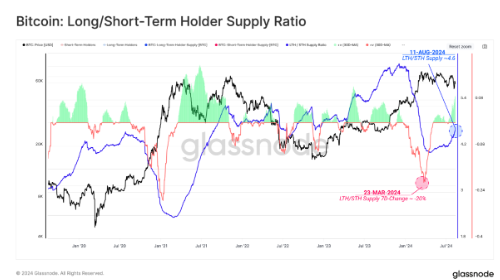

On-chain data reveals that nearly 50% of the current Bitcoin supply has not been moved by investors in the last six months. According to data provided by analysis firm Glassnode, the latest issue of the weekly newsletter “The Week Onchain” shows that investors did not sell at the peak.

Bitcoin Investors Accumulate

Despite Bitcoin reaching an all-time high about five months ago, a significant portion of BTC investors continues to double down on their holdings. Glassnode, examining the realized cap HODL waves indicator, revealed that slightly more than 45% of all Bitcoins have remained inactive in wallets for at least the last six months.

Despite BTC reaching its ATH and subsequent price fluctuations, a large portion of market participants chose to remain inactive. Long-term holders (LTHs) – investors who have not sold their coins for at least 155 days – were present both at the all-time high and later in the market.

Glassnode explained:

We can also use the 7-day change in LTH supply as a tool to evaluate the rate of change in their total balances. We can see significant LTH distribution, typical of macro top formations, at the March ATH. Less than 1.7% of trading days recorded greater distribution pressure. Recently, this metric has returned to positive territory, indicating the LTH cohort’s preference to hold their coins.

This situation led to the percentage of network wealth held by this group first stabilizing and then starting to increase again. Despite significant selling pressure from LTHs during the ATH market, the wealth held by long-term investors remains historically high compared to previous all-time high breakpoints.

BTC Selling Concerns Dominate Market Sentiment

Throughout the month, the selling pressure from investors never left traders’ minds. Amid the sharp sell-offs in early August, the environment of concern created by dropping to six-month lows was combined with analyses showing that previously purchased BTCs were moving on-chain.

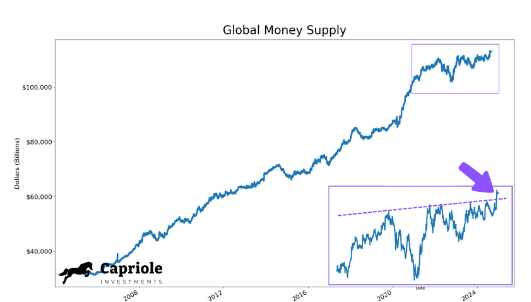

Amid the recent fluctuations in the Crypto Fear & Greed Index, the entire crypto world seems focused on the ongoing uncertainty in crypto. On the other hand, optimism about global liquidity is growing day by day, while some investors believe that political and economic relaxations could positively impact the rise of cryptocurrencies.

Charles Edwards, founder of Bitcoin and digital asset fund Capriole Investments, made a post on X this week, noting:

Global money supply is exploding. We also just came out of a massive 4-year consolidation. What do you think this means for Bitcoin?