The crypto market began to recover this morning during the Asian opening, led by Bitcoin reclaiming the $63,000 level with a total gain of approximately 4%. This week’s economic calendar does not feature many striking reports but can still shed light on the direction of the economic recovery in the US. US employment data may affect the possibility of a Federal Reserve rate cut later this year.

What to Expect This Week?

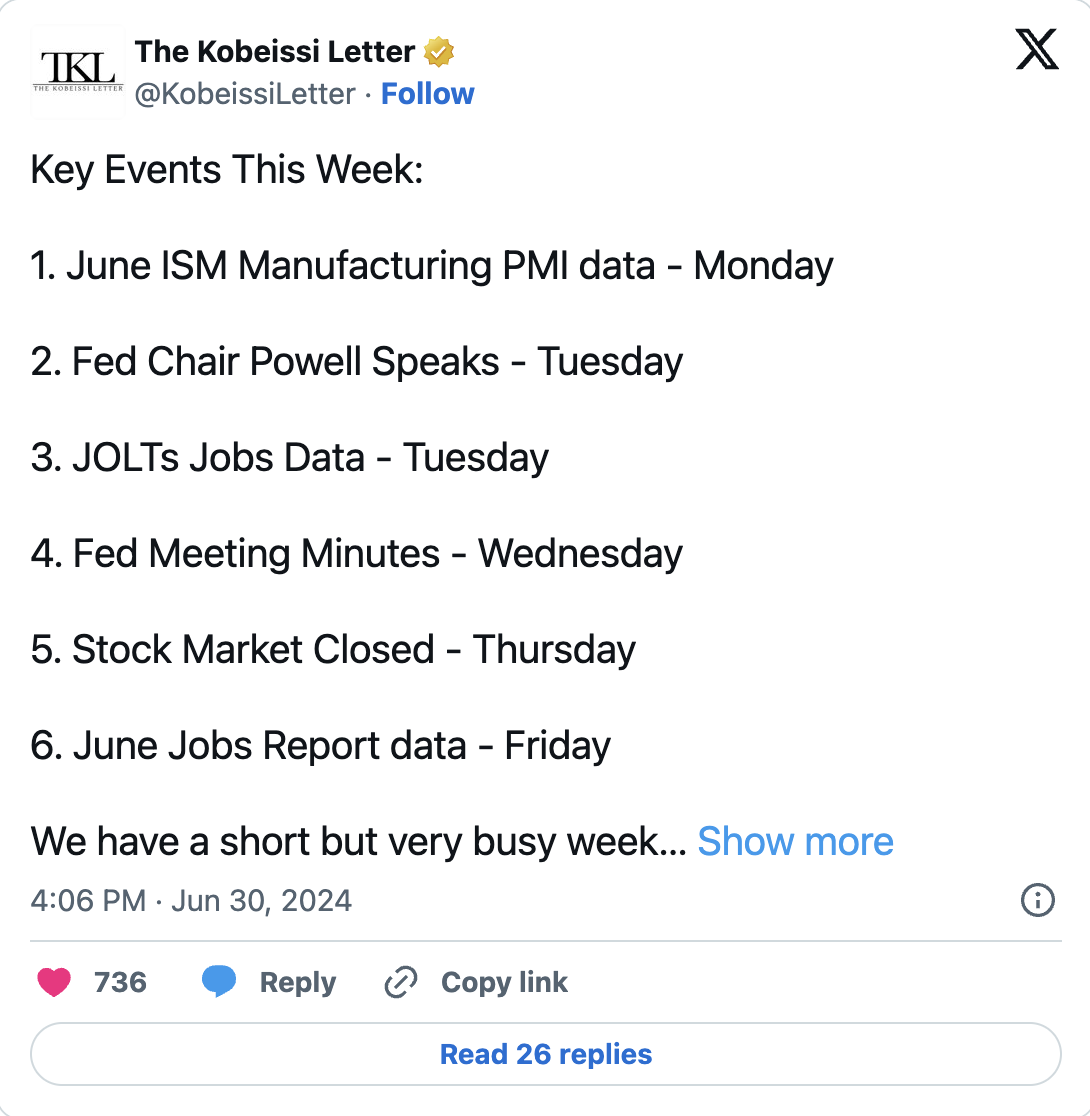

On July 1, the June ISM Manufacturing PMI data will be shared. This report shows business conditions in the manufacturing sector and provides an indicator of broader economic conditions. It is used to assess the state of the economy and predict changing trends.

A similar ISM Services PMI report will be released on July 3, highlighting conditions in the US service sector, which contributes to over 70% of GDP. Changes in these PMI reports often precede changes in the broader economy.

Federal Reserve Chairman Jerome Powell will make statements at the European Central Bank conference on July 2, followed by the release of the Fed‘s June meeting minutes on July 3. These can provide insights into how central bankers view inflation, interest rates, and the economy.

