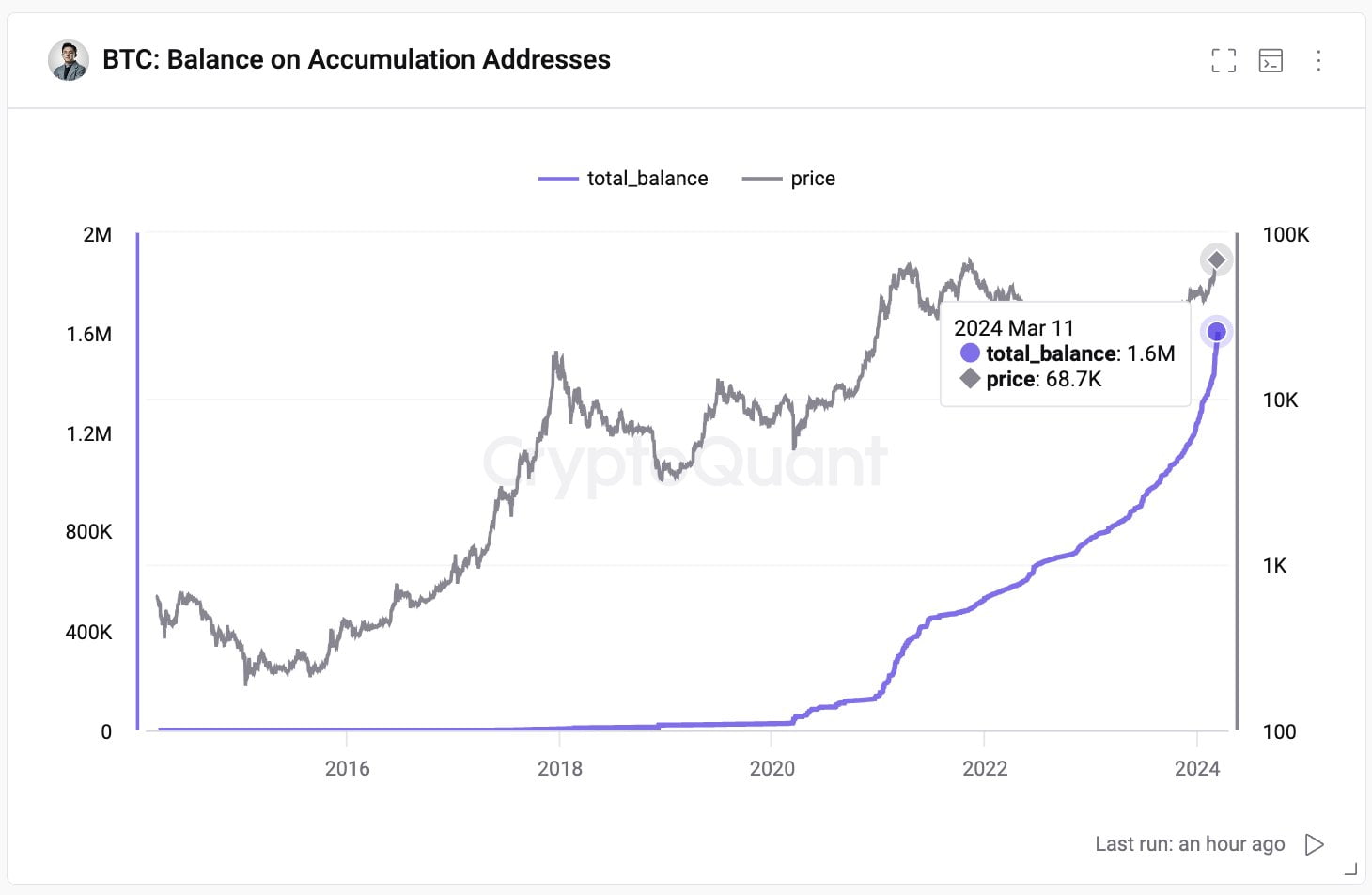

“Last week, spot ETF funds saw a net inflow of +30,000 Bitcoins. Known entities like exchanges and miners hold about 3 million Bitcoins, including 1.5 million from US institutions. If it continues at this pace, we’ll see a sell-side liquidity crisis in 6 months.”

Key Details on the Process

The Grayscale Bitcoin Trust (GBTC) continues to change the trend with daily outflows routinely reaching $500 million. Popular commentator WhalePanda noted that considering the increases in Bitcoin price since the ETF’s launch in January, the dollar value of GBTC’s diminishing Bitcoin assets has actually hardly decreased.

Ki predicts that when a supply issue caused by ETF demand occurs, the impact on Bitcoin’s price could exceed market expectations. The analyst commented on this issue:

“When a sell-side liquidity crisis occurs, the next cyclical peak could exceed our expectations due to limited sell-side liquidity and a constrained order book.”

Ki also highlighted an ongoing broad uptrend in Bitcoin held by wallets known as accumulation addresses, which only have incoming transactions, indicating that it should double before the crisis begins.

Türkçe

Türkçe Español

Español