When examining on-chain data in the cryptocurrency world, it is observed that shrimps, who represent the smallest portion of Bitcoin investors, have recently been making sales. So, what could this mean for Bitcoin?

Bitcoin Analysis

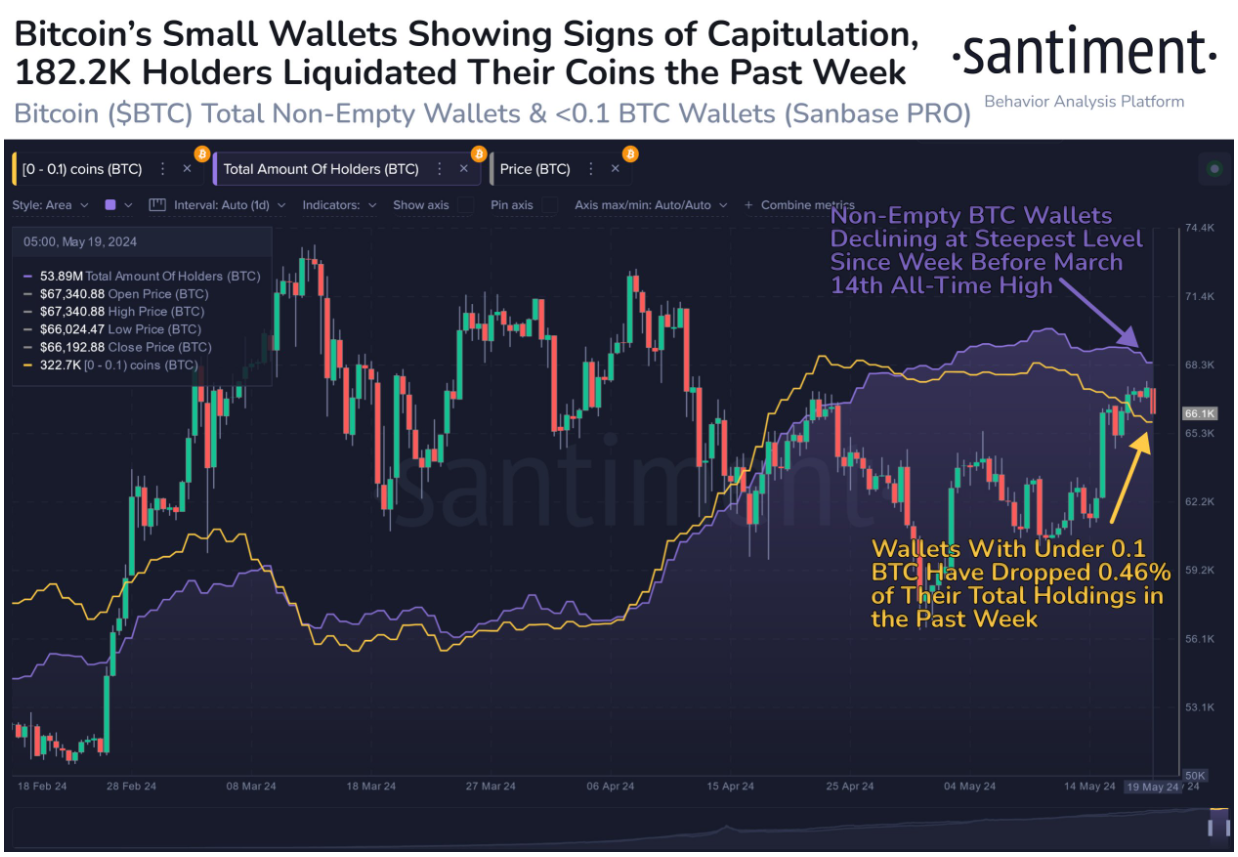

According to information provided by on-chain data provider Santiment, the Total Supply Held metric has recently recorded a decline. This indicator reveals the total number of addresses on the blockchain that currently have a non-zero balance.

An increase in this metric can be interpreted as a potential sign of increased individual purchases in the cryptocurrency. On the other hand, a decrease in value indicates that some investors have decided to exit BTC and empty their wallets. Crypto Traders Are Rushing to This App – Here’s Why You Should Too

In this context, a graph showing the trend in Bitcoin’s Total Supply Held over the past few months is shown below:

As can be seen from the graph above, there has been a recent decline in Bitcoin’s Total Supply Held, which can be interpreted as a significant number of investors giving up on the cryptocurrency.

The recent decline in this metric is interpreted as the sharpest drop since the ATH renewals that lasted for days in March. The price movement above $67,000 was likely one of the main events that convinced these investors to sell.

Santiment also shared information in the same graph indicating the total Bitcoin supply held by investors with less than 0.1 BTC in their wallets. These small investors represent a portion of individual investors and are referred to as shrimps.

From the graph, it is seen that BTC shrimps sold 0.46% of their BTC holdings. On the other hand, the decline mirrored the decrease in the Total Supply Held. Therefore, it can indeed be considered that those who sold their investments were not whales but this small investor group.

Individual investors may believe that the current price rise will not last as long as expected. Therefore, they might be taking advantage of the opportunity to sell at prices they consider relatively high.

The statement made by the analytics firm Santiment was as follows:

Historically, small wallets dumping their coins to larger wallets is encouraging and bullish for BTC.

What is the Current Bitcoin Price?

Following the recent price movement on Bitcoin, it was seen that the cryptocurrency surpassed the $68,000 level for the first time since April 12. When this price movement was last seen, there was a decline rather than a rise. Within only 20 days after the price was seen, it had dropped to $56,000.

Today, as of the time of writing, BTC is trading at $68,400. This price emerged as a result of approximately a 3% increase. During this period, BTC’s market cap surpassed $1.3 trillion following a similar rise, while the 24-hour trading volume exceeded $28 billion after a 65% increase.

Türkçe

Türkçe Español

Español