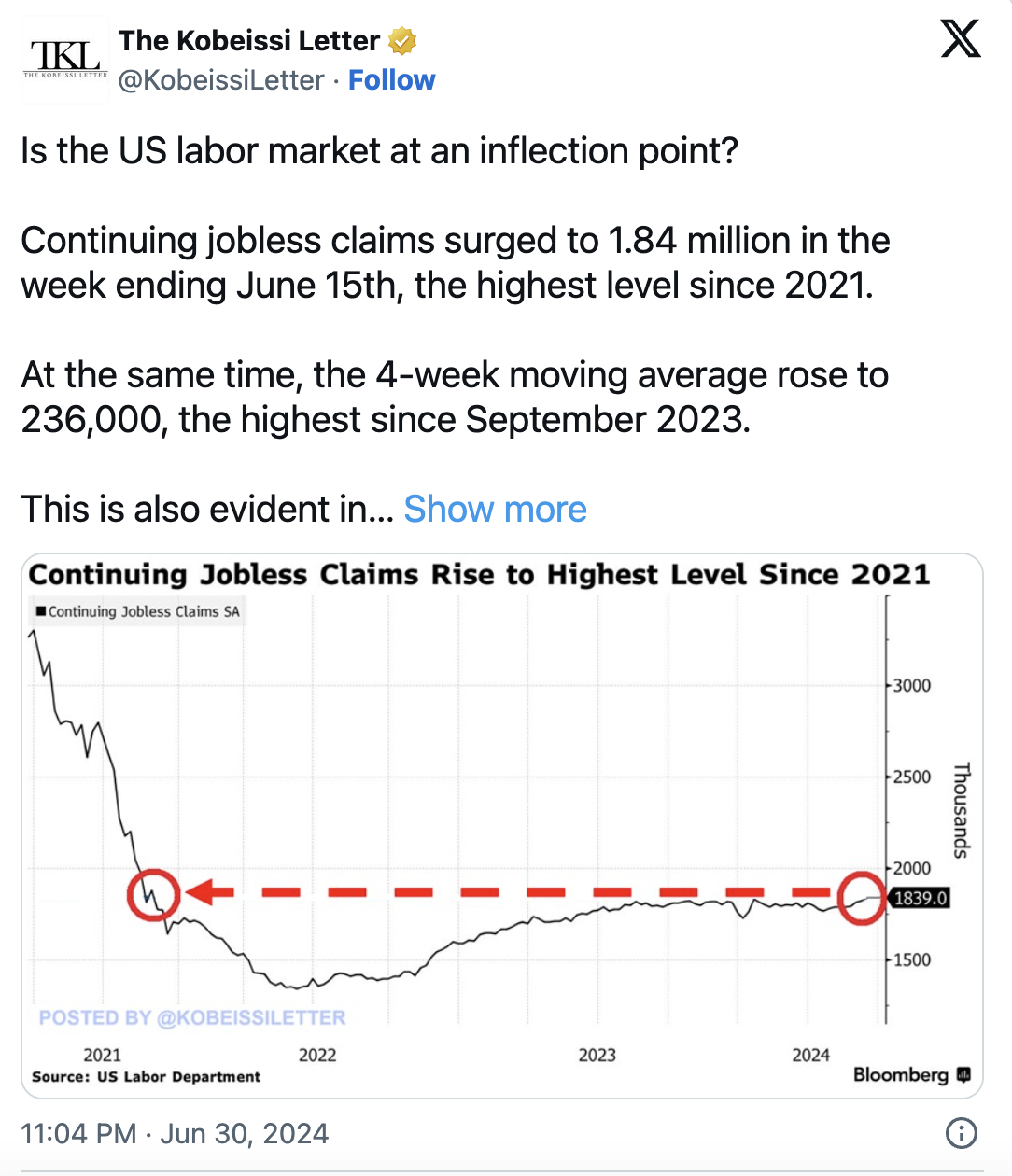

Unemployment data will be released on July 5, and these reports will be closely monitored by the Fed to measure the overall health of the economy. Central bank policymakers have stated that it is important to closely monitor employment along with improving inflation. An unexpected rise in unemployment could prompt the Fed to act more aggressively on rate cuts, with the first expected in September.

What’s Happening in the Crypto Market?

If the economic data from the US is positive, the crypto markets are expected to continue their gradual recovery. Markets have largely been range-bound in terms of total market value since the end of February, fluctuating around $2.5 trillion. However, during last week’s decline, they reached the lower boundary of this range.

Bitcoin increased by 3% in the last 24 hours, reaching $63,300 at the time of writing, the highest level in just over a week. Ethereum prices also gained a similar amount, reaching $3,483 ahead of this week’s important ETF announcements. Altcoins largely surged, with Solana (SOL), Avalanche (AVAX), Chainlink (LINK), and Near Protocol (NEAR) achieving larger gains.