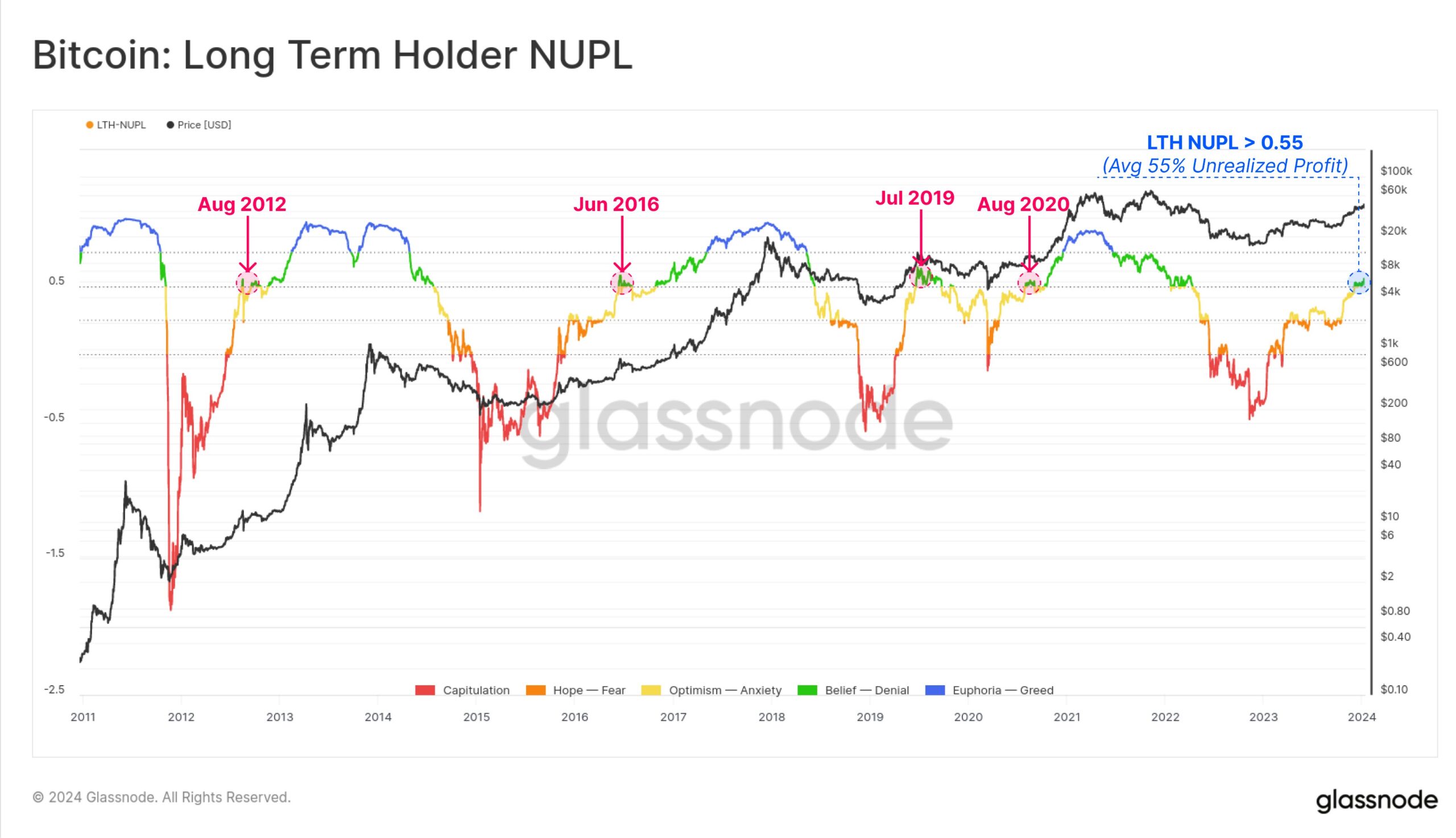

A recent report by Glassnode indicates a notable improvement in the metric showing the Unrealized Profit and Loss of those who have held Bitcoin for a long time. This significant metric has returned to levels observed before the Terra collapse, leading to speculation that the market may enter a “belief” phase in January 2024.

Unprecedented Unrealized Profits: A Positive Change for Bitcoin’s Long-Term Holders

By mid-January 2024, the average unrealized profit for Bitcoin’s long-term holders impressively rose to 55%, indicating a “significantly positive” trend. Glassnode’s analysis reveals that Bitcoin’s long-term holders last experienced such profits before the Terra Luna ecosystem’s downturn, in the early first quarter of 2022.

Despite these profits, some long-term holders chose to sell their assets at current prices to benefit from the recent Bitcoin rally. However, the Long-Term Holder Supply has only slightly decreased by about 75,000 BTC since November 2023, from its all-time high. Remarkably, this group of investors continues to control a significant portion of the circulating Bitcoin supply, at 76.3%.

Historical Perspective: Overcoming Negative Trends

Before the third quarter of 2023, the Long-Term Holder Supply metric remained negative for over a year, indicating that passionate Bitcoin investors were holding onto their coins at a loss. The recent shift to positive territory highlights a significant turnaround for this investor group and reflects renewed optimism and confidence in Bitcoin‘s potential.

Despite positive developments for long-term investors, Bitcoin unexpectedly fell below the year’s lowest levels. Glassnode’s “rainbow” version of the chart shows a shift from the “Optimism/Anxiety” zone to the “Belief” zone, in line with moderate optimism among investors.

Simultaneously, the approval of a Bitcoin ETF in the US sent mixed signals to the market. Following the rise, the BTC price dropped to nearly $40,000 on major spot exchanges. Glassnode attributes this 18% price drop to unhealthy derivative leverage dynamics and some investors taking spot profits.

Current Situation: Bitcoin’s Market Position

As of the latest update, Bitcoin is trading at $42,348, down 1.27% in the last 24 hours. The evolving dynamics of Bitcoin’s price and the influential role of long-term holders continue to shape the narrative in the crypto market.

In conclusion, Glassnode’s analysis emphasizes the resurgence of unrealized profits for Bitcoin’s long-term holders, indicating a positive change in sentiment.

Türkçe

Türkçe Español

Español