Bitcoin remains above $54,500 and is still close to the $55,000 resistance level. Meanwhile, ETH has reached a new annual high. Even though crypto investors encounter selling pressure at resistance zones, BTC‘s chart shows that new resistances are being tested without significant corrections, fostering a more hopeful atmosphere. So, why is Ethereum on the rise?

Why Is Ethereum Rising?

Ether has gained 20% in BTC parity since February 12. We had been suggesting that the price in the ETHBTC pair was lingering at the bottom and that an upward attack could start. This has indeed happened, and the concurrent rise in BTC price has created an exciting scenario.

ETHBTC Pair Analysis

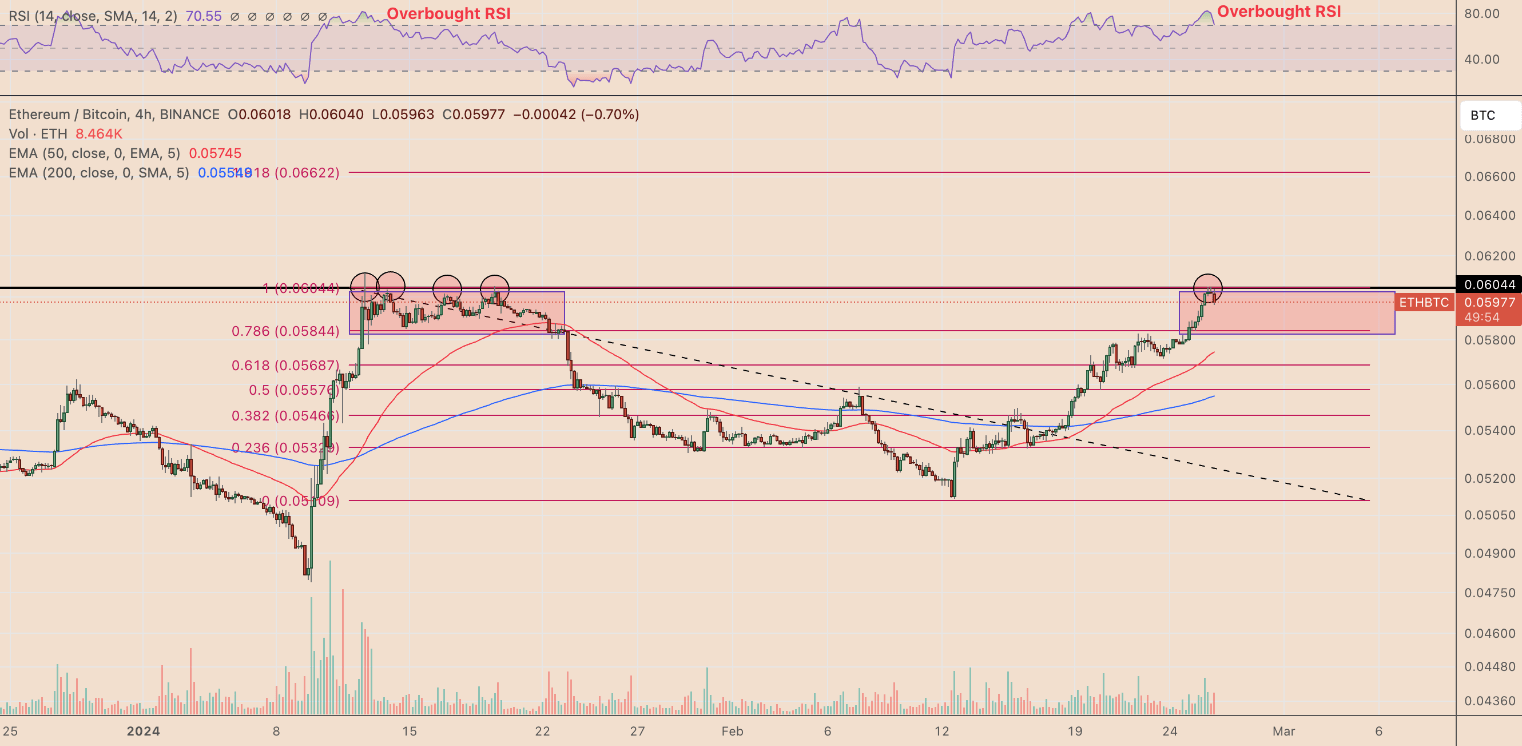

The primary reason for the rise is the increase in price in the ETHBTC pair up to the 0.0604 resistance zone. However, this level has hosted significant corrections in the past, and the RSI climbed above 70, entering the overbought territory. Both the technical outlook and the RSI indicate excessive demand, explaining the gains against the dollar, while also highlighting the possibility of a new correction.

