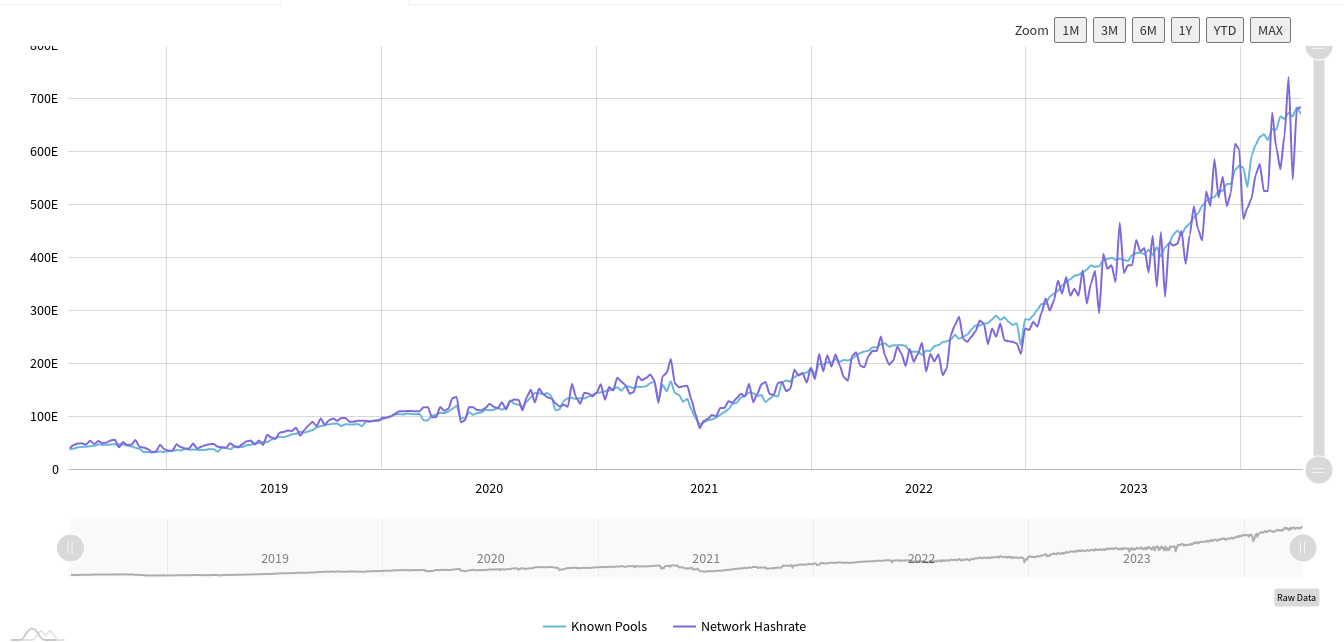

Currently, the mining difficulty, which is near all-time highs, is expected to increase by about 2% on April 11, surpassing 85 trillion for the first time. Despite the Bitcoin price’s approximately one-month-long consolidated movement, data from the monitoring source BTC com indicates that the hash rate decreased by less than 1% during this period.

What’s Happening in the Mining Sector?

The mining hash rate also indicates a similar trend. Raw data obtained from MiningPoolStats shows the total computational power distributed across the network at 684 exahash (EH/s) per second. The figures suggest that the output from known mining pools is practically at the highest level ever seen.

According to developments on the topic, preparations for the halving process are coming from various sources. Among them is the declaration by Bitdeer Technologies, the Bitcoin mining partner of the Kingdom of Bhutan, of its intention to increase mining production sixfold before the halving event.

Increasing Sales on the Bitcoin Front

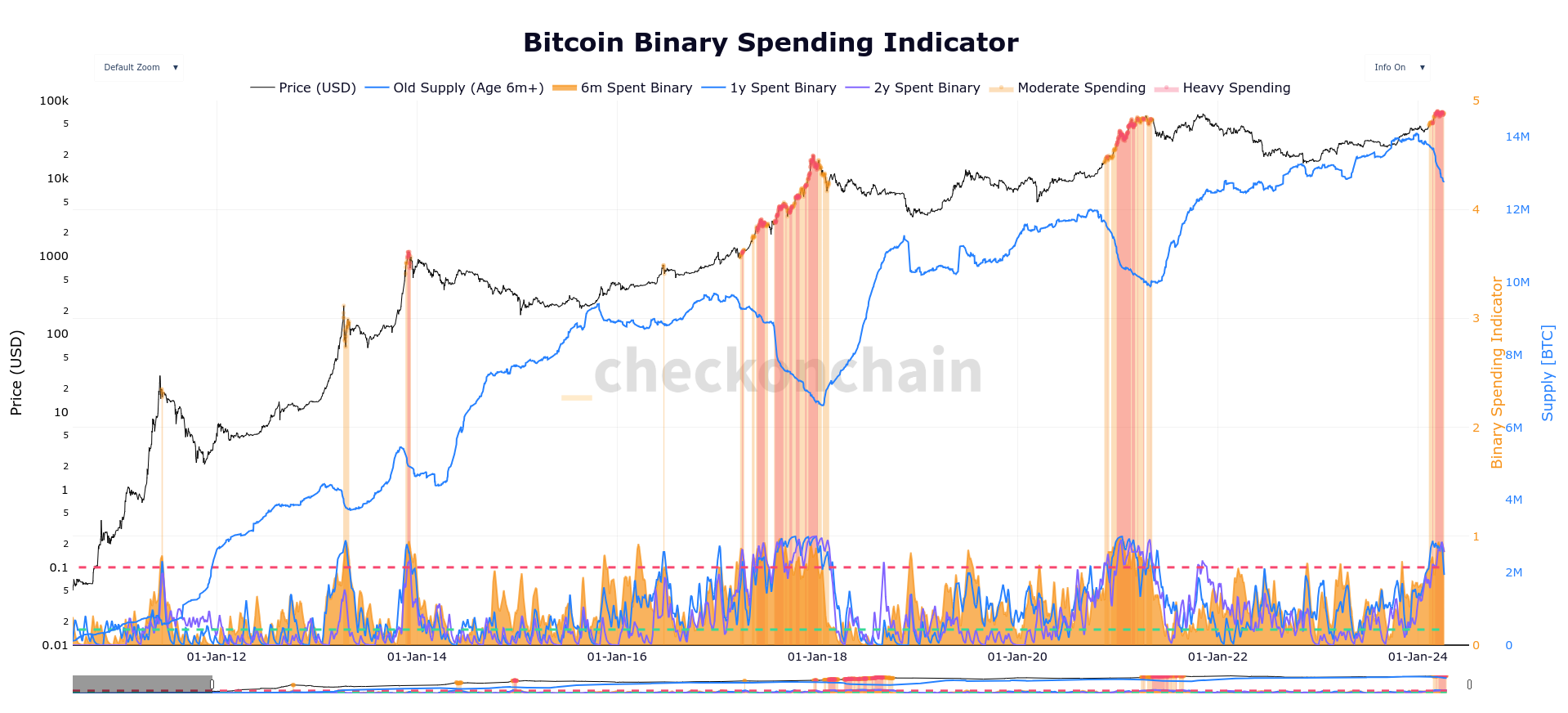

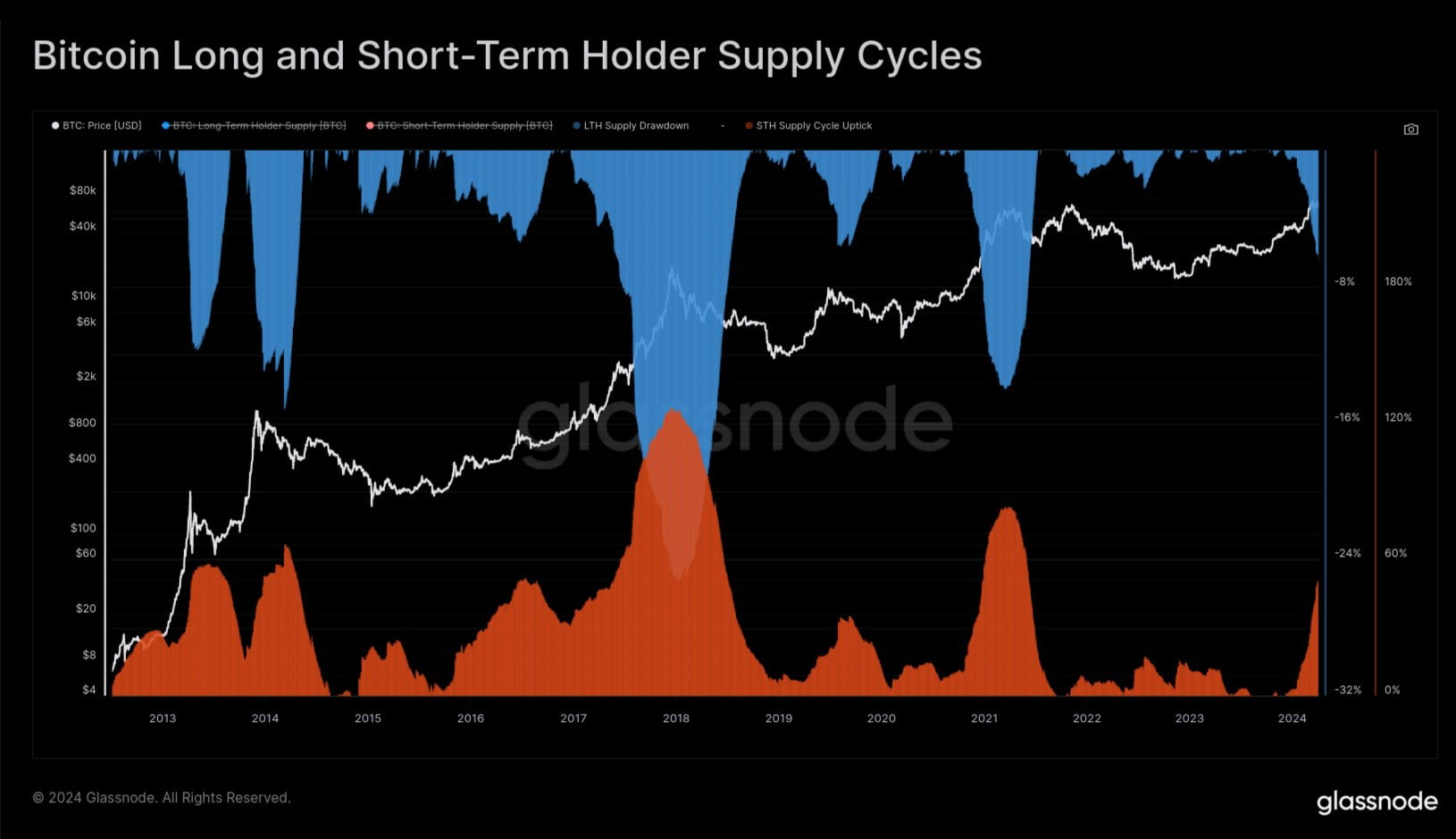

It is noticeable that Bitcoin’s long-term holders (LTH) are becoming increasingly active sellers at current prices. As the spent output profit ratio (SOPR) shifts more in their favor, old assets are also moving on the chain. However, according to Checkmate, an on-chain analyst at blockchain data analytics firm Glassnode, this situation is extremely normal and should not lead to a sell-off pressure in the market:

“This Bitcoin ATH break is similar to almost every previous ATH break. Long-Term Holders begin to spend their assets, taking advantage of new demand and liquidity. They are the smart money that buys low and sells high.”

A chart from the data statistics platform Checkonchain examines the spending habits of various Bitcoin investors over time. According to Checkmate, history so far is a matter of repetition. LTH institutions tend to sell about 14% of the Bitcoin supply they control during bull markets, and so far, less than half of that has left their wallets:

“In the previous two cycles, new demand for Bitcoin was able to offset this LTH selling side for about 6-8 months and at the same time significantly increased prices. If we consider the typical LTH Supply decline to be 14%, we are about 40% through this process.”

Türkçe

Türkçe Español

Español