Bitcoin (BTC) continues to close below $69,000, and investors are more cautious with altcoins. This caution is linked to the weak appetite in the spot Bitcoin ETF channel despite the upcoming halving. Moreover, negativity on the macroeconomic front continues to pressure the bulls.

Chainlink (LINK)

RWA is collaborating with industry giants like Swift and has the potential to capture a significant share in the trillion-dollar market. Moreover, it already has a monopoly in the DeFi space regarding price feeds. Many assets, including Coinbase‘s USDC stablecoin, work with it.

Although the long-term outlook seems positive, there is a risk of double-digit declines for Chainlink in the short term. Chainlink’s price has fallen in recent days and is now finding buyers at $17.3. Moreover, on-chain data indicates that losses may continue.

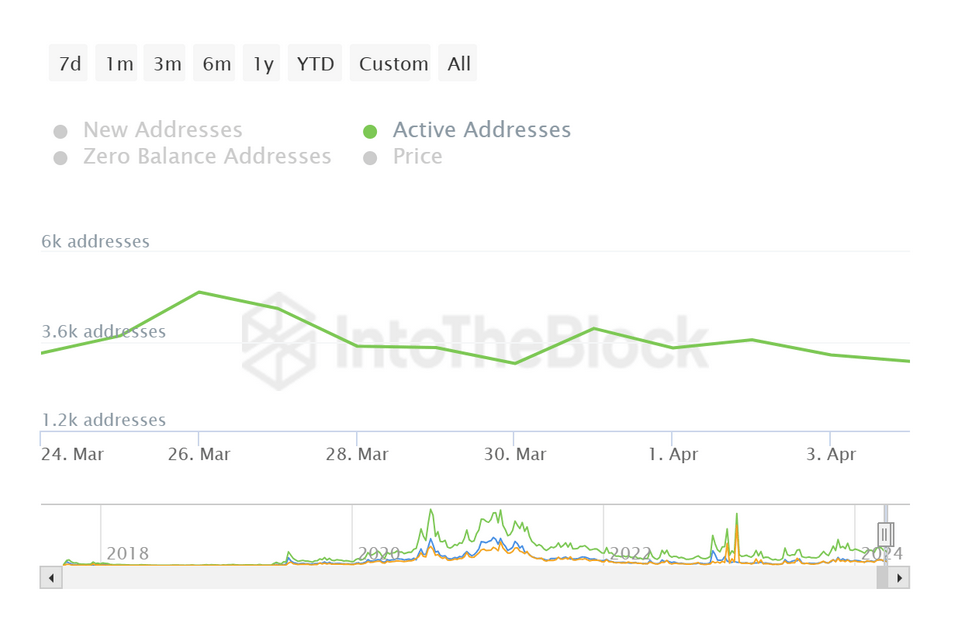

The number of active addresses on the network has decreased by about 44.7% in the last two weeks. The decline from 5,560 to 3,070 addresses tells us that investor interest is waning. The RSI is in the 40 region and has the potential to move towards the oversold area. If it falls to 30, this will indicate that fewer investors are willing to buy at higher levels.

Considering Bitcoin’s inability to close above $69,000, a significant decline in LINK Coin’s price may not be far off.

LINK Coin Predictions

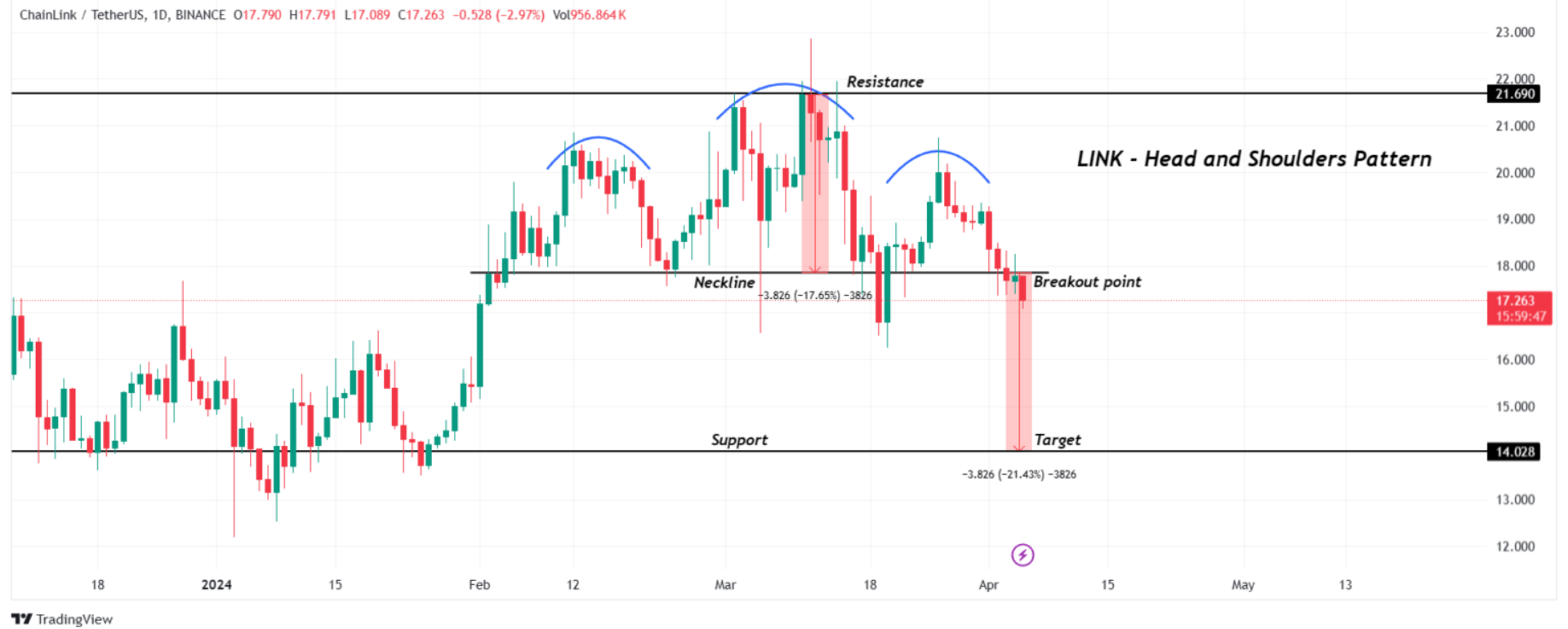

Technical analysis also confirms the risk of a continued decline. Chainlink is forming a head and shoulders pattern, which is often a precursor to a drop. Historically, this pattern is associated with declines.

The neckline is at $17.85, and at the time of writing, the price is closing below this area. If this weak posture continues, the LINK Coin price could experience a rapid pullback to the formation target of $14.02.

However, if the group of investors who bought between $15.56 and $17.48 avoids selling at a loss, the price may not stay low for long. The medium and long-term outlook is positive, so it seems unlikely that LINK Coin investors will start selling at a loss immediately. Still, there is little resistance to a downward move without the $17.85 turning into support.

Türkçe

Türkçe Español

Español