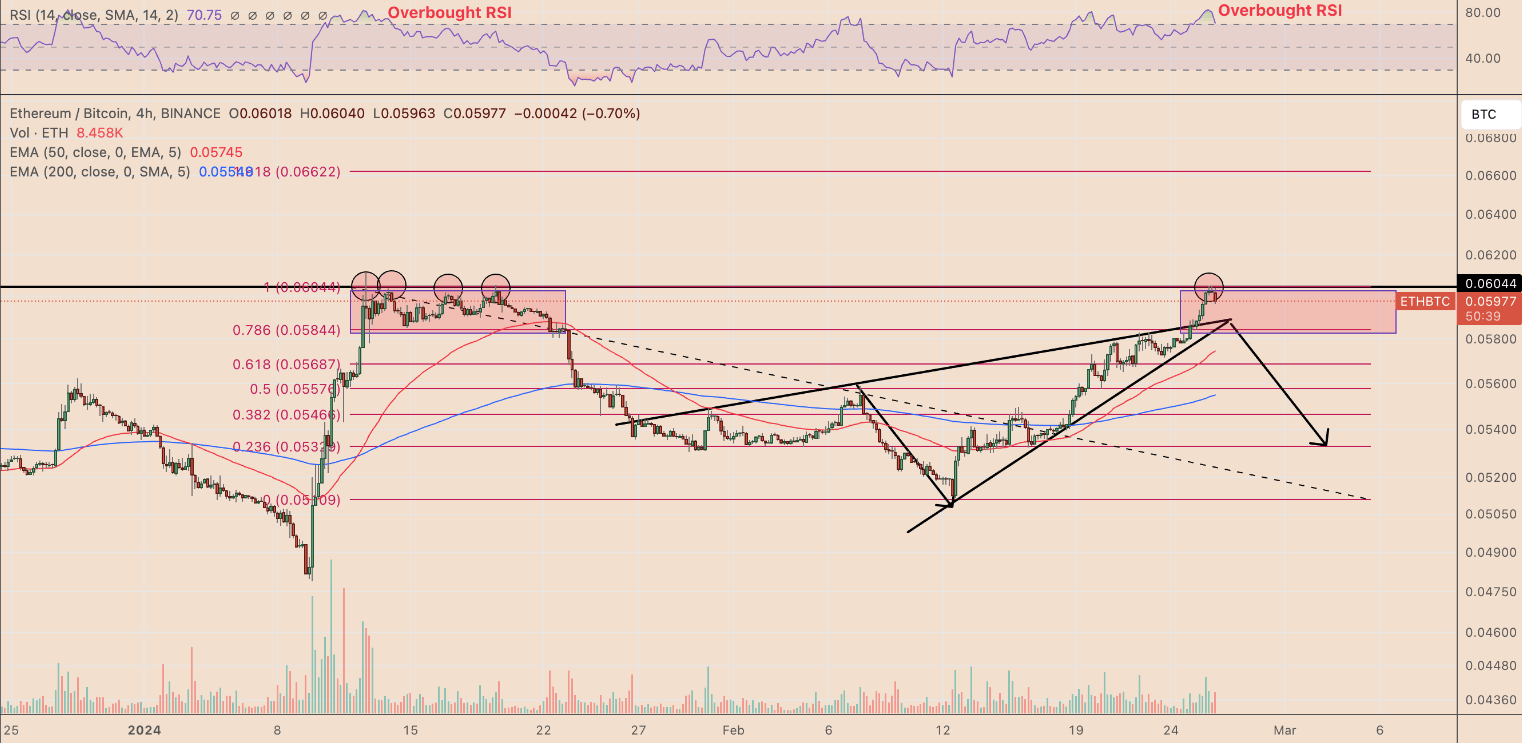

Rising Wedge Formation

On the other hand, the rising wedge formation in the ETHBTC pair points to a potential 10% drop to $0.053 by March. These formations often lead to significant corrections and, combined with the initial signal of a decline, suggest that profit-taking could start soon while also explaining the current rise.

