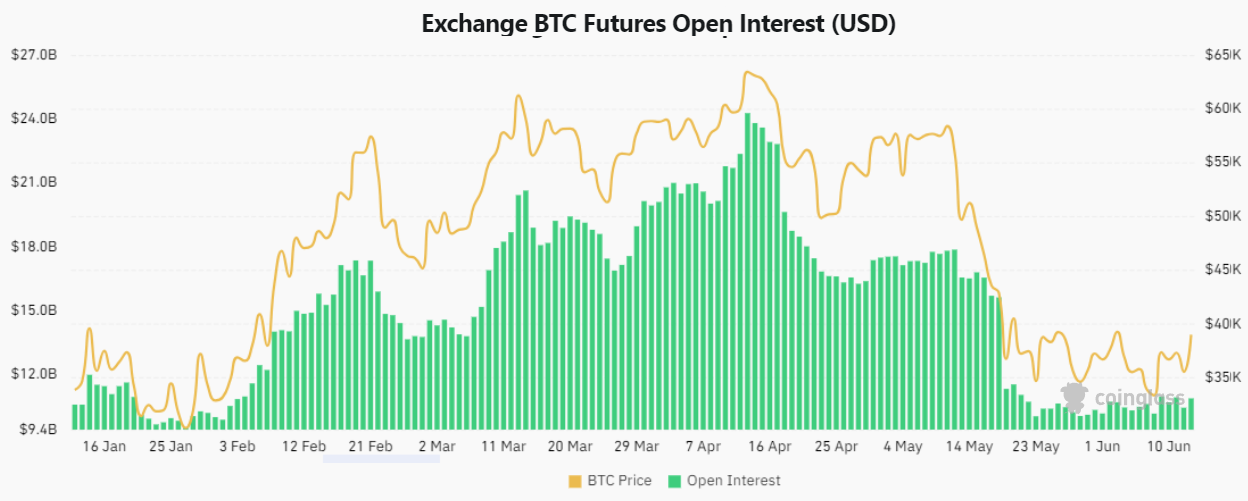

Bitcoin reached the $53,000 level on February 20th and briefly exceeded $52,900 before a correction occurred due to $50 million in long liquidations in the futures market. Despite a drop to $50,750, the open interest in Bitcoin futures remained at $23.7 billion, just 2.5% below the all-time high seen in April 2021.

What’s Happening with Bitcoin?

In April 2021, open interest peaked at $24.3 billion but failed to break the $64,900 resistance, leading to a 27% correction within 11 days. With the current strong demand for Bitcoin futures contracts, investors are pondering the likelihood of a similar outcome.

Some investors argue that the increase in open interest for Bitcoin futures signals excessive leverage, but this is not universally true. Every futures transaction requires a buyer and seller of equal size, and an investor can be fully hedged even when using leverage, such as buying a monthly Bitcoin futures contract and simultaneously selling an equivalent amount of perpetual contracts if there’s an appropriate price difference.

Key Details on Bitcoin Futures

The record high open interest of $24.3 billion does not carry significant weight on its own. In 2021, supported by individual investor inflow, Binance led the market share in Bitcoin futures, while currently, the dominance primarily lies with CME, which is largely composed of institutional investors. These data do not eliminate the possibility of a sharp Bitcoin price correction driven by futures markets but do reduce the likelihood.

It could be argued that high open interest increases the potential for cascading liquidations, which is a valid point. However, significant leverage in the system is required for such conditions to occur, which is less likely with CME contracts that require a 50% deposit margin. Similarly, Deribit investors tend to adopt a less risky approach compared to Bybit, leading to different liquidation levels. Essentially, aggregating all Bitcoin futures open interest into a single pool lacks logical consistency.

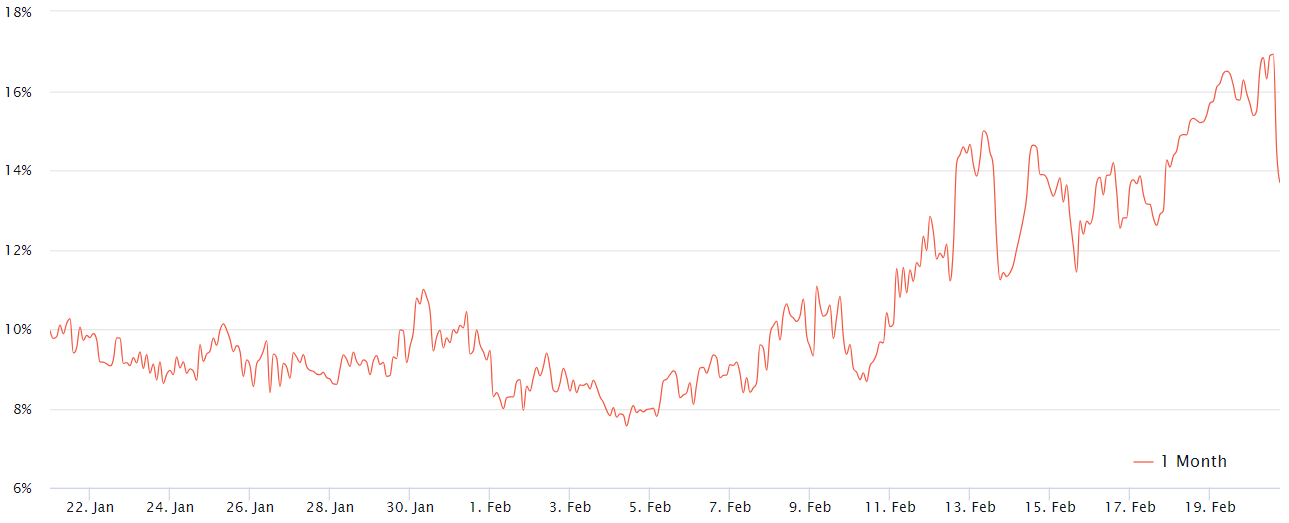

Regardless of the leverage used, the optimism of professional investors can be assessed by examining the premium on Bitcoin futures contracts. In normal markets, these contracts should trade at 5% to 10% higher than normal spot markets to account for the extended settlement periods.

The premium of the fixed monthly contract for Bitcoin, known as the basis rate, peaked at 17% on February 20th as the price approached $53,000. Currently, the indicator is at 14%, indicating that the drop to $50,750 has not diminished the bullish trend. The fact that these figures are calculated annually and that the cost of carrying a leveraged long position for a month is 1.1% is noteworthy.

Türkçe

Türkçe Español

Español