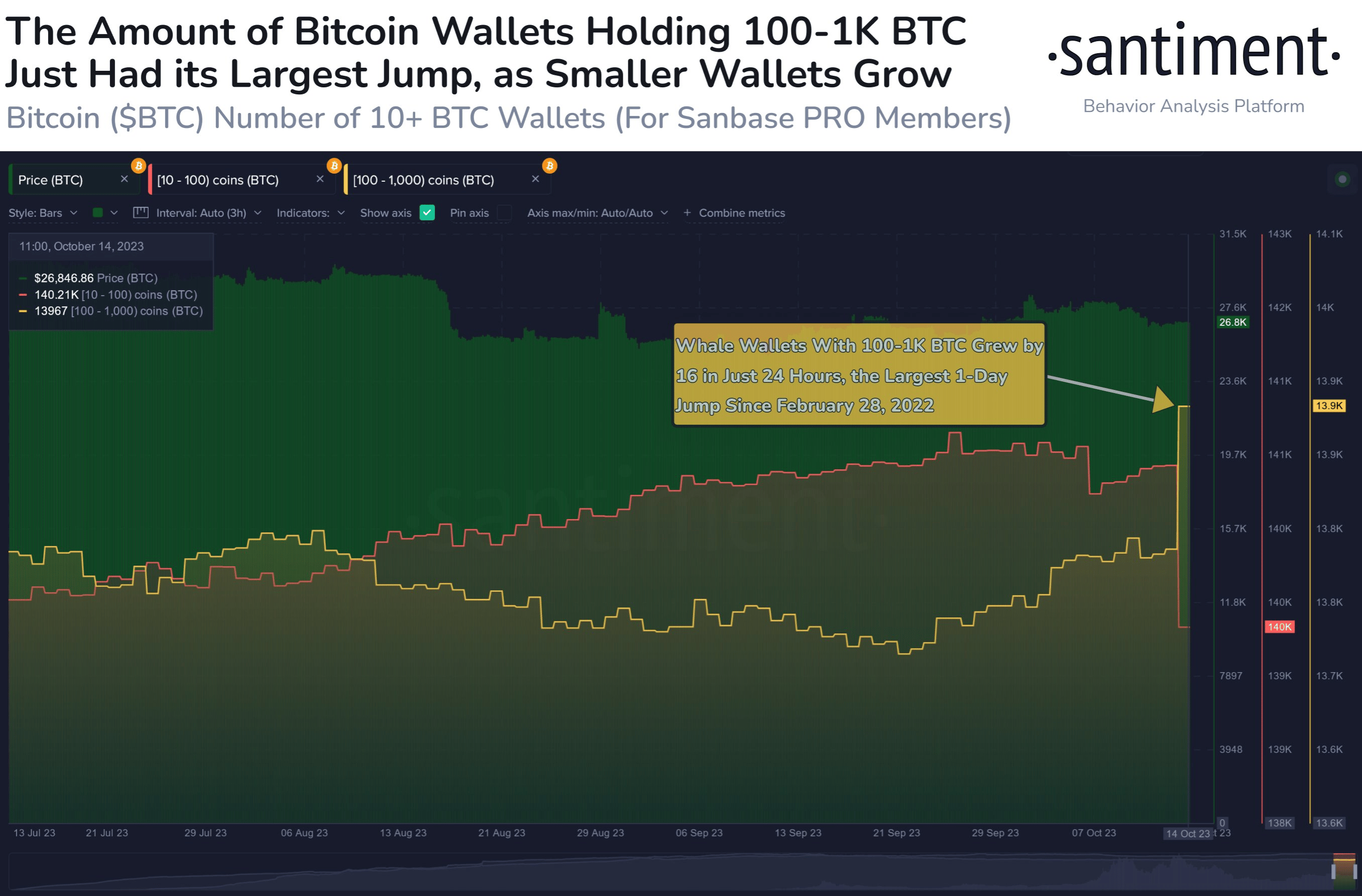

The recent declines in the cryptocurrency market have caused many investors to worry and suffer significant losses. Despite this negative period in the markets, some data continues to bring hope. According to an important development shared by data analysis platform Santiment, 16 new wallets have joined Bitcoin whale addresses in the past 24 hours.

Bitcoin Investor Numbers Increasing

According to Santiment’s data, this increase in whale addresses indicates the most significant one-day increase since February 28, 2022. There has been a significant increase in the number of wallets holding between 100 to 1,000 Bitcoins. With this development, the number of Bitcoin whale wallets has reached 13,967.

In addition to this rise in numbers, there has also been an increase in wallet addresses holding smaller amounts of Bitcoin. At the time of writing this article, 140,210 addresses hold assets between 10 to 100 Bitcoins.

According to data previously shared by Santiment, there has been a historic increase in the number of wallets holding at least 10 Bitcoins since February 2022. Since March 2022, 11,806 new addresses have been opened for wallets holding more than 10 Bitcoins, indicating a growth of 8.12% in individual addresses.

All of these increases in Bitcoin whale addresses indicate the best time for long-term Bitcoin investments. Blockchain data analysis firm IntoTheBlock revealed that investors who have held Bitcoin for over a year own 69% of the total supply.

Critical Warnings for Bitcoin Price

With the decline in the last week of October, the price of Bitcoin failed to hold above $28,000 and dropped to $26,900 due to the selling pressure. Analysts are warning about the $25,000 risk for the Bitcoin price in the process that started with geopolitical instabilities. IntoTheBlock, emphasizing the selling pressure from Bitcoin mining companies, made special mention of this issue.

According to the analysis company, the sale of 20,000 Bitcoins by miners this week, the highest amount since April, shows that miners are taking advantage of high Bitcoin prices to balance their operational costs. Although not rare, this situation can bring significant selling pressure to the market.

However, according to analysts, developments such as the potential approval of a sports exchange-traded fund (ETF) by the U.S. Securities and Exchange Commission and the Bitcoin halving event could trigger a rise in the price.

Türkçe

Türkçe Español

Español