Bitcoin, after the worsening of the US inflation outlook, fell to $61,000 on July 3. Data from TradingView showed that Bitcoin’s price strength began to slowly recover after a 2% daily close drop. This situation further exacerbated the current negative condition, reaching local lows of $60,561 on centralized exchanges, erasing weekend gains.

Powell’s Words Set the Agenda

The mood worsened further as US Federal Reserve Chairman Jerome Powell spoke about the economy and monetary policy at an event in Portugal. He stated that the Fed needed to be more convinced that the conditions were right to lower interest rates; a significant move watched by crypto and risk asset bulls. Powell shared the following at the event:

“We want to understand that the levels we see are a real reading of what is truly at the core of inflation.”

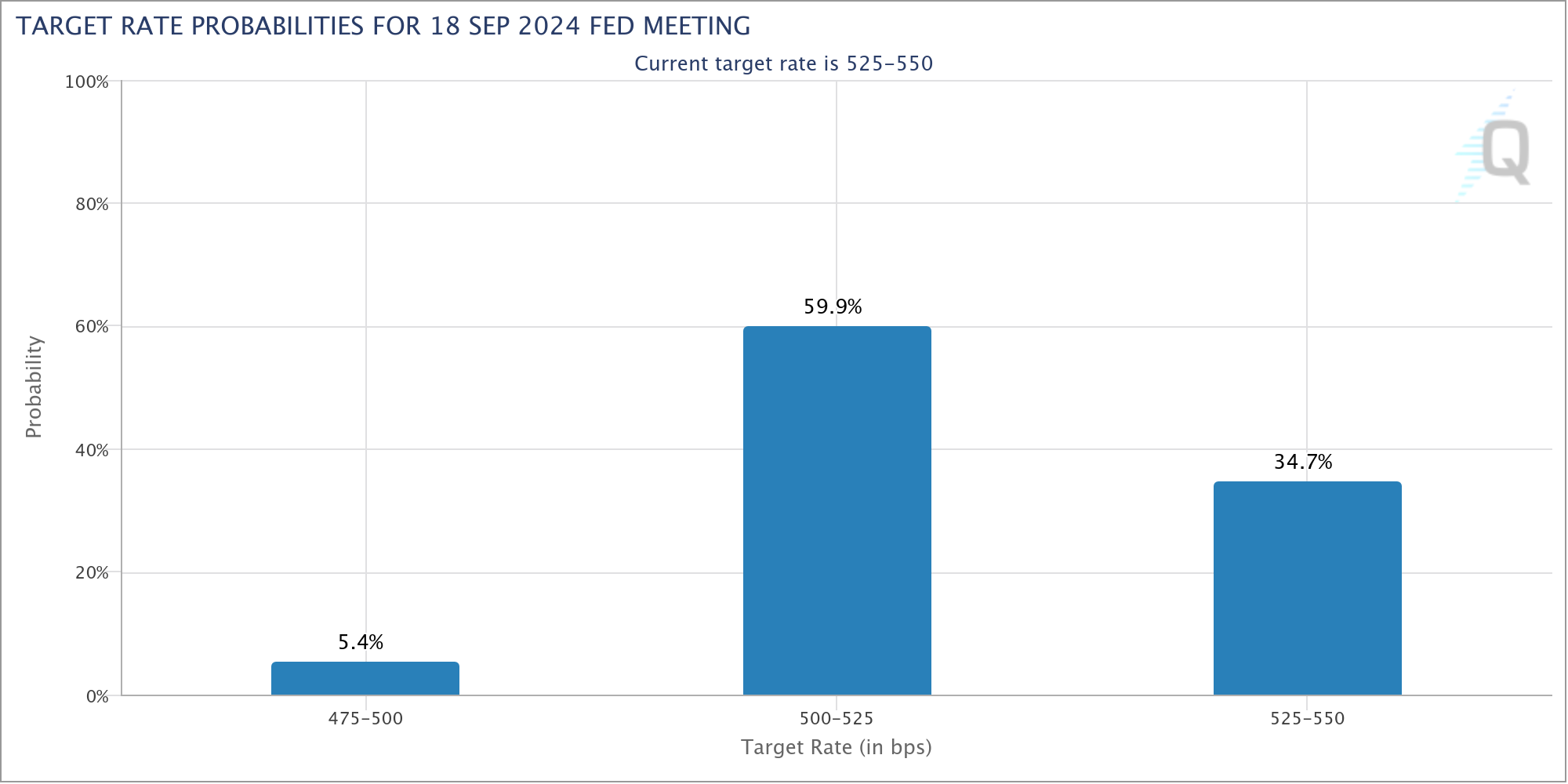

Markets slightly reduced the likelihood of a rate cut at the Fed’s Federal Open Market Committee (FOMC) meeting in September; according to data from CME Group’s FedWatch Tool, it was still around 65% at the time of writing.

What’s Happening on the Bitcoin Front?

Bitcoin market participants watched with disappointment as the BTC/USD pair returned to the bottom of a very familiar range. Popular trader Skew highlighted manipulative liquidity movements on exchanges through order spoofing; the latest example provided general resistance, and this situation was added and removed many times.

He added that spot demand on Binance, the largest global exchange, was at $60,000 and below during the day. Others noted that Bitcoin filled the latest gap that emerged thanks to the weekend rise in CME futures.

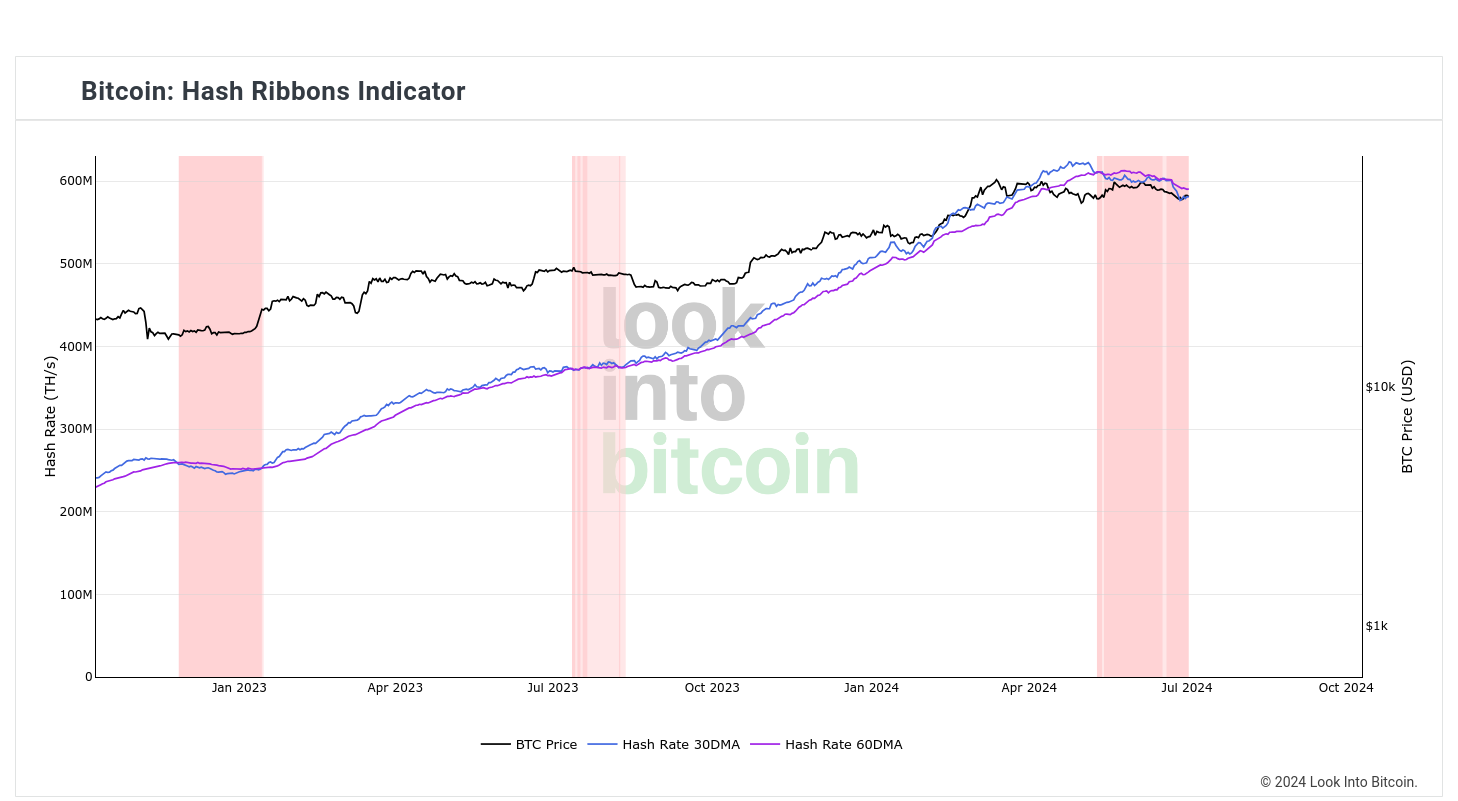

For Charles Edwards, founder of crypto asset fund Capriole Investments, the recent Bitcoin price movement was a cause for concern. He argued that the markets were not reconciling with the ongoing capitulation phase among miners and shared the following on X:

“This doesn’t have to happen, time heals all wounds, but Bitcoin is not patient. Either we are lucky and the price consolidates between $60,000 and $70,000 within two months, or we will face a healthy overdue correction.”

Türkçe

Türkçe Español

Español