With the influence of corporate interest in cryptocurrencies, Bitcoin (BTC) briefly reached the highest level of the year at $31,000 last week. According to CoinMarketCap, the rally catalyzed by TradFi giant BlackRock’s application for a spot Bitcoin Exchange-Traded Fund (ETF) resulted in a 13.27% increase in the leading cryptocurrency’s value compared to the previous week.

Bitcoin Future

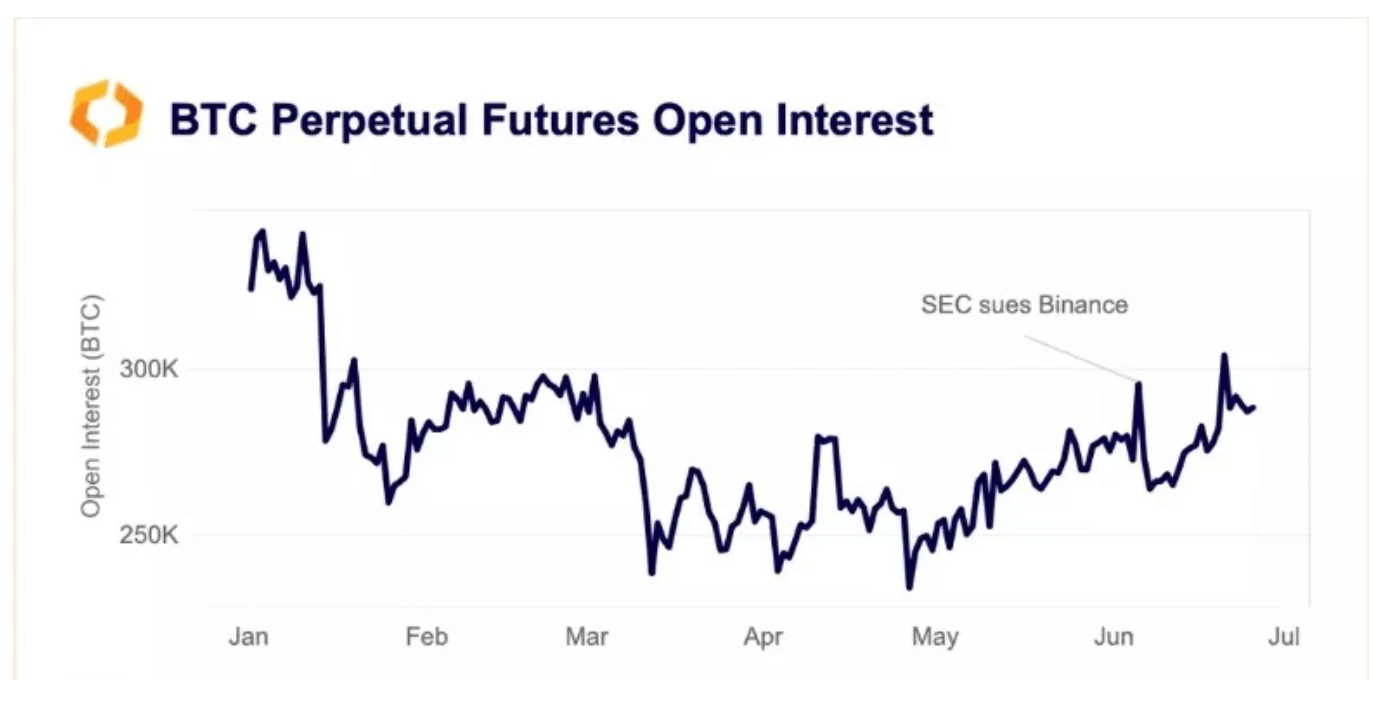

According to crypto market data provider Kaiko, the rally gained momentum from derivative markets. Open Interest (OI) or the dollar value locked in BTC futures contracts recently hit an annual high, while OI in terms of BTC reached its highest level since January 2023.

The price increase, completed with the rise in OI, demonstrated higher capital inflow to the BTC market and increased speculative interest.

Moreover, as prices rose, many short position traders expecting price falls closed their positions to limit their losses. This further increased BTC’s price. According to Coinglass, this situation reflected in an increase in short liquidations last week. At the time of writing, over $3 million worth of short positions have been liquidated in the last 24 hours.

Bitcoin Price Chart

Despite significant interest in the derivatives market, Kaiko downplayed the dominance in strengthening BTC’s recent rally. The reason is that the ratio of BTC’s spot volume to futures volume remained steady without a significant increase or decrease over the last three months.

Spot volume is formed by buying and selling assets at the current market price. Kaiko noted that the ratio of Binance‘s spot BTC volume to Coinbase has shown a sharp decline since the US Securities and Exchange Commission’s (SEC) lawsuit against the two crypto giants.

Hence, BTC volumes on Coinbase were growing faster than those on Binance. As Coinbase is primarily used in the American market, it could be concluded that spot trading activity was directed by the US.

The interest of major institutional players ignited expectations for a BTC bull run as market sentiment significantly shifted from ‘neutral’ to ‘greed.’ At the time of writing, BTC was trading at $30,700.55.