The cryptocurrency market has recently faced significant selling pressure, causing major altcoins to fall below critical support levels. Despite the increase in accumulation in Spot Bitcoin ETFs, the high selling pressure indicates that many are heavily selling their assets.

The Shocking Miner Impact on Bitcoin Price

Bitcoin surpassed $71,000, and the SEC gave the green light to the spot Ethereum ETF, making market participants optimistic about reaching an all-time high (ATH). These expectations were shattered when Bitcoin’s price was rejected, triggering a strong downward trend.

Significant bearish candles outweighed buying pressure, dragging Bitcoin’s price out of its upward range. This situation led to the belief that Bitcoin might soon hit the much-speculated bottom below $60,000. Crypto Traders Are Rushing to This App – Here’s Why You Should Too

Although there have been record-level inflows from institutional investors recently, the questions of “who is selling Bitcoin and contributing to this selling pressure” are of great curiosity. Experts point to miners’ capitulation as the first significant factor. Bitcoin’s price has been consolidating in a range for over 100 days, likely leading to a rare miner capitulation phase, especially after the last block reward halving.

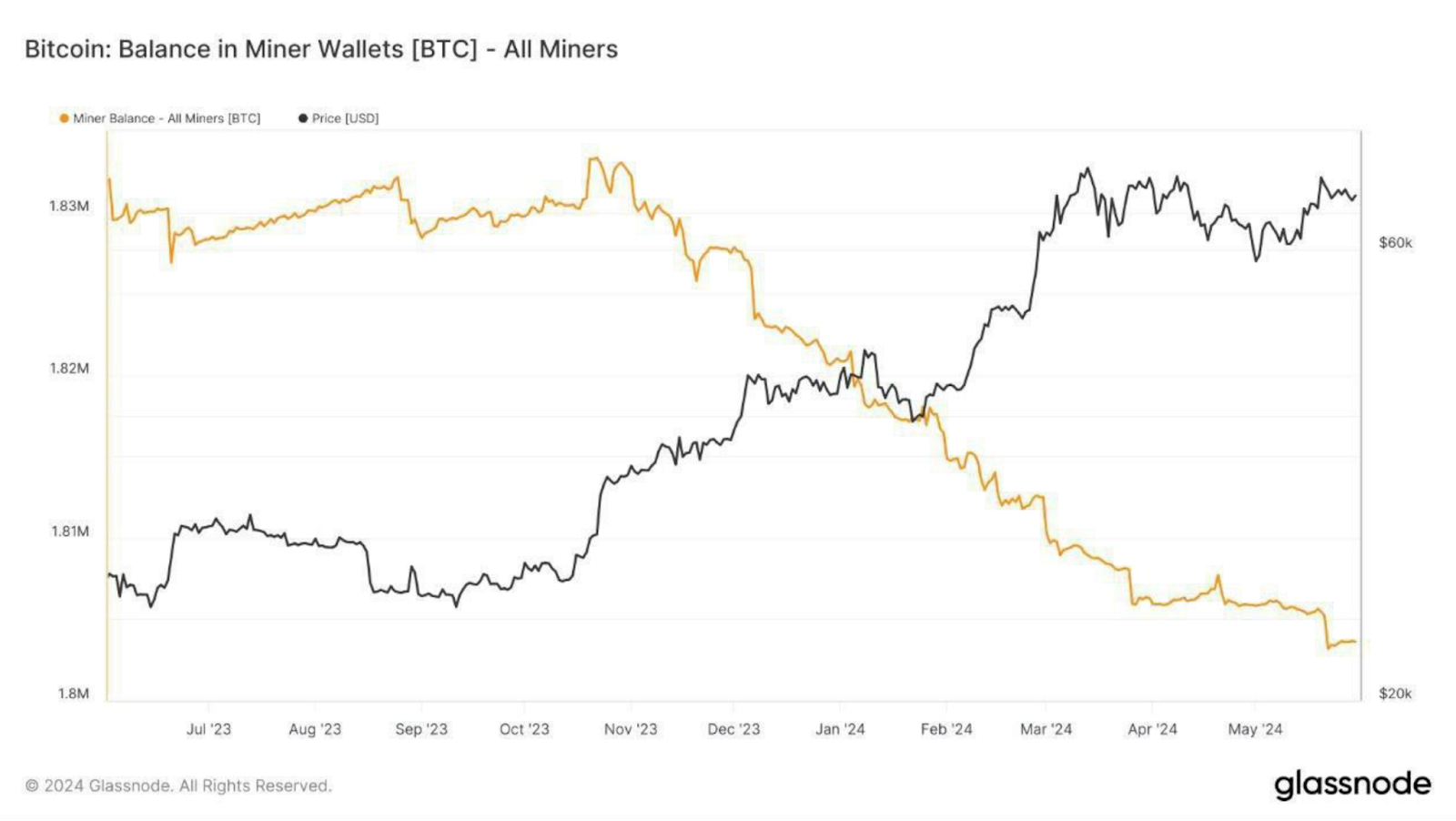

The average cost for miners has risen above $75,000 per BTC, while the spot price has fallen below $67,000. This discrepancy may have forced miners to sell their balances, reaching their lowest levels in 6 to 8 months.

Data from Glassnode reveals a steady decline in Bitcoin miner balances, reaching the lowest levels in recent years with increased sales following the fourth block reward halving in April 2024. Miner balances dropped from 1.84 million BTC at the beginning of 2023 to 1.8 million BTC as of May 2024. This trend indicates that miners are selling BTC to cover operational expenses after the block reward reduction.

Recently Sold Over 1,200 BTC

Bitcoin miners recently sold over 1,200 BTC (approximately $80 million), significantly contributing to the recent price correction, preventing the rally from surpassing the critical resistance at $71,800. Fortunately, this capitulation phase seems to be nearing its end, potentially paving the way for a new bullish phase.

Although the end of the miner capitulation phase is promising, it remains to be seen whether Bitcoin can overcome the current resistance and reach new highs. The market’s reaction in the coming days will be crucial in determining the next direction of Bitcoin’s price.

Türkçe

Türkçe Español

Español