The fourth Bitcoin halving is now behind us. Everyone now anticipates a rise in the prices of Bitcoin and other cryptocurrencies. BTC, the flagship cryptocurrency, today broke the $66,000 resistance. As Bitcoin’s price increased, Bitcoin Layer-2 coins left the cryptocurrency BTC behind with an increase of 5% to 20% following the halving of mining rewards. This rise occurred amidst a spike in transaction fees on the Bitcoin Blockchain led by Runes.

Bitcoin Layer-2 Tokens Attract Attention

With BTC’s halving, tokens associated with Bitcoin Layer-2 solutions particularly stood out. Stacks’ (STX) native token STX rose about 20% to $2.87 due to the halving effect. Meanwhile, Bitcoin gained just over 4.7%, reaching $66,300. According to Velo Data, the cryptocurrency STX was one of the top 25 best-performing cryptocurrencies in the last 24 hours.

Other Layer-2 coins like Elastos’ ELA token and SatoshiVM’s SAVM also rose by 11% and 5% respectively after the halving.

Bitcoin Layer-2 Solutions Could Become Popular

Bitcoin Layer-2 solutions are projects that address scalability and transaction speed limitations on the Bitcoin Blockchain. These solutions provide scalability by transacting off the main chain.

Ethereum‘s Layer-2 solutions often focus on scaling the Ethereum Blockchain, while Bitcoin Layer-2 projects aim to scale the main Blockchain that does not operate an Ethereum-like virtual machine and offer programmability features.

Increase in Bitcoin Transaction Fees

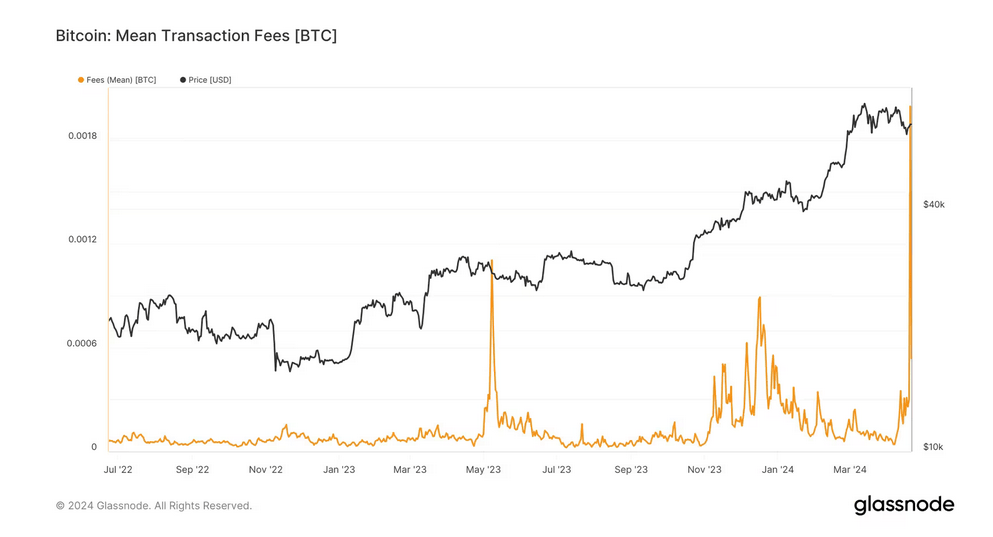

The rise of Bitcoin Layer-2 coins in the market came amidst an increase in transaction fees on the Bitcoin Blockchain. According to Glassnode, the average transaction fee rose to about 0.0020 BTC after the halving, reaching the highest level since early 2018.

One reason for the increase in fees is the launch of a new protocol called Runes, which allows users to mint tokens and trade. The launch of Runes accelerated speculative trading activities, leading to higher transaction costs.

According to Ord.io, the total number of Runes inscriptions on the Bitcoin Blockchain was 3,700 at the time of writing. These figures are just one of the factors influencing the rise of Layer-2 coins. If transaction fees on Bitcoin continue to rise, this could lead to greater popularity and higher prices for Bitcoin Layer-2s.