According to the analysis of MN Trading Founder Michael Van de Poppe, Bitcoin (BTC) could enter a bull market over the next one to two years. Van de Poppe highlights the downward trend in yields of 2-year and 10-year Treasury notes in a recent post about the subject.

Fed Factors in BTC

A reversal in yields generally means that short-term interest rates become higher than long-term rates due to economic uncertainty or a weak growth outlook. He suggests that the market is pessimistic based on economic figures, as there is a “significant weekly downtrend” in government bonds.

Van de Poppe notes that the current yield trends are a response to the monetary policy decisions of the Federal Open Market Committee (FOMC). Now that the tightening practice has ended, November’s inflation figures could be good news for the Fed. According to Bloomberg data, inflation in November fell below the Fed’s annual 2% target for the first time in over three years, based on a six-month annualized measure. This development, along with expectations of interest rate cuts next year, has improved market sentiment during the holiday season.

Expert Opinion on Bitcoin

Fed cuts are generally positive for technology stocks as they reduce corporate borrowing costs. Bloomberg reported in September 2023 that Bitcoin’s price has moved back in sync with technology stocks after briefly disrupting this relationship in June. Therefore, all technological advancements and cheaper financing could help Bitcoin rise after a stagnant year in terms of price movement.

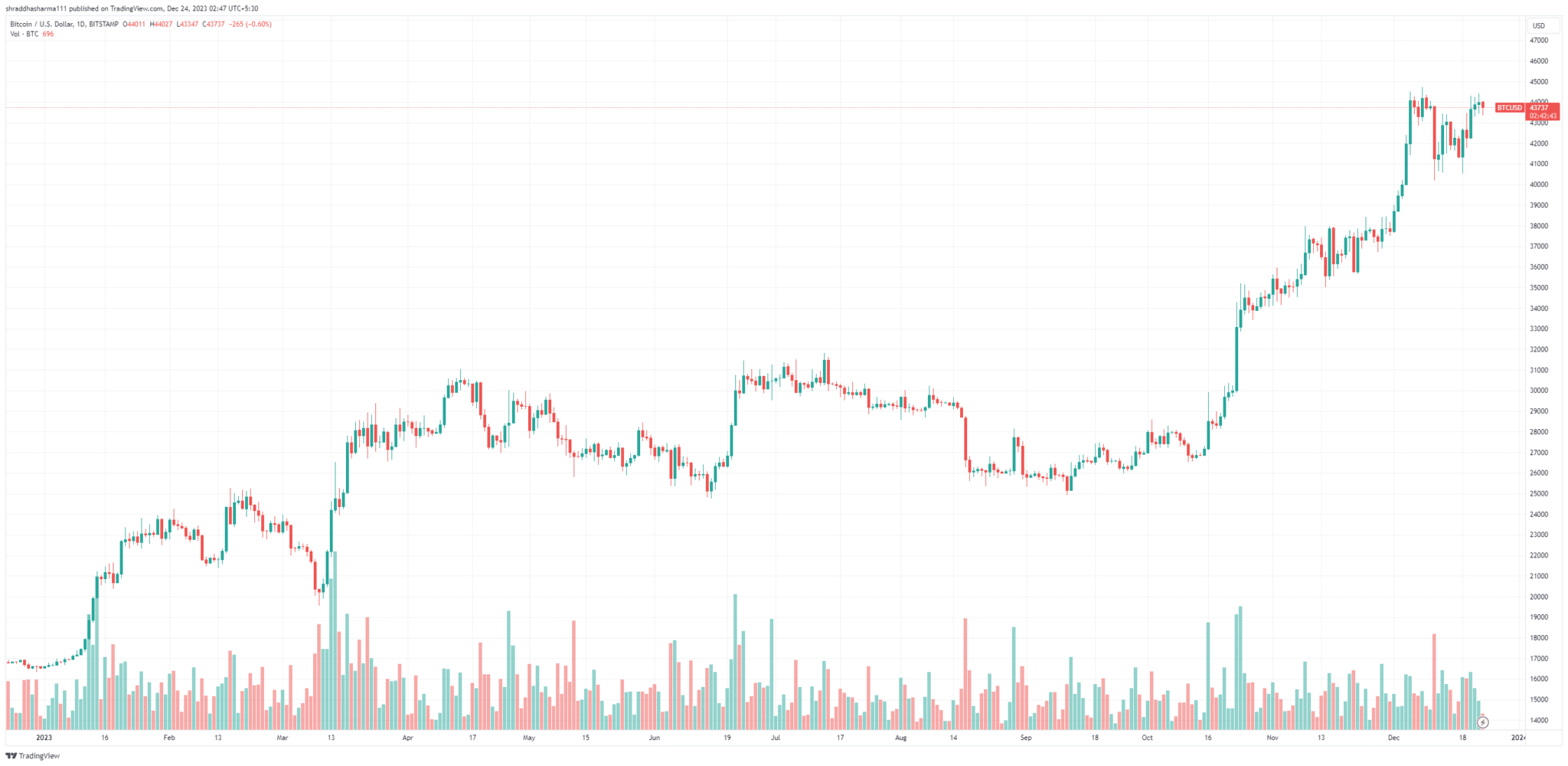

Van de Poppe also mentions that the bull market followed a similar yield curve trend in 2018 and reflects the current market trajectory. While positive macroeconomic factors indicate a potential Bitcoin bull run, the market is also approaching a halving event in a few months. As of December, Bitcoin’s price has risen to this year’s high of $44,000, marking an approximate 160% increase, but this price is still about 37% lower than the all-time high of $69,000 reached in 2021.

Türkçe

Türkçe Español

Español