Bitcoin halving event is approaching, and market participants are carefully observing the changes within the ecosystem. Historically, the anticipation surrounding the halving event has particularly encouraged a bullish sentiment in the months following the exact date of the halving, rather than immediately. This is attributed to the delayed impact of reduced mining production on the market. Bitcoin miners, who are very important for this ecosystem, often prefer not to liquidate their assets on a daily basis.

What’s in Store for Bitcoin?

In preparation for Bitcoin’s halving event, professional investors are increasingly turning to option strategies. This approach allows positions to be evaluated in the futures market with a relatively small upfront deposit, avoiding the risk of direct liquidation common in futures markets.

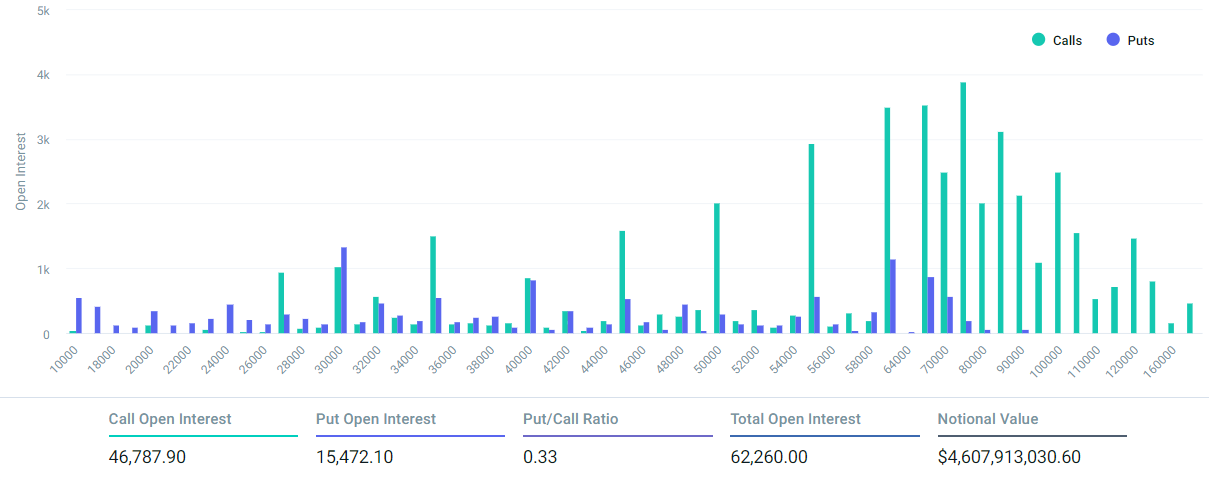

At Deribit, open interest for options expiring on June 28th has reached $4.5 billion, indicating a significant imbalance between call (buy) and put (sell) options, with call positions being three times greater than put positions. However, since the crypto trading community is in an optimistic trend, this high-level view requires deeper analysis.

In a process that seems overly ambitious, there are call options targeting Bitcoin prices of $140,000 and up to $200,000 for the June 28 expiration. Excluding predictions that the price will be above $90,000, the realistic open interest for call options is approximately $2.72 billion. Conversely, many put options were purchased before Bitcoin rose above $50,000, reducing the likelihood of profitability. Currently, there is an open position of $250 million in put options fixed at $57,000 or higher.

Bitcoin’s unexpected performance surge; successful approval of a spot exchange-traded fund in the US, inflation dropping to 3%, or the absence of a predicted global economic slowdown by June 28th have surprised the bears. Consequently, the scenarios of a decline associated with Bitcoin’s halving event are looking increasingly unlikely.

The Halving Process and Bitcoin

Past speculations about a death spiral triggered by the halving of block rewards and the subsequent decrease in miner participation have been consistently refuted. The Bitcoin network adjusts its difficulty level every 2016 blocks, approximately every two weeks, ensuring stability even in volatile hashrate levels.

Bitcoin price, in a hypothetical scenario where it drops to $47,000 by June 28th, would represent a 32% decrease from current levels, making the open interest for put options $422 million. In contrast, call options up to $46,000 represent a risk of $670 million, highlighting a market trend towards neutral-bullish strategies for the upcoming Bitcoin halving event set to expire on June 28th.

Türkçe

Türkçe Español

Español