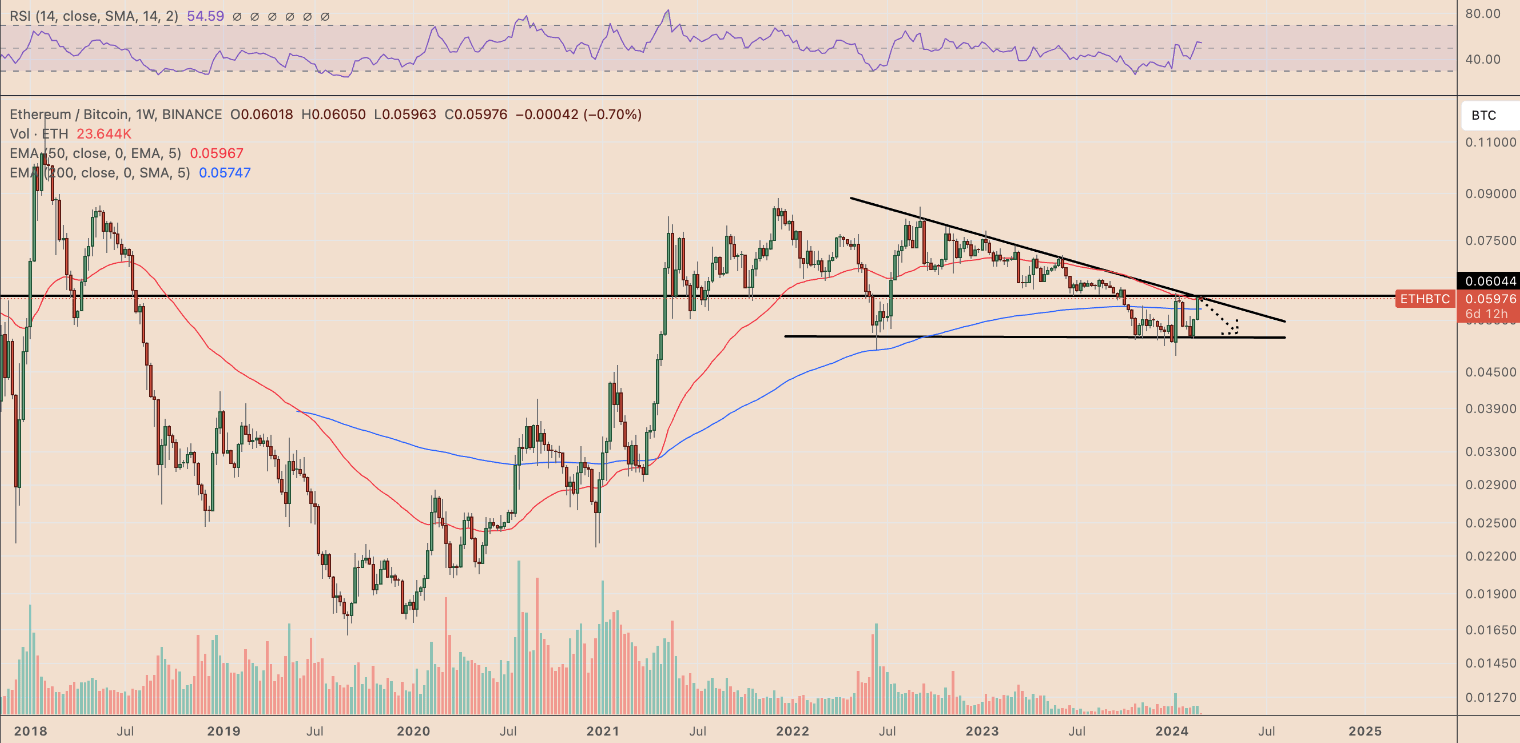

Descending Triangle Formation

The weekly chart shows the price attempting to close above the long-term trend line, reflecting a downward trend. This trend line coincides with ETH/BTC’s 50-week EMA. This resistance convergence could pose a greater obstacle than expected for Ether’s upward attempts in the coming weeks. The 0.051 BTC region, where sharp recoveries occurred in June 2022 and between October 2023-January 2024, is a significant pause point.

