The leading cryptocurrency has recently dipped below $90,000, causing continued volatility in altcoins. Investors face challenging times as the Federal Reserve’s pessimism dampens optimistic forecasts for the coming year, with critical support identified at $88,000. This article examines the current status of an on-chain alarm that accurately predicted the last three significant market movements.

Major Cryptocurrency Signal

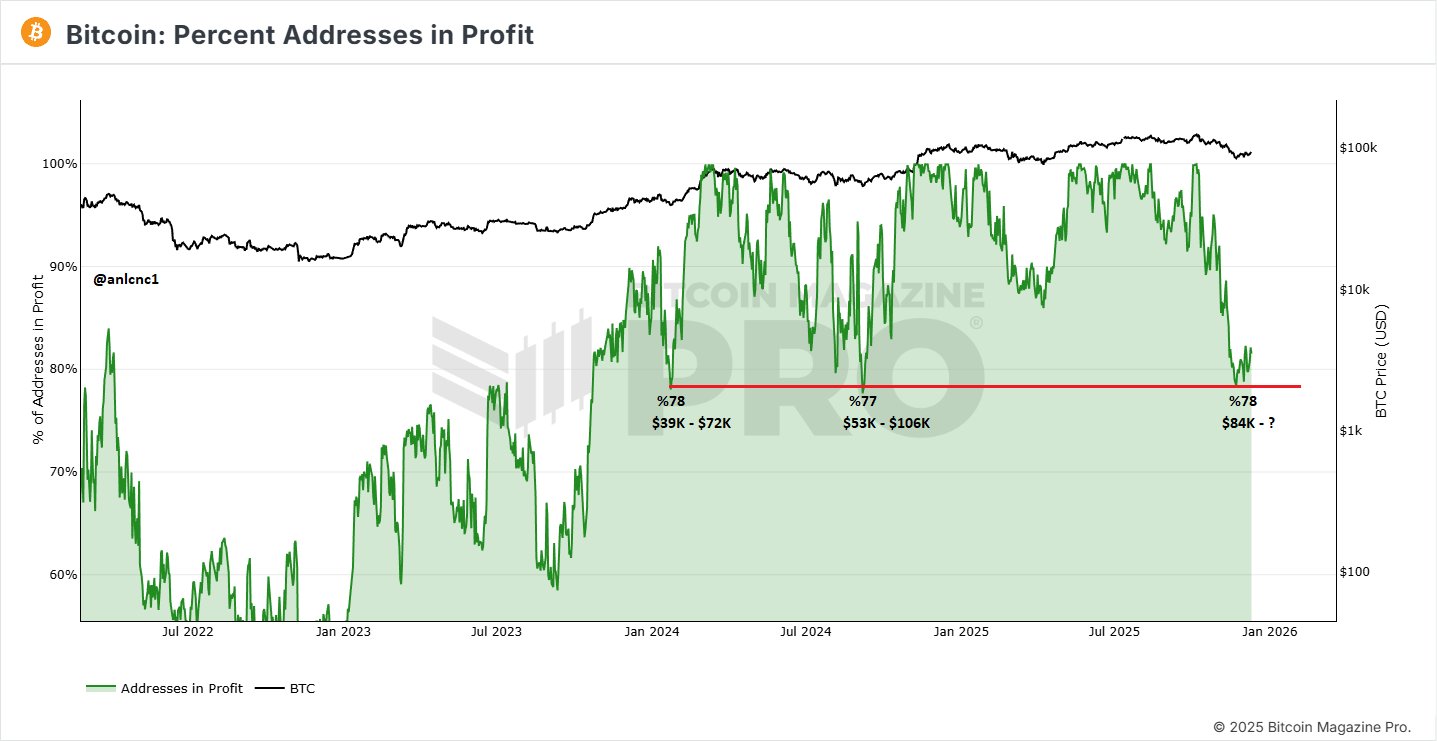

A significant indicator monitoring Bitcoin  $91,081 investors’ profitability has revealed local lows at each occasion when the profit percentage dropped below 80%. This parameter serves as a crucial signal for pinpointing local bottoms in Bitcoin cycles. According to current analyses, profitability has once again decreased to 78%, closely mirroring previous cycles where a rebound occurred.

$91,081 investors’ profitability has revealed local lows at each occasion when the profit percentage dropped below 80%. This parameter serves as a crucial signal for pinpointing local bottoms in Bitcoin cycles. According to current analyses, profitability has once again decreased to 78%, closely mirroring previous cycles where a rebound occurred.

The analysis points out that when Bitcoin addresses fell below 80% profitability, local dips emerged, leading to substantial gains in subsequent months. Currently, profitability has fallen to 78%, which correlates with the $84,000 level. Although the profitability rate is still relatively high, suggesting this is not a bear market bottom, historical patterns suggest potential for market gains as local dips form.

Current Status in Cryptocurrencies

Recent insights from CryptoQuant highlight the plight of short-term investors, who are now enduring one of 2025’s most challenging downturns despite previous substantial gains. Currently, prices remain below the realized price, putting many recent buyers at a loss.

“Despite short-term volatility, weak hands continue to sell during rebounds, maintaining market pressure. Structurally, such deep losses typically surface later in correction phases rather than earlier,” the analysis suggests.

An update on the Binance BTC/Stablecoin Reserve Ratio signals potential market turnaround. According to analyst anlcnc1, recent trends show a weakening in negative Bitcoin to Stablecoin flows, while a shift back to Stablecoin to Bitcoin flows is emerging, which is a positive development for the market.

“As previously mentioned, the weakening of negative flows and the resurgence of positive flows indicate a bullish trend. The current ratio stands at 1.23, and a rise above 1.50 would confirm a market bottom, though the market is still at the dip formation stage.”