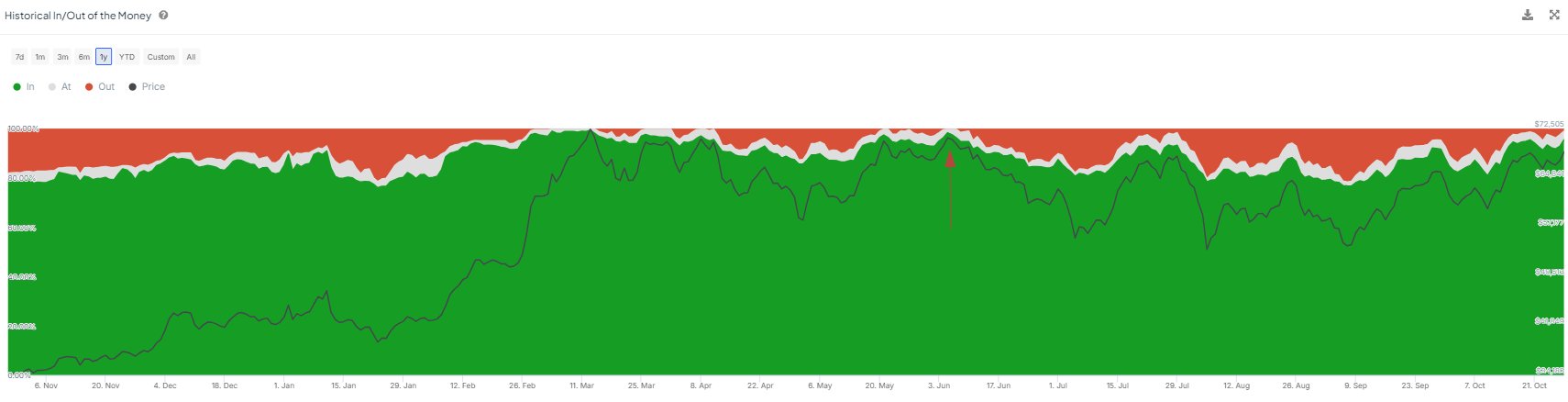

As Bitcoin (BTC)  $107,870 approaches its historical peak, most investors are experiencing profits. According to data from IntoTheBlock, Bitcoin’s price has surged past $71,000, placing 99% of investors in a profitable position. Market analysts indicate that this trend signifies a marked increase in investor confidence. Similar price levels were observed in June; however, Bitcoin could not sustain its rise during that period.

$107,870 approaches its historical peak, most investors are experiencing profits. According to data from IntoTheBlock, Bitcoin’s price has surged past $71,000, placing 99% of investors in a profitable position. Market analysts indicate that this trend signifies a marked increase in investor confidence. Similar price levels were observed in June; however, Bitcoin could not sustain its rise during that period.

99% of Bitcoin Investors Enjoy Profits

The recent increase in Bitcoin’s price has generated significant enthusiasm among investors. Experts suggest that this high profitability rate reinforces faith in the market’s upward potential. Although historical trends indicate a possibility of declining prices following similar situations, the prevailing sentiment is that the positive market atmosphere may continue this time.

Investors are closely monitoring whether the leading cryptocurrency can maintain these levels and reach even higher. Sustaining the high percentage of profitable investors is crucial for continued growth. Should investors perceive a halt in price increases, they might sell off their assets, leading to profit-taking and subsequent price drops.

Will Bitcoin Experience a New Surge?

Bitcoin’s ability to surpass the $71,000 threshold again prompts investors to ask, “Will this time be different?” Despite reaching similar levels in June, Bitcoin failed to maintain its position above that price point. However, the current market appears to be built on a stronger foundation.

Data indicates that the market’s current state is more favorable compared to previous levels, with Bitcoin finding robust support. Analysts are optimistic that Bitcoin could test new highs in the near future, especially with Donald Trump leading the U.S. presidential race and positive macroeconomic data backing the trend.

Currently, the Bitcoin market continues to send positive signals following recent developments.

Türkçe

Türkçe Español

Español