Whales

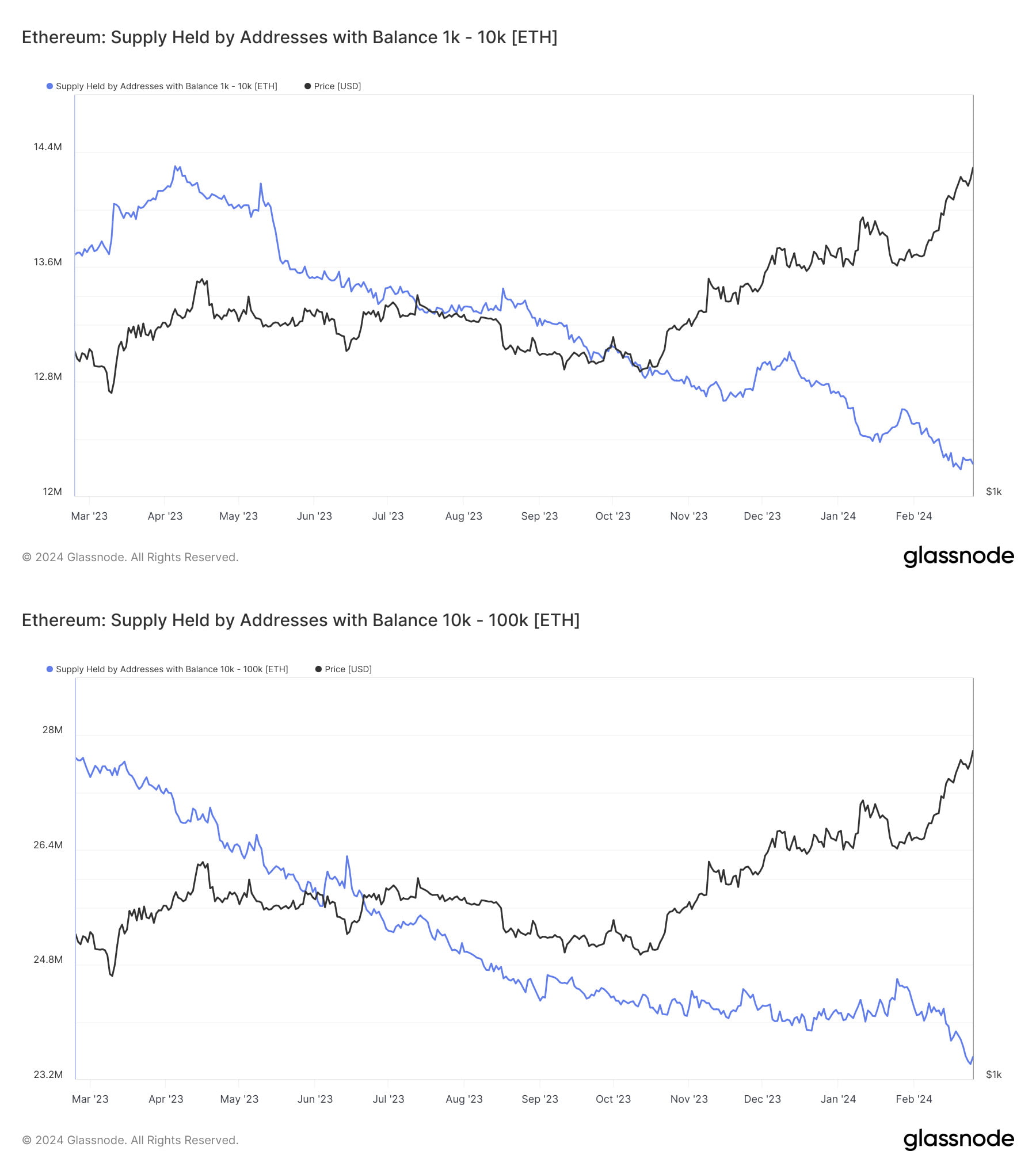

As the price rises, long-term investors in bull markets sell to newcomers. This is fine as long as the price continues to rise. However, during transition periods, on down days, such a trend usually triggers rapid losses in price. Now, Ethereum bulls are facing a crucial test because, according to Glassnode data, whales holding 1,000-100,000 ETH made significant sales in February.

If long-term investors observing these formations are making sales for buying back at lower prices, significant declines could occur across altcoins.

Türkçe

Türkçe Español

Español