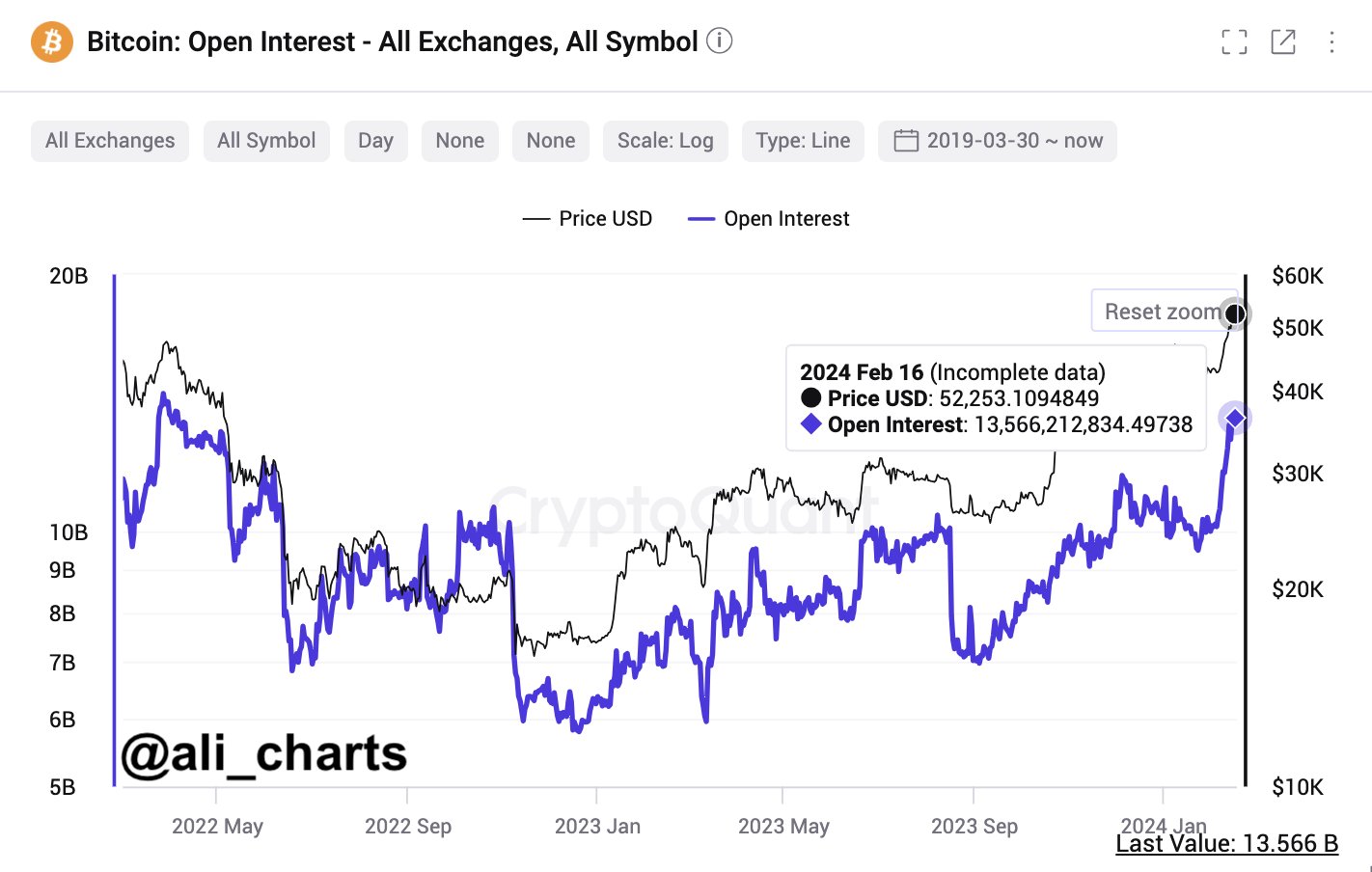

The total number of open long and short positions across all cryptocurrency exchanges, reflecting the open interest of Bitcoin (BTC), has skyrocketed to its highest level since April 2022, exceeding $13.5 billion. This increase in open interest indicates a significant rise in trading activity and investor participation in the Bitcoin market.

Surge in Bitcoin Open Interest: Reaches $13.57 Billion

The rise in Bitcoin’s open interest comes during a period of increasing bullish trends and volatility in the cryptocurrency market. Bitcoin’s price has followed a strong trajectory in recent weeks, surpassing the $52,000 mark as investors grapple with uncertainty in the global economy and financial markets.

Experienced cryptocurrency analyst Ali Martinez shared the “Bitcoin: Open Interest – All Exchanges” chart from CryptoQuant on his personal X account, adding a note that the total number of open long and short BTC positions across all cryptocurrency exchanges, representing Bitcoin’s open interest, has reached its highest level since April 2022, hitting $13.57 billion.

How Can the Increase in Bitcoin Open Interest Be Interpreted?

The increase in open interest points to growing optimism among investors taking increasingly larger positions in the Bitcoin market. This rise in trading activity is fueled by various factors, including increased institutional adoption, growing individual investor interest, and speculation about further price increase potential.

Additionally, the rise in open interest indicates an increase in the number of investors betting on both the upward and downward potential of Bitcoin’s price. As is known, long positions represent bullish bets on the price of Bitcoin, while short positions indicate bearish sentiment and expectations of a price decline.

The increase in open interest particularly highlights the growing importance of derivative markets in the cryptocurrency market. Derivatives such as futures and options contracts allow investors to speculate on the future price movements of the underlying asset, BTC, without having to purchase it, thus providing more liquidity and price discovery in the market.

Türkçe

Türkçe Español

Español