The king cryptocurrency is currently above $44,000, marking an encouraging recovery for altcoins. Altcoins like MINA, SOL, and INJ Coin are reaching new heights, with Solana surpassing the $80 threshold. While altcoins continue to rise, Ethereum’s price has not yet recovered as expected. So, what were the reasons behind the recent surge?

Why Did Bitcoin Rise?

Bitcoin‘s price started climbing today, surpassing $44,200 and reaching $44,283. This movement was exciting as the 2023 peak on the Binance exchange was $44,700. Moreover, the recovery from $40,000 has created an expectation among investors of a similar breakthrough to previous tough resistance levels.

The reason for the rise is undoubtedly related to the anticipated approval of a spot Bitcoin ETF in the first month of the coming year. The SEC had a total of 9 meetings with Grayscale and BlackRock in December alone. All these meetings were unusually frequent. Moreover, while the SEC previously issued direct rejections, now the increased communication is exciting. On the other hand, the feeling that the SEC’s requests are being met is increasing as potential issuers continue to update their ETF prospectuses.

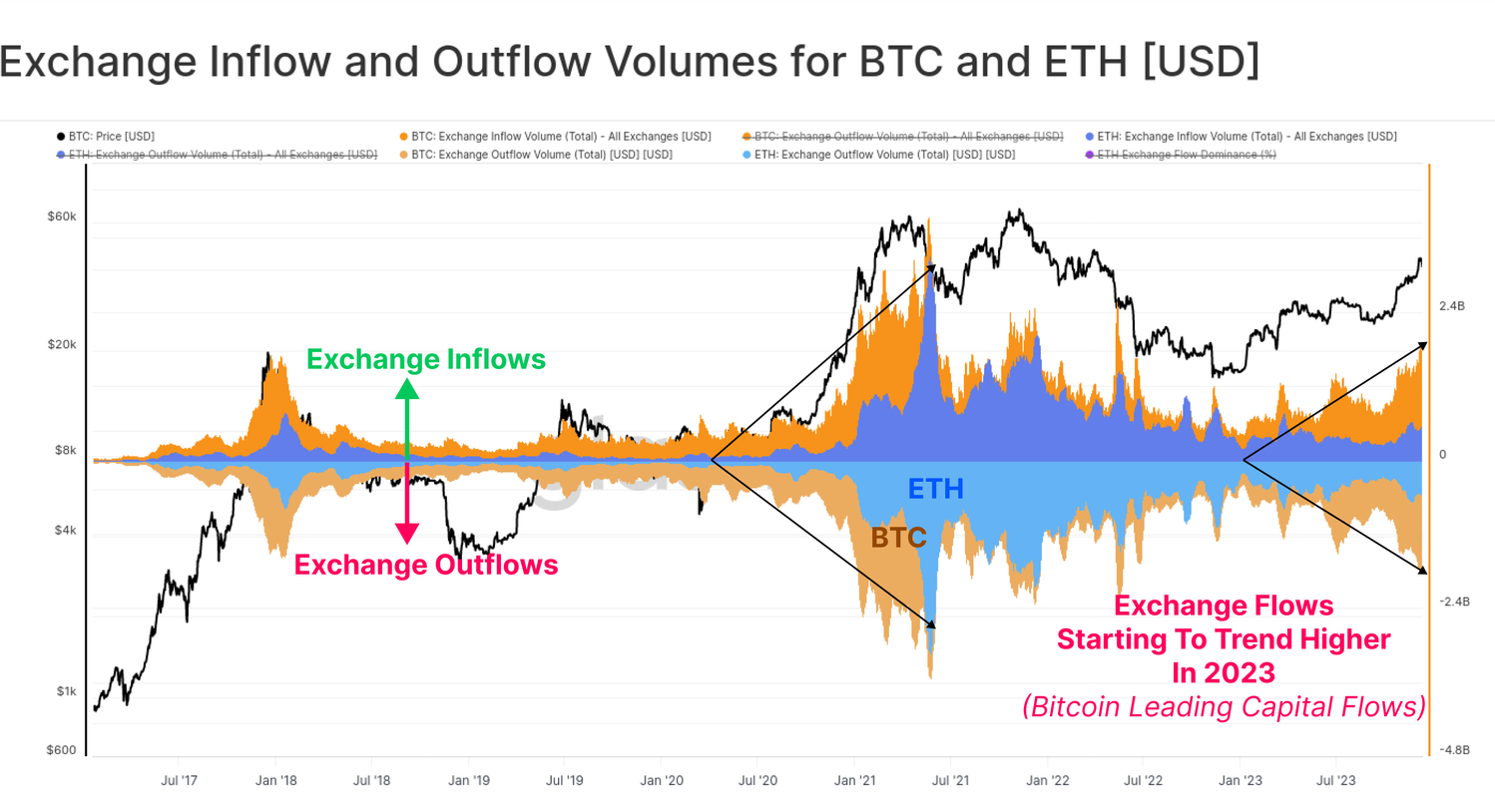

The fear surrounding centralized exchanges seems to be dissipating with volumes on the entry and exit side continuing to increase in the months following the Binance deal. The increase in Bitcoin inflows and outflows from exchanges potentially supports the belief in an ETF approval.

Crypto Surge: Analysts’ Comments

Throughout the year, the BTC price increased by 166%, and we saw gains exceeding 20 times in altcoins. We are experiencing a year-end where things on the macro front are getting on track. Next year, interest rate cuts are starting, and the market is, as always, more optimistic than the Fed.

Speaking about macro events and ETF developments, XYO Network’s co-founder Markus Levin said;

“I think most analysts were surprised that the Fed said interest rate cuts could happen relatively early next year. I must point out the uncertainty of how much assets will be at risk in the event of a real interest rate cut. However, we will see a serious price catalyst with the approval of these BTC ETFs.”

MicroStrategy CEO Saylor says that the Bitcoin ETF will be the biggest financial event since the launch of the S&P 500. Yes, if you had bought Bitcoin with billions of dollars, you could probably make more assertive comments than Saylor.

Galaxy Digital predicts a 74% price increase in the first year following the launch of a spot BTC ETF. If the SEC is going to give approval, it will do so between January 5-10. So, we have roughly 20 days left.

Türkçe

Türkçe Español

Español