Bitcoin has once again fallen below the $40,000 mark, reaching such low levels for the first time in nearly 50 days. The previous surge, fueled by ETF approvals and optimism for 2024, had gained momentum from this region. Now, after the ETF approval, the price has returned to this critical area. So, what is the expected scenario for cryptocurrencies?

Cryptocurrencies on the Decline

The pullback in BTC price has led to significant losses in altcoins. The ETH price, which was targeting $3,000, is now struggling to hold even $2,200, SOL Coin briefly fell below $80, and BNB lost its key $300 support.

Analysts’ BTC Predictions

The recent price movement has made investors more confident about the local peak. This sentiment is also reflected among analysts. According to experienced trader Bob Loukas, Bitcoin’s weekly cycle chart indicates that the price has reached its peak.

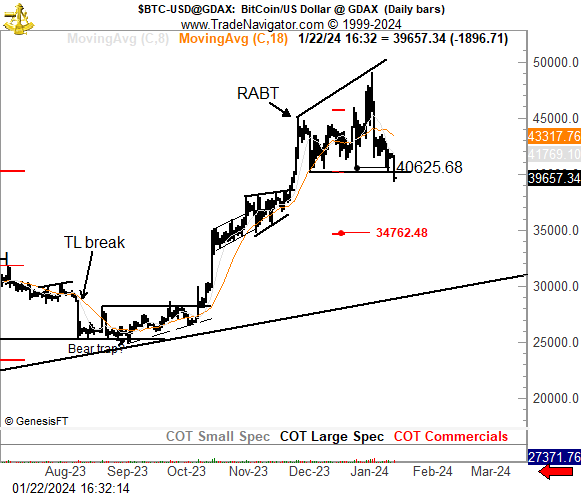

Peter Brandt also confirmed the downtrend by stating that the price has completed “a broadening wedge pattern that turned negative above $42,400.” Last week, many experts were suggesting that the ascending parallel channel from December could break down on January 12, potentially leading to a drop to $38,500.

Brandt’s chart shared on January 22 suggests that the price could fall to $34,700. Bitfinex’s short-term target is a drop to $36,000. They also announced their pre-halving predictions at $32,000.

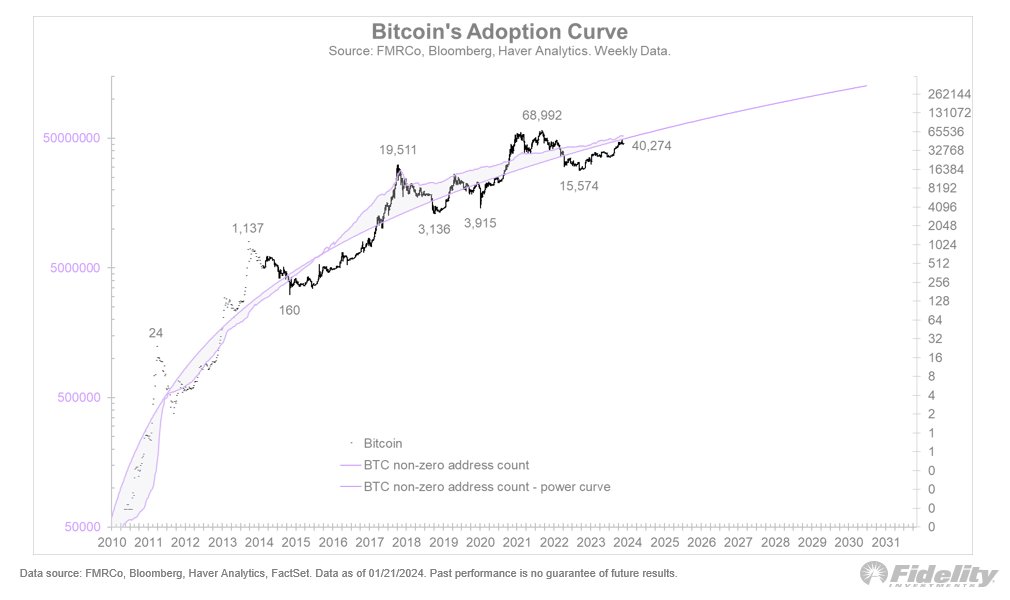

Fidelity Investments Global Macro Director Jurrien Timmer was more moderate and wrote;

“In my view, the price of Bitcoin is being driven by the size and growth of its network, which in turn is driven by scarcity features (stock-to-flow) and real rates (Fed policy). As seen in the chart, the Bitcoin network is growing along a standard power regression curve. This indicates that the S-curve structure of the Bitcoin network continues.”

Until the Fed meeting at the end of the month, investors are expected to maintain their current anxiety for an average of one more week due to both macro pressures and the balancing of GBTC sales. However, afterwards, the excitement of “the first rate cut is coming,” with a still 50% expectation of a rate cut at the March meeting, could draw investors back into risk markets. If this is supported by entries into spot BTC ETFs, a faster recovery